Why Kroger Stock Dropped 12% in March

What happened

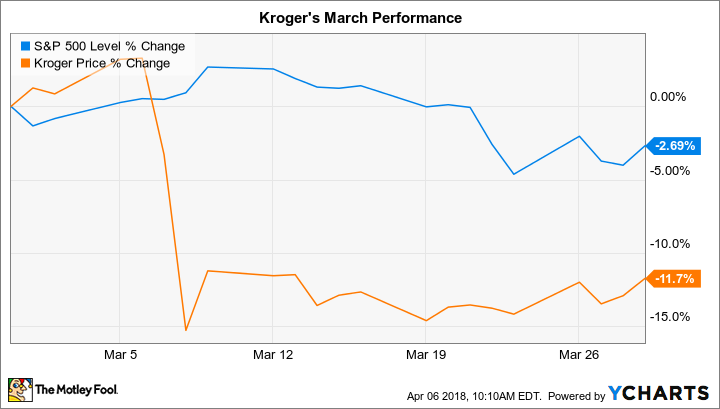

Kroger (NYSE: KR) trailed the market last month by shedding 12% compared to a 3% decrease in the S&P 500, according to data provided by S&P Global Market Intelligence.

That slump added to a difficult run for the retailer's shareholders, who have seen the stock give up over 30% in the past three years even as the broader market gained 28%.

So what

The March decline came following quarterly results that paired improved sales trends with reduced profitability. On the bright side, the supermarket chain wrapped up its 13th consecutive year of market share growth as comparable-store sales gains sped up to their fastest pace in more than a year. Detracting from that result was the fact that operating margin fell, and earnings dropped for the second straight year.

Image source: Getty Images.

Now what

Rising sales volumes indicate that Kroger's business isn't in retreat, and the retailer has a few promising growth avenues available, such as its popular private label brands like Simple Truth. Management is hoping to push deeper into the quickly growing prepared food delivery market, too.

But investors will have to be patient as they wait for these initiatives to take hold. At the same time, they'll have to accept the reduced profits that are driven by the combination of heavy growth investment spending and a retailing industry that's forcing its biggest players to cut prices to protect market share.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance