Why Freeport-McMoRan (NYSE:FCX) may be Able to Maintain High Performance Despite a Market Pullback

First published on Simply Wall St News

Investors can switch strategies from looking for potential winners to holding on to stocks that are expected to underperform the least. Considering the current state of the market, we decided to revisit Freeport-McMoRan Inc. (NYSE:FCX) after earnings and see the stock's potential to maintain current price levels.

In this article, we will look at the risks and opportunities for Freeport, and see how analysts expect the stock to perform in the future.

The key takeaways of our analysis are:

Freeport grew profits as expected and analysts still see a possibility for earnings growth until 2023, which may keep the stock up.

Inflation and supply chain disruptions are keeping global resource prices up, as opposed to economic growth and high CapEx spending.

Freeport expects to benefit from future renewable energy projects by governments and businesses.

Future Estimates

Last week, FCX reported earnings, which managed to slightly surpass analyst expectations. The stock did well and posted:

- Revenue: US$6.60b (up 36% from 1Q 2021).

- Net income: US$1.53b (up 113% from 1Q 2021).

- Profit margin: 23% (up from 15% in 1Q 2021). The increase in margin was driven by higher revenue.

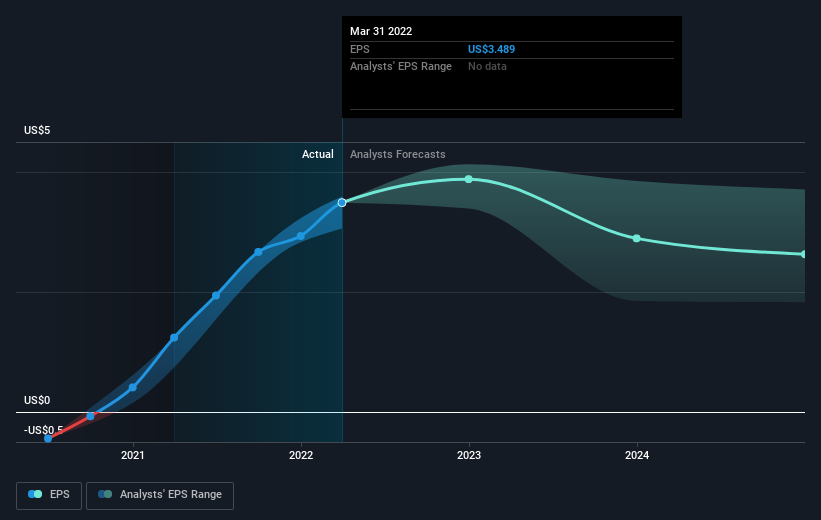

In the chart below, we see that analysts have been projecting increases in earnings during the last 5 quarters, and the company successfully delivered. Future earnings are still expected to grow during 2022, and a normalization is expected after 2023.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

During three years of share price growth, Freeport-McMoRan achieved compound earnings per share growth of 38% per year. This EPS growth is lower than the 50% average annual increase in the share price. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

Risks & Opportunities

After the earnings report, the stock dropped 6.7%, and is now trading around 2021 highs. The built-in ability of the company to pass on inflation costs to consumers have made it a high performer in 2021. The last two years have been great for the stock, as the share price marched upwards over that time, and is now 235% higher than it was.

Check out our latest analysis for Freeport-McMoRan

Supply disruptions and financial inflation have propelled the stock price upwards, and the company is posting record earnings and cash flows. Although analysts expect this trend to continue until 2023, we need to remember that FCX is a cyclical commodity company, which means that the company performs best when it is in a high economic growth period with limited supply. Currently, inflation is substituting for high real growth, while the economy is expecting a slowdown, and supply constraints are not resulting in high CapEx spending by governments and businesses, but rather by supply-chains disruptions.

As we can see, this indeed results in higher profits, however the reasons for this are less desirable and may be short-lived. Inflation and an economic slowdown may significantly reduce the spending power of consumers, leading to an overall decreased demand for resources.

An additional risk factor is the continued lockdown of Shanghai, which is further disrupting the shipping supply-chains stemming from China. The situation is impacting production, development projects, as well as resulting in some highly volatile moves for the Chinese currency.

During the last earnings call, management also outlined some key opportunities for the company. Currently, the advantage in Freeport may be found in their positioning to benefit from rising Copper prices for the renewable energy projects and infrastructure projects, as well as substantial gold mining capacities that are known to be a historical hedge against inflation.

Conclusion

While Freeport managed to maintain high stock prices in the last two years, the company may be pulled down by a possible slowdown in the economy. However, given the high inflation hedge from their copper and gold business, Freeport may be one of the companies that are the least affected in a crisis - both resources are primary in most production chains, as well act as a natural hedge against inflation.

To understand Freeport-McMoRan better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Freeport-McMoRan you should be aware of.

We will like Freeport-McMoRan better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Yahoo Finance

Yahoo Finance