Why Manufacturing Stocks Soared During Trump's First Year in Office

Manufacturing stocks hit a home run during President Donald Trump's first year in office. Investor interest in the manufacturing sector, in fact, fired up months before Trump took office as the 45th U.S. president in January 2017, thanks to Trump and Hillary Clinton's campaign promises to rebuild America's infrastructure and create jobs, once elected.

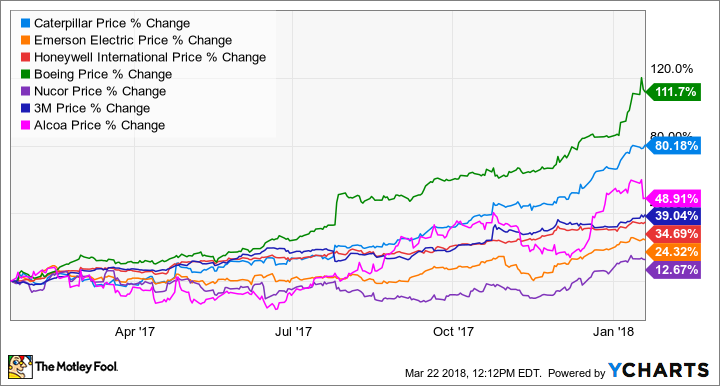

Manufacturing is a huge sector, with the Institute for Supply Management (ISM) recognizing 18 industries within it, including primary metals, machinery, transportation equipment, chemical products, and electrical equipment, appliance, and components. So while it's difficult to find a single benchmark to gauge stock performances, here's a look at some of the top-performing large manufacturing stocks during the one-year period following President Trump's election.

Manufacturing Company | 1-Year Return* |

|---|---|

The Boeing Company (NYSE: BA) | 111.7% |

Caterpillar (NYSE: CAT) | 80.18% |

3M Co. (NYSE: MMM) | 39.04% |

Honeywell International (NYSE: HON) | 34.69% |

Alcoa (NYSE: AA) | 48.91% |

Emerson Electric (NYSE: EMR) | 24.32% |

Nucor (NYSE: NUE) | 12.67% |

Data source: YCharts. *Total returns are from Jan. 20, 2017 through Jan. 19, 2018.

For a broader view of how the manufacturing sector fared during the one-year period, you needn't look further than the Purchasing Managers Index, or PMI -- the most widely used indicator of U.S. manufacturing generated by ISM. The index marked the 16th consecutive month of growth in December 2017 with a reading of 59.7, where any reading above 50 indicates expansion. For perspective, see how closely the rise in the Dow Jones Industrial Average mirrored that of the PMI.

ISM Purchasing Managers Index data by YCharts

If you're wondering what's the deal with the widening gap between PMI and the Dow Jones Industrials at the tail end of the graph, there was a Trump trigger in December that sent stocks even higher -- something I'll touch upon later. Nonetheless, Trump can't take the entire credit for the manufacturing sector's strong performance, as there were a lot of moving parts.

Of commodities, global markets, and internal efficiencies

The fortunes of several manufacturing companies are tied closely to commodity prices, and it isn't limited to primary metal players such as aluminum giant Alcoa or steel manufacturer Nucor. Equipment manufacturers and component suppliers, right from Caterpillar to Emerson Electric and Honeywell, have significant exposure to commodities.

Manufacturing stocks left investors richer during Trump's first year in office. Image source: Getty Images.

Caterpillar, for instance, displayed a solid turnaround in its languishing mining-equipment segment as a recovery in key commodities spurred spending activity. With the company beating analysts' estimates quarter after quarter in the past year or so, investors were bound to be excited. Strong international markets acted as a cherry on top, especially for conglomerates like 3M that have hugely diversified portfolios with a large global footprint. In fact, 3M's sales hit record highs in 2017.

Meanwhile, metal and mining stocks had more than just commodity prices backing their rise. While refining capacity constraints in China boosted prospects for aluminum stocks like Alcoa, Trump's moves to investigate illegally subsidized steel and aluminum imports and slap tariffs in line with his "Buy American and Hire American" executive order sent stocks in the sector soaring.

To be fair, commodity-centric companies were already doing their bit to lower costs and strengthen their financial standing even as they awaited a recovery in end markets. And that was a major factor that reignited investor interest in 2017. Nucor's aggressive deleveraging efforts and opportunistic investments in growth during the downturn helped it turn up one of its best years yet in 2017 despite muted steel prices.

Trump's tax reforms just before the year closed were all the market needed to pump more money into manufacturing stocks.

The big tax effect

Trump's campaigns to lower corporate taxes fueled hopes of higher corporate earnings in the market. When the Tax Cuts and Jobs Act was finally passed in December 2017, effective corporate taxes came down to 21%.

A cut in taxes on repatriation of funds held overseas added fuel to the fire, as diversified, global companies have had large sums of money parked abroad. For example, Caterpillar was holding nearly 91.8%, or $$9.6 billion, of its total marketable securities and cash overseas, according to a Bloomberg report released late last year.

Thanks to lower taxes, several companies bumped up their fiscal 2018 earnings estimates last quarter, including 3M, Emerson Electric, and Honeywell. Aerospace and defense heavyweight Boeing went a step further, announcing in December a "$300 million investment in corporate giving, workforce development, and workplace improvements as a result of the new tax law." Boeing could, in fact, be among the biggest beneficiaries of the tax reforms, as a provision to deduct capital expenditures should help defer tax payments and boost investments in research and development.

Stocks across the manufacturing sector extended their gains in December and January as the tax reforms came into fruition and companies delivered strong fourth-quarter results and guidance for 2018.

With companies across the board eyeing another strong year ahead as they make the most of tax benefits and strong domestic and international markets, manufacturing stocks are unlikely to cool down anytime soon.

More From The Motley Fool

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool recommends 3M and Nucor. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance