Why Investors Shouldn't Be Surprised By National Express Group PLC's (LON:NEX) Low P/E

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

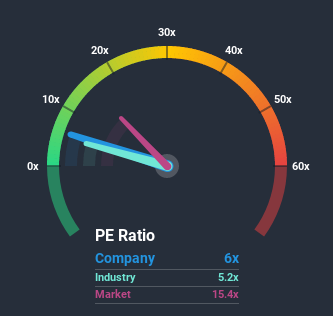

When close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 16x, you may consider National Express Group PLC (LON:NEX) as a highly attractive investment with its 6x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, National Express Group has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for National Express Group

How Does National Express Group's P/E Ratio Compare To Its Industry Peers?

It's plausible that National Express Group's particularly low P/E ratio could be a result of tendencies within its own industry. You'll notice in the figure below that P/E ratios in the Transportation industry are also significantly lower than the market. So this certainly goes a fair way towards explaining the company's ratio right now. Some industry P/E's don't move around a lot and right now most companies within the Transportation industry should be getting stifled strongly. Still, the strength of the company's earnings will most likely determine where its P/E shall sit.

Want the full picture on analyst estimates for the company? Then our free report on National Express Group will help you uncover what's on the horizon.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, National Express Group would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.0% last year. The latest three year period has also seen a 26% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 4.0% per year as estimated by the seven analysts watching the company. With the market predicted to deliver 8.2% growth each year, that's a disappointing outcome.

With this information, we are not surprised that National Express Group is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of National Express Group's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for National Express Group you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance