Why Lincoln National (LNC) is a Good Addition to Your Portfolio

Lincoln National Corp. LNC is set for growth on the back of an improving economy and increased awareness for life insurance products due to the COVID-19 pandemic.

The Zacks Consensus Estimate for earnings for the current year has been revised 10.5% upward over the past 60 days. The stock presently carries a Zacks Rank #2 (Buy) and has an impressive Value Score of B. Back-tested results show that stocks with a Growth Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, handily outperform other stocks.

You can see the complete list of today’s Zacks #1 Rank stocks here.

This insurance company is a good addition to your portfolio, given solid fundamentals and improving economic conditions.

Business Tailwinds

The COVID-19 pandemic has increased the importance of getting life insurance coverage and the improving employment scenario bodes well for the Group insurance business. Of late, the pandemic headwinds have been declining and vaccines are more widely being rolled out. This combination of underlying growth and improving mortality results positions the company well for growth of the Life Insurance and Group businesses.

The company’s Retirement business is also poised to benefit from an improved economic backdrop and an expanding set of retirement solutions products.

Lincoln National is adding to its distribution force by attracting insurance advisors, which would be beneficial for sales growth.

The company has done an impressive job of protecting investment returns in the face of a low-interest rate environment. Its portfolio is performing quite well with a high credit quality, which has been improving in recent years. It is to be noted that 96% of its fixed-income assets are investment-grade, with 59% rated A or higher. Investment income has been rising over the past several years and should continue to do so as it also invests in alternative avenues, which have performed strongly in recent quarters.

Apart from working on growing the top line via product innovation, the company is working to slash costs for preserving margins. It continues to report declining expense ratios in most of its businesses. It is investing in client-facing digital tools, which will improve user experience and improve the company’s efficiency. Expense-saving initiatives will continue to contribute to earnings growth.

Solid Capital Position

We cannot overlook its robust balance sheet and strong free cash flow generation. This combination helps in effective capital deployment on the back of a strong capital position, improving capital market and a positive outlook for its business.

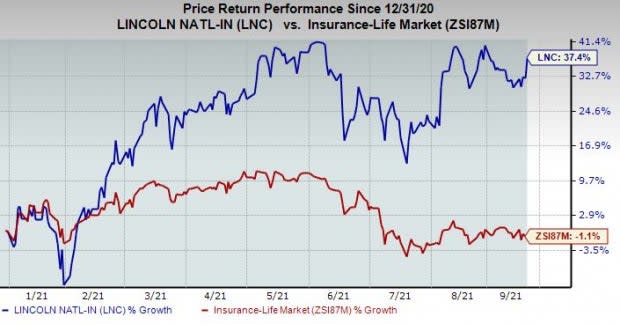

Share Price Performance

The stock has gained 32.3% year to date compared with the industry’s decline of 1.13%.

Image Source: Zacks Investment Research

Other players in the same space like Aflac Inc. AFL, Principal Financial Group, Inc. PFG, and Manulife Financial Corp. MFC have gained 22.7%, 32.5%, and 10.3%, respectively, over the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Principal Financial Group, Inc. (PFG) : Free Stock Analysis Report

Manulife Financial Corp (MFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance