Why Office Depot, Inc. Stock Lost 19% Last Month

What happened

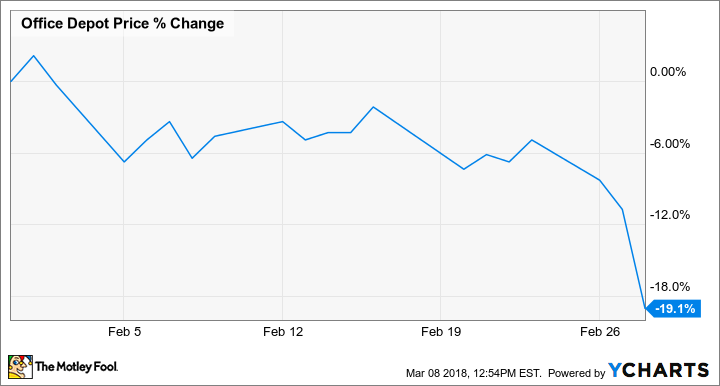

Shares of Office Depot, Inc. (NASDAQ: ODP) took a dive last month after the struggling office-supply retailer turned in disappointing guidance for 2018 fourth-quarter earnings results and sales growth came up short. According to S&P Global Market Intelligence, the stock lost 19% in February.

As the chart below shows, the bulk of Office Depot's losses came when it reported earnings at the end of the month.

So what

Office Depot stock fell 9% on Feb. 28, as the company said comparable sales in its retail division fell 4% as overall revenue declined 5% to $2.58 billion, missing estimates at $2.61 billion. Gross margin in the period dropped 44 basis points to 23.5%, and the company posted adjusted earnings per share of $0.08, down from $0.11 a year ago, but a penny above the analyst consensus at $0.07. The company closed 26 stores in the quarter, leaving it with 1,378 locations, and also completed its acquisition of CompuCom Systems, which is part of its strategy of pivoting toward the IT Enterprise market.

Image source: Getty Images.

CEO Gerry Smith noted, "Trends in the Business Solutions Division continued to improve sequentially and we also saw relative improvement in store traffic recently as a result of strategic shifts in our offer and marketing mix."

Now what

Despite that upbeat remark, Office Depot's guidance for the current year missed the mark as it anticipates sales rising to $10.6 billion from $10.24 billion last year with help of the CompuCom acquisition, but that was below estimates at $10.63 billion. It also expects adjusted earnings per share of $0.30, down from $0.45 last year and less than the consensus at $0.56.

Office Depot is continuing to transition away from retail, and its investments in its new serviced-based model will pressure earnings, though the company expects profits to grow in 2019. While the strategy looks like a smart move, the headwinds in the office-supply industry may be too strong to overcome.

More From The Motley Fool

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance