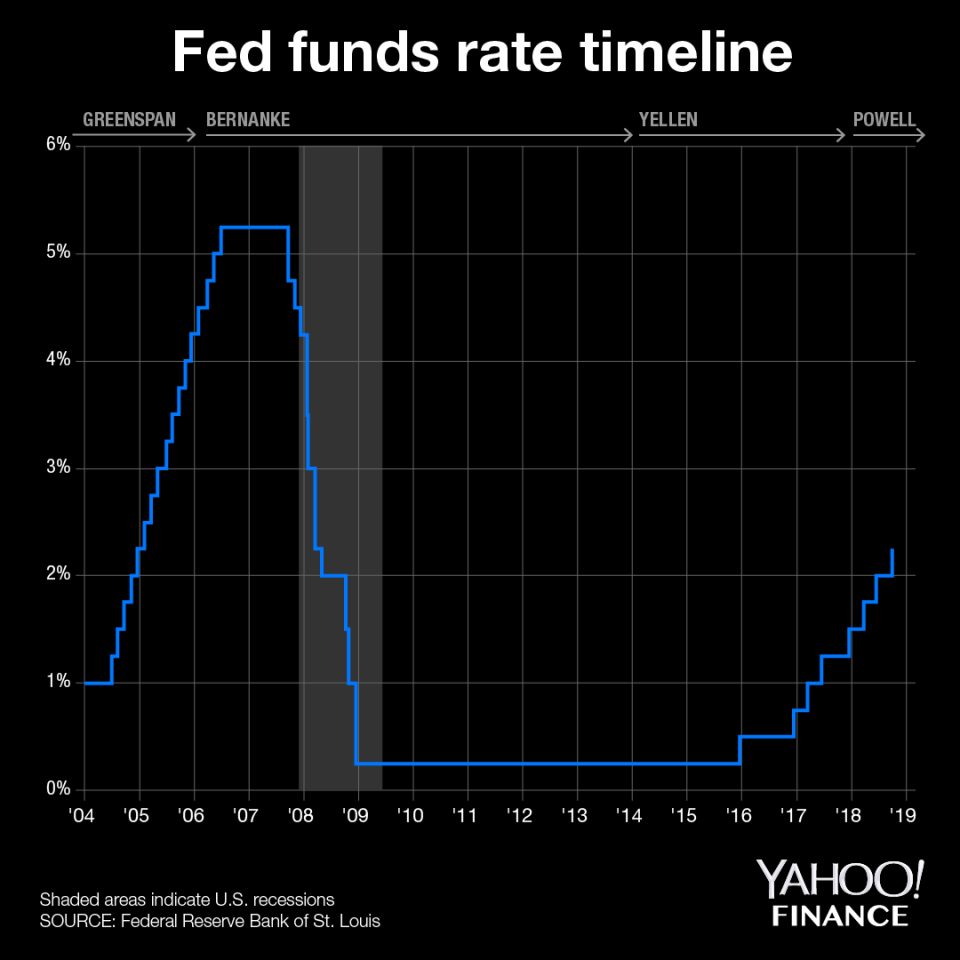

Why low interest rates could cause a ‘colossal reckoning’

A rate cut is all the buzz right now, sitting a top wish lists both in Washington and on Wall Street.

But best-selling financial author and long-term Wall Street insider William Cohan says low interest rates could lead to the next financial crisis.

“Low interest rates for this long — it's almost been 10 years now of low interest rates — is an absolute recipe for disaster,” Cohan told Yahoo Finance’s The Final Round. “You're talking to a guy who's written two books about the financial crisis, and let me tell you, we are far closer to the next financial crisis than we are to this euphoria that seems to be knowing no bounds.”

Cohan spent nearly two decades on Wall Street as a mergers-and-acquisitions banker before writing two best-selling books about the financial crisis “House of Cards: A Tale of Hubris and Wretched Excess on Wall Street” and “Money and Power: How Goldman Sachs Came to Rule the World.”

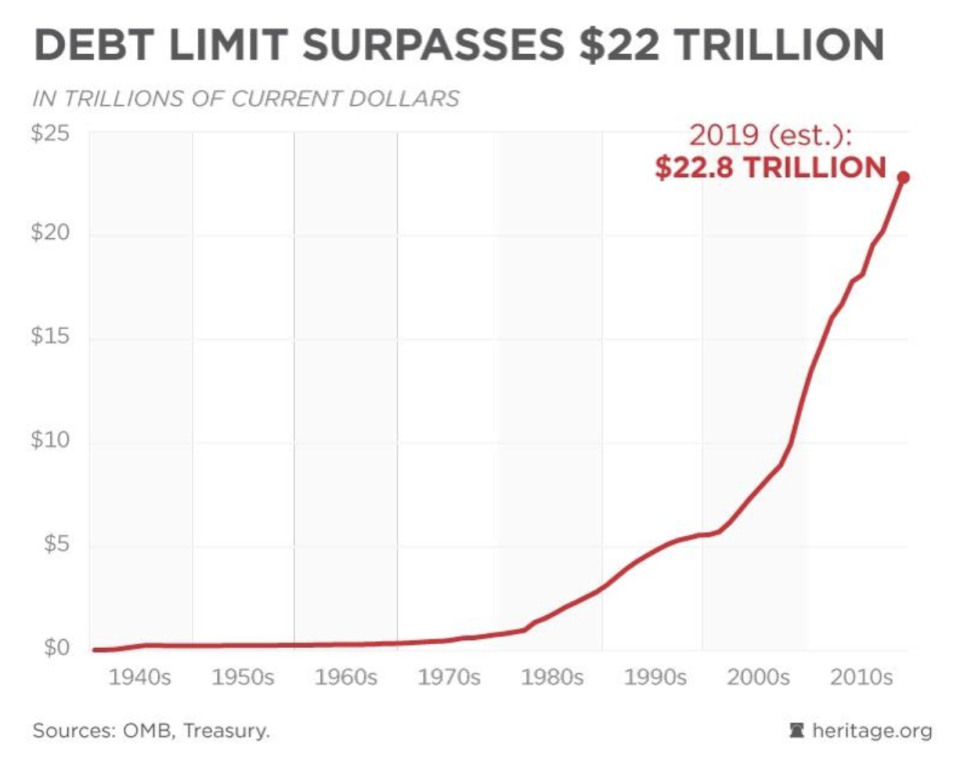

According to Cohan, the astounding levels of national debt, both on the consumer and corporate sides, have become a critical issue in large part caused by the Fed’s easy monetary policy and the prolonged low-interest rate environment.

“We are awash in debt - whether it's auto loans, mortgages, corporate debt, credit card debt or student loans,” Cohan said. “Why? Because the Fed has decided that interest rates are going to be low for an extended period of time, and you get rewarded to borrow money. There's going to be a colossal reckoning, in my opinion.”

Cohan points out that at the time of the financial crisis there was about $5 trillion in corporate debt. Today, we’re getting closer to $10 trillion on corporate issuance, with a good portion of it sitting in junk territory.

“Companies are being rewarded to load up on debt,” argued Cohan. “There's more than a trillion dollars of BBB-rated paper. You know, one little hiccup in the economy and all that BBB debt becomes junk debt. Lots of principal is going to be lost.”

With the markets pricing a 100% chance or a July rate cut during the upcoming FOMC meeting, Fed Chairman Jerome Powell is widely expected to move on rates, which Cohan says would be a mistake.

“We are on the verge of actually doing something correct about interest rates last fall when there wasn't a single high yield deal issued in December…. That was a good thing,” Cohan said. “Then unfortunately Trump jawboned to Jay Powell, and now he's slinking back into his cave with lower interest rates. That is the worst possible thing that could be happening right now.”

Iryna Kirby is a producer for Yahoo Finance. Follow her on Twitter at @IrynaNesko.

Read more:

Powell to Congress: 'Uncertainties' continue to weigh on the economy

Why the Fed shouldn’t be afraid to make a rate cut ‘mistake’ right now

David Zervos: The Fed is ‘the greatest monetary policy experiment in history’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance