Why Jabil (JBL) Appears a Solid Investment Proposition Now

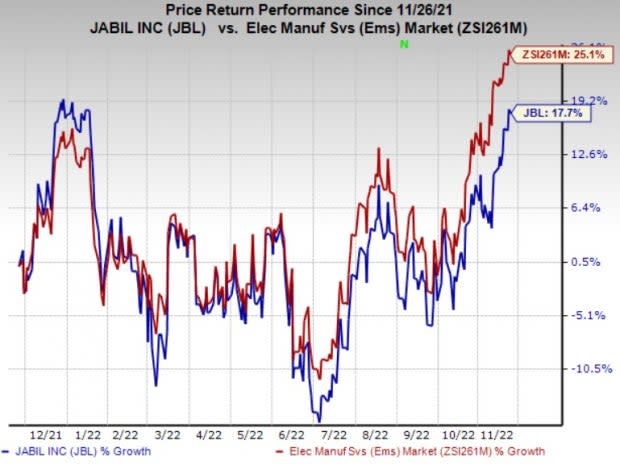

Shares of Jabil Inc. JBL have risen 17.7% over the past year, driven by healthy revenues on the back of a flexible business model and a quick time-to-market schedule to meet clients’ evolving needs. Earnings estimates for the current fiscal year have increased 19.6% over the past year, while that for the next fiscal year rose 16.5%, implying solid inherent growth potential. With healthy fundamentals, this Zacks Rank #1 (Strong Buy) electronics solutions provider appears to be a solid investment option at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

Growth Drivers

Headquartered in St. Petersburg, FL, Jabil is one of the largest global suppliers of electronic manufacturing services. The company offers electronics design, production, product management and after-market services to customers catering to aerospace, automotive, computing, consumer, defense, industrial, instrumentation, medical, networking, peripherals, storage and telecommunications industries.

Jabil’s focus on end-market and product diversification is a key catalyst. The company’s target that “no product or product family should be greater than 5% operating income or cash flows in any fiscal year” is commendable. This initiative should position it well on the growth trajectory. The diversification will increase the reliability of the company’s earnings and revenues, thereby driving returns for investors in the long haul.

In addition, Jabil’s top-line growth is expected to benefit from strength in healthcare, cloud, retail and industrial. The company is likely to gain from the rapid adoption of 5G wireless and cloud computing in the long haul. It is benefiting from solid demand in key end markets together with excellent operational execution and skillful management of supply chain dynamics.

With more than 260,000 employees across 100 locations in 30 countries, Jabil is likely to benefit from secular growth drivers with strong margin and cash flow dynamics. Moreover, its unmatched end-market experience, technical and design capabilities, manufacturing know-how, supply chain insights and global product management expertise have put it in good stead. An extensive global footprint is further strengthened by a centralized procurement process, which, coupled with a single Enterprise Resource Planning system, aids customers with end-to-end supply chain visibility.

Jabil has a VGM Score of A. The stock delivered an earnings surprise of 9.3%, on average, in the trailing four quarters and has a long-term earnings growth expectation of 12%.

Other Key Picks

TESSCO Technologies Incorporated TESS, sporting a Zacks Rank #1, delivered an earnings surprise of 126.1%, on average, in the trailing four quarters. Earnings estimates for TESSCO for the current year have moved up 44.3% since November 2021.

TESSCO offers products to the industry’s top manufacturers in mobile communications, Wi-Fi, wireless backhaul and related products. With more than three decades of experience, it delivers complete end-to-end solutions to the wireless industry.

Harmonic Inc. HLIT, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 79.3%, on average, in the trailing four quarters. Earnings estimates for Harmonic for the current year have moved up 48.6% since March 2021.

Harmonic provides video delivery software, products, system solutions and services worldwide. With more than three decades of experience, it has revolutionized cable access networking via the industry's first virtualized cable access solution, enabling cable operators to more flexibly deploy gigabit Internet service to consumers' homes and mobile devices.

AudioCodes Ltd. AUDC, sporting a Zacks Rank #1, is likely to benefit from the secular tailwinds related to IP-based communications. Incorporated in 1992 and headquartered in Lod, Israel, it offers advanced communications software, products and productivity solutions for the digital workplace. It has a long-term earnings growth expectation of 9%.

AudioCodes aims to leverage its long-term partnership with Microsoft to further strengthen its market position. It is also likely to benefit from its continued focus on high-margin businesses.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

TESSCO Technologies Incorporated (TESS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance