Why Is Immune Design (IMDZ) Down 2.7% Since Its Last Earnings Report?

A month has gone by since the last earnings report for Immune Design Corp. IMDZ. Shares have lost about 2.7% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is IMDZ due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Immune Design Posts Narrower-Than-Expected Loss in Q4

Immune Design reported a loss of 29 cents per share in fourth-quarter 2017 results, narrower than the Zacks Consensus Estimate of a loss of 39 cents and the year-ago quarter’s loss of 57 cents.

Quarter in Detail

Total revenues were $0.5 million, down from $2.1 million in the year-ago quarter. Revenues received from the collaboration with Sanofi (SNY) for G103 (HSV2 therapeutic cancer) contributed majorly. Quarterly revenues missed the Zacks Consensus Estimate of $1 million.

Research and development (R&D) expenses declined 29% to $8.5 million in the quarter. The downturn was due to the decrease in clinical trial costs as a result of the timing of when the related costs associated with Immune Design’s current clinical trials were incurred. A decrease in in-licensing royalties and fees, attributable to the settlement and license agreements with Theravectys in October 2016 and a decline in contract manufacturing costs activities primarily owing to the timing of when services are performed, also led to the decline.

General and administrative expenses fell 2.7% to $4.3 million.

Pipeline Update

Immune Design is developing multiple candidates using its discovery platforms — ZVex and GLAAS — in the field of immuno-oncology. Notably, its key pipeline candidates include CMB305 and G100.

Following discussions with the FDA, the company announced plans to initiate a pivotal phase III study, supporting a Biologics License Application for CMB305 on patients with synovial sarcoma. Progression free survival (PFS) and overall survival (OS) will become independent primary endpoints. Post the success of PFS, the FDA may forward approval. The company plans to initiate the study in mid-2018.

Additionally, the company presented interim analysis of CMB305 Combination Therapy at ASCO in June 2017. Per the analysis, NY-ESO-1+ synovial sarcoma or myxoid/round cell liposarcoma patients, receiving the combination of CMB305 and Roche Holding AG’s (RHHBY) Tecentriq, experienced greater clinical benefit in the form of Disease Control Rate (including partial responses), median Progression Free Survival, Time to Next Treatment and immune response, than those receiving Tecentriq alone.

Meanwhile, CMB305 is being evaluated for soft tissue sarcoma (STS) patients as a monotherapy and in combination with an anti-PD-L1 antibody. In fact, the company presented CMB305 monotherapy data at ASCO from 25 STS patients with recurrent disease. Per the data, median overall survival (mOS) has not yet been reached in these patients, with an overall survival rate at 12 and 18 months of 83% and 76%, respectively. The company also presented an updated data from this study in March 2018. The data showed that with a median follow-up of 17.7 months, a median overall survival (mOS) of 23.7 months has been reached for the whole population but not yet for the synovial sarcoma patient subset.

The company also provided an updated data for G100 later in the month. The data showed that with a median follow-up of approximately 12 months, the objective response rate (ORR) in the combination arm (G100+XRT in combination with pembrolizumab) increased from 39-54%, while the ORR of G100+XRT is constant at 15%.

2017 Results

Immune Design reported a loss of $1.75 per share in 2017, narrower than the Zacks Consensus Estimate of a loss of $1.89 and the year-ago loss of $2.47.

Total revenues in 2017 were $7.2 million, down from $13.3 million in the year-ago quarter.

2018 Outlook

Immune Design expects cash to fund operations into the second half of 2020.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed an upward trend in fresh estimates. There has been one revision higher for the current quarter.

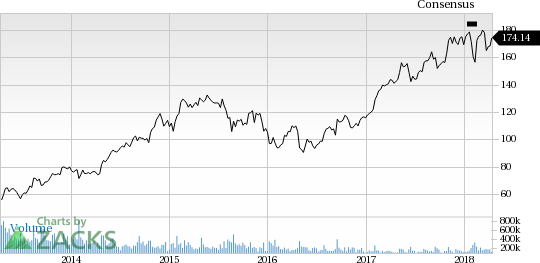

Immune Design Corp. Price and Consensus

Immune Design Corp. Price and Consensus | Immune Design Corp. Quote

VGM Scores

At this time, IMDZ has a subpar Growth Score of D. Its Momentum is doing a bit better with a C. However, the stock was allocated a grade of F on the value side, putting it in the fifth quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for momentum based on our styles scores.

Outlook

Estimates have been trending upward for the stock and the magnitude of this revision looks promising. Notably, IMDZ has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Immune Design Corp. (IMDZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance