Why Investors Should Hold On to the TopBuild (BLD) Stock

Shares of TopBuild Corp. BLD have declined 30.9% year to date, given continuous supply-chain disruptions, and higher raw material and labor costs.

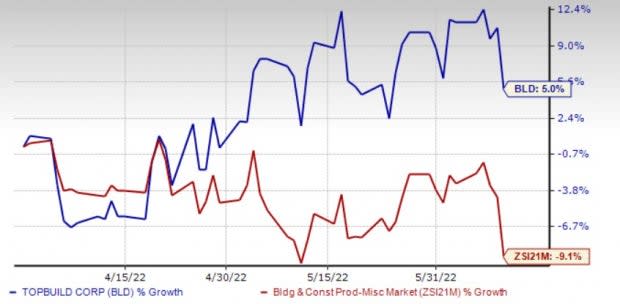

However, the company has solid fundamentals that are expected to continue driving profits for the long term. Given the strong fundamentals, shares of this installer and distributor of insulation and other building products have risen 5% quarter to date against the industry’s 9.1% decline.

Image Source: Zacks Investment Research

The 2022 earnings estimates for this Zacks Rank #3 (Hold) company have moved upward to $14.95 per share from $14.80 over the past seven days. This positive trend signifies bullish analysts’ sentiments, indicating robust fundamentals and the expectation of outperformance in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s delve deeper and find out the factors aiding the surge.

Solid Performance

TopBuild has been recording solid earnings and revenue growth over the last few quarters. During first-quarter 2022, the company’s sales increased 57.4%, adjusted earnings per share grew 73.3%, adjusted gross margin expanded 160 bps and adjusted EBITDA margin expanded 170 bps from the prior-year period. This impressive margin expansion led to increased profitability, depicting a flexible operating model and ability to quickly reduce costs.

This impressive performance was backed by a higher sales volume and solid contributions from acquisitions and pricing at both businesses, defying the labor and material-constrained market.

Upbeat View

Backed by a robust residential housing market and strengthening commercial market, TopBuild now expects sales between $4.65 billion and $4.80 billion for 2022 compared with $4.5-$4.65 billion expected earlier. The estimated figure indicates an increase of 33-37% year over year. Adjusted EBITDA is projected within $810-$860 million compared with $770-$820 million projected earlier. This suggests growth from $605.9 million reported in 2021.

For 2022, the company expects demand to remain solid across three of the end markets it serves: residential, commercial and industrial. The company remains focused on driving top-line growth, the successful integration of DI and improving operational efficiencies.

Higher ROE & Earnings Growth Rate

TopBuild’s superior return on equity (ROE) is also indicative of its growth potential. The company’s ROE currently stands at 25.6% compared with the industry’s 11.6%. This indicates efficiency in using shareholders’ funds and the ability to generate profit with minimum capital usage.

Earnings growth is also a key factor in stock valuation. The Zacks Consensus Estimate for 2022 earnings of $14.95 per share calls for 37.8% year-over-year growth. The solid growth rate depicts the stock's promising future.

Inorganic Strategy

BLD’s systematic inorganic strategy has been supplementing organic growth, and expanding access to additional markets and products. During first-quarter 2022, BLD made three acquisitions. On Mar 31, 2022, it acquired Green Energy, an insulation company located in Oregon. Prior to that, on Feb 3, 2022, TopBuild acquired Billings, a residential insulation installer serving the Montana and Northern Wyoming markets. On Jan 12, 2022, BLD had acquired Southwest, an insulation company in Florida.

The company has a strong pipeline of prospective acquisitions mainly focused on the insulation business, which accounted for 79% of the Installation segment’s sales in 2021.

3 Construction Stocks to Buy Now

Better-ranked stocks, which warrant a look in the Construction sector, include Simpson Manufacturing Co., Inc. SSD, Beazer Homes USA BZH and Patrick Industries PATK.

Simpson Manufacturing — currently carrying a Zacks Rank #1 — designs, engineers, manufactures and sells wood and concrete construction products.

SSD’s expected earnings growth rate for 2022 is 18.1%. The Zacks Consensus Estimate for current-year earnings has improved 11.6% over the past 60 days.

Beazer Homes — also sporting a Zacks Rank #1 — designs, builds and sells single-family homes. BZH designs homes to appeal primarily to entry-level and first move-up homebuyers. Beazer Homes USA’s objective is to provide customers with homes that have quality and value. BZH’s subsidiary, Beazer Mortgage, originates the mortgages for the company's homebuyers.

Beazer Homes’ expected earnings growth rate for fiscal 2022 is 48.9%. The Zacks Consensus Estimate for current-year earnings has improved 14.6% over the past 60 days.

Patrick Industries — currently carrying a Zacks Rank #2 (Buy) — is a leading component solutions provider for the RV, marine, and manufactured housing industries. Patrick Industries, like many others in the broader RV and consumer marine space, is witnessing a massive run of revenue growth that began about a decade ago.

Patrick Industries’ expected earnings growth rate for 2022 is 33.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance