Why Is Garmin (GRMN) Down 3.8% Since Its Last Earnings Report?

A month has gone by since the last earnings report for Garmin Ltd. GRMN. Shares have lost about 3.8% in the past min that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is GRMN due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

Garmin reported better-than-expected results in the fourth quarter of 2017 with revenues and earnings surpassing the Zacks Consensus Estimate.

Earnings of 79 cents per share outpaced the consensus mark by 4 cents. Also, the bottom line was up 6% sequentially and 9% year over year.

The results were driven by solid performance in fitness, marine, outdoor and aviation segments. Auto revenues declined year over year.

During the quarter, the company plans to approve cash dividend of $2.12 per share, which will be payable in four equal installments on dates to be determined by the board.

Management focuses on continued innovation, diversification and market expansion to explore growth opportunities in all business segments. However, macroeconomic challenges remain part of the operating environment.

Revenues

Garmin’s fourth-quarter revenues of $888 million beat the Zacks Consensus Estimate by $15 million and were up 19.6% sequentially and 3.2% from the prior-year quarter. The year-over-year increase was backed by higher demand across fitness outdoor, marine and aviation segments.

Segmental Revenues

Garmin’s Outdoor, Fitness, Marine, Auto/Mobile and Aviation segments generated 23%, 31%, 9%, 22% and 15% of quarterly revenues, respectively. Seasonality results in considerable variations in Garmin’s quarterly revenues.

Outdoor revenues were up 9.9% sequentially and 15.9% year over year, driven mainly by robust demand for wearables and growth of inReach subscription services.

The Fitness segment increased 65.2% sequentially and 0.8% from the year-ago quarter. The year-over-year increase was driven by GPS enabled products, partially offset by declines in basic activity trackers.

The Marine segment increased 8.3% sequentially and 24.1% year over year. The year-over-year improvement was driven by strength in chartplotter and fish finder products. Also, Navionics acquisition added to growth.

The Auto/Mobile segment was up 3.4% sequentially but down 13.7% on a year-over-year basis. The year-over-year decrease was mainly due to shrinking of the personal navigation device (PND) market, partially offset by OEM growth and strength in niche categories such as fleet, camera, truck and RV.

Aviation segment revenues were up 4.1% sequentially and 10.7% from the prior-year quarter. The increase was mainly driven by higher sales of aftermarket products and positive contributions from OEM products.

Revenues by Geography

While America generated 48% (up 25% sequentially but down 4.3% year over year) of total revenues, EMEA and APAC contributed 38% (up 16.7% sequentially and 12.6% year over year) and 14% (up 10.3% sequentially and 7.7% year over year), respectively.

Operating Results

Gross margin was 56.2%, up 150 basis points (bps) from the year-ago quarter. Stronger demand drove volumes across all segments except Auto, pulling down segment gross margins on a year-over-year basis.

Operating expenses of $320.1 million were up 3% from $311 million in the year-ago quarter. Operating margin of 56.2% was up 160 bps year over year owing to an increase in operating income.

GAAP net income was $149.8 million or 79 cents per share compared with $137.9 million or 73 cents per share a year ago.

Balance Sheet

Inventories were up 10% sequentially to $517.6 million. Cash and marketable securities were approximately $1.05 billion compared with $1.14 billion in the previous quarter. The company has no long-term debt.

As of Dec 30, the company generated cash flow of $198.3 million from operating activities and free cash flow of $143.8 million.

2018 Guidance

For full-year 2018, management expects revenues of $3.2 billion and pro-forma earnings of $3.05 per share.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimate. There have been two revisions lower for the current quarter.

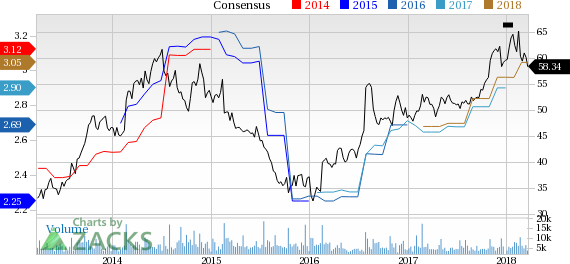

Garmin Ltd. Price and Consensus

Garmin Ltd. Price and Consensus | Garmin Ltd. Quote

VGM Scores

At this time, GRMN has an average Growth Score of C. Its Momentum is doing a bit better with a B. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than growth investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, GRMN has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance