Why It Might Not Make Sense To Buy AVEVA Group plc (LON:AVV) For Its Upcoming Dividend

AVEVA Group plc (LON:AVV) stock is about to trade ex-dividend in 4 days. If you purchase the stock on or after the 7th of January, you won't be eligible to receive this dividend, when it is paid on the 5th of February.

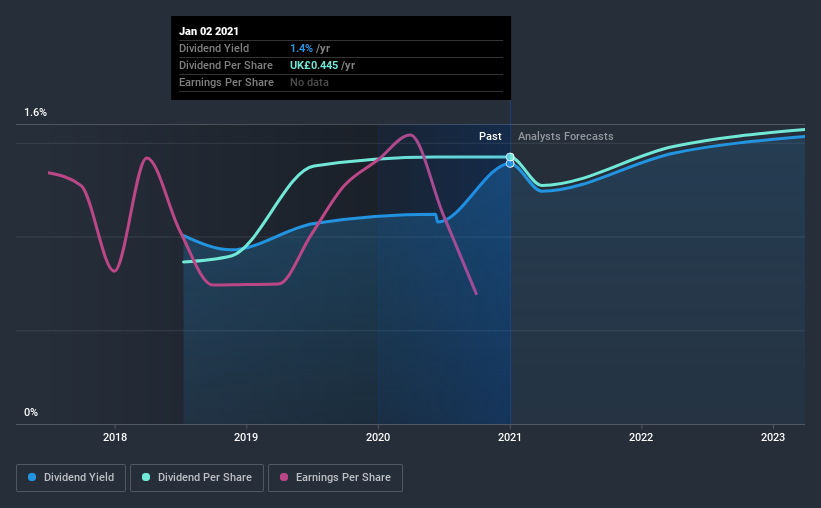

AVEVA Group's upcoming dividend is UK£0.12 a share, following on from the last 12 months, when the company distributed a total of UK£0.45 per share to shareholders. Calculating the last year's worth of payments shows that AVEVA Group has a trailing yield of 1.4% on the current share price of £32.02. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for AVEVA Group

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. An unusually high payout ratio of 228% of its profit suggests something is happening other than the usual distribution of profits to shareholders. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out more than half (72%) of its free cash flow in the past year, which is within an average range for most companies.

It's good to see that while AVEVA Group's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. AVEVA Group's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 45% a year over the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, two years ago, AVEVA Group has lifted its dividend by approximately 28% a year on average. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. AVEVA Group is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

The Bottom Line

Is AVEVA Group worth buying for its dividend? It's never fun to see a company's earnings per share in retreat. What's more, AVEVA Group is paying out a majority of its earnings and over half its free cash flow. It's hard to say if the business has the financial resources and time to turn things around without cutting the dividend. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with AVEVA Group. For instance, we've identified 4 warning signs for AVEVA Group (1 can't be ignored) you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance