Why Hummingbird Resources' (LON:HUM) CEO Pay Matters

The CEO of Hummingbird Resources PLC (LON:HUM) is Dan Betts, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Hummingbird Resources.

See our latest analysis for Hummingbird Resources

Comparing Hummingbird Resources PLC's CEO Compensation With the industry

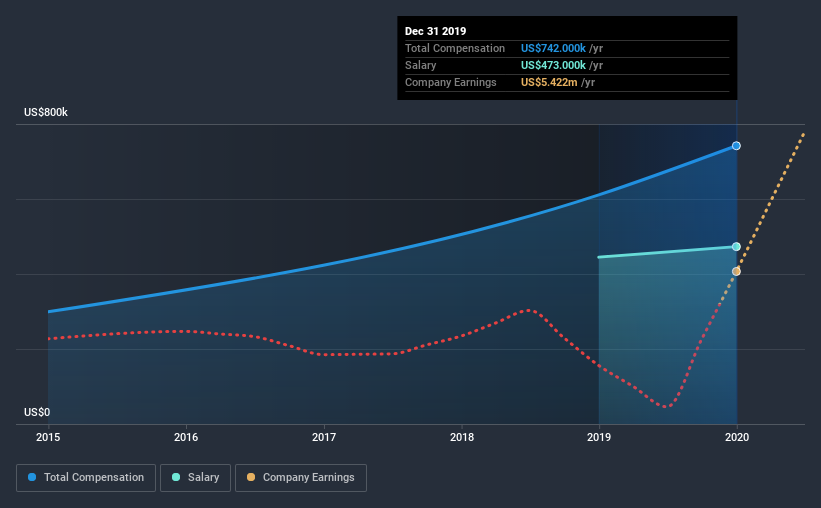

According to our data, Hummingbird Resources PLC has a market capitalization of UK£113m, and paid its CEO total annual compensation worth US$742k over the year to December 2019. We note that's an increase of 21% above last year. In particular, the salary of US$473.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between UK£75m and UK£300m, we discovered that the median CEO total compensation of that group was US$659k. From this we gather that Dan Betts is paid around the median for CEOs in the industry. Furthermore, Dan Betts directly owns UK£1.4m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$473k | US$445k | 64% |

Other | US$269k | US$166k | 36% |

Total Compensation | US$742k | US$611k | 100% |

Talking in terms of the industry, salary represented approximately 65% of total compensation out of all the companies we analyzed, while other remuneration made up 35% of the pie. Hummingbird Resources is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Hummingbird Resources PLC's Growth Numbers

Hummingbird Resources PLC has seen its earnings per share (EPS) increase by 75% a year over the past three years. Its revenue is up 55% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Hummingbird Resources PLC Been A Good Investment?

Since shareholders would have lost about 19% over three years, some Hummingbird Resources PLC investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we touched on above, Hummingbird Resources PLC is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. On the other hand, the company has logged negative shareholder returns over the previous three years. But on the bright side, EPS growth is positive over the same period. It's tough for us to say CEO compensation is too generous when EPS growth is positive, but negative investor returns will irk shareholders and reduce any chances of a raise.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Hummingbird Resources that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance