Why Is News (NWSA) Up 1.5% Since Its Last Earnings Report?

It has been about a month since the last earnings report for News Corporation NWSA. Shares have added about 1.5% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is NWSA due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

News Corp Q2 Earnings & Revenues Surpass Estimates

News Corporation reported the fifth straight quarter of positive earnings surprise, when it posted second-quarter fiscal 2018 results. Also, revenues surpassed the Zacks Consensus Estimate for the second consecutive quarter. Results gained from sturdy performance at the Digital Real Estate Services, the Cable Network Programming segments.

Q2 Highlights

News Corp posted adjusted earnings of 24 cents a share, exceeding the Zacks Consensus Estimate of 19 cents and climbed 26.3% from the year-ago quarter. Including one-time items, the publisher of The Wall Street Journal reported quarterly loss of 14 cents a share compared with a loss of 50 cents in the prior-year period.

Moreover, News Corp stated that its total revenues in the reported quarter were $2,180 million, up 3% from the year-ago quarter. The top line outpaced the Zacks Consensus Estimate of $2,133 million as well. Its adjusted revenues (excluding the impact of acquisitions, foreign currency fluctuations and divestitures) came in at $2,077 million, reflecting a year-over-year fall of 1%.

While, advertising revenues declined 6.6% to $702 million, circulation and subscription revenues increased 7.1% to $637 million. Consumer revenues also inched up 0.7% to $453 million while revenues from real estate were up 20% to $222 million. Meanwhile, Other revenues improved 20.3% to $166 million.

Segment Details

Revenues from the News and Information Services segment remained flat year over year to $1,298 million in the reported quarter. At News UK, News Corp Australia and Dow Jones the top line increased 7%, 4% and 1%, respectively. However, at News America Marketing the metric decreased 16%. Further, the segment’s adjusted revenues declined 5% from the year-ago quarter.

Advertising revenues fell 6% due to soft home delivered revenues at News America Marketing, mainly attributable to two fewer free-standing inserts as well as lower custom publishing revenues. Also, softness in the print advertising market along with the decision to stop The Wall Street Journal’s international print editions in the quarter impacted the results. These were somewhat mitigated by contributions from the buyout of ARM, a modest growth of advertising revenues at News UK, and foreign currency tailwinds.

Circulation and subscription revenues grew 6% on account of strong contribution from Dow Jones, reflecting nearly 10% growth in the circulation revenues, persistent increase in digital subscriber at The Wall Street Journal along with sturdy growth at its professional information business. Furthermore, the contributions from ARM buyout, rise in cover and subscription price, and favorable currency impact aided revenue growth. The improvement was partly compensated with diminished newsstand volume at News UK.

In the quarter under review, digital revenues accounted for 29% of segment revenues compared with 26% in the year-ago period. Adjusted segment EBITDA fell 7% to $134 million.

The Book Publishing segment reported revenues of $469 million, up 1% from the prior-year period. Digital sales, which constituted 16% of Consumer revenue, rose 2% from the prior-year quarter owing to increase in downloadable audio book sales. However, the segment’s adjusted revenue dipped 1% in the fiscal second quarter while adjusted EBITDA was up 5% to $79 million.

Revenues at the Digital Real Estate Services segment advanced 21% year over year to $292 million on the back of sustained growth witnessed across REA Group (up 24%) and Move (up 18%). Nonetheless, growth was partly compensated with the divestiture of REA Group’s European business and the sale of Move’s TigerLead product. Further, the segment’s adjusted revenues were up 18%. Also, adjusted EBITDA grew 22% to $115 million.

The Cable Network Programming segment’s revenues came in at $120 million, up 15% on account of the buyout of ANC and rise in affiliate revenue at FOX SPORTS Australia. The segment’s adjusted revenues also grew 6% in the quarter. However, adjusted EBITDA fell 22% to $40 million.

Other Financial Aspects

News Corp ended the quarter with cash and cash equivalents of $1,856 million, borrowings of $187 million and shareholders’ equity of 10,860 million, excluding non-controlling interest of $298 million.

Capital expenditures of $128 million were incurred in the six months of fiscal 2018 while free cash flow available to the company was $16 million.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates have trended downward during the past month. There have been four revisions lower for the current quarter.

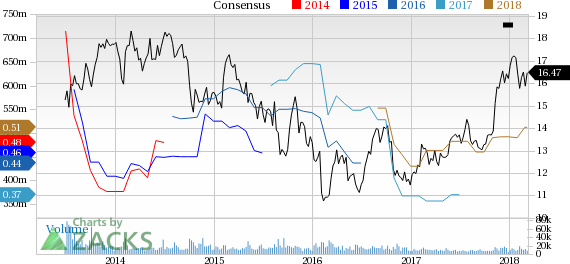

News Corporation Price and Consensus

News Corporation Price and Consensus | News Corporation Quote

VGM Scores

Currently, NWSA has a nice Growth Score of B and a grade with the same score on the momentum front. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is equally suitable for growth and momentum investors while value investors may want to look elsewhere.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, NWSA has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

News Corporation (NWSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance