Why Is PACCAR (PCAR) Up 1.3% Since Its Last Earnings Report?

It has been about a month since the last earnings report for PACCAR Inc. PCAR. Shares have added about 1.3% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is PCAR due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

PACCAR Earnings and Revenues Beat Estimates in Q1

PACCAR’s first-quarter 2018 adjusted earnings were $1.45 per share, up from 88 cents recorded in the year-ago quarter. Earnings surpassed the Zacks Consensus Estimate of $1.31. Results were aided by record quarterly truck deliveries, robust Parts revenues and pretax profits.

During the quarter, PACCAR posted quarterly consolidated net sales and revenues of $5.65 billion. Its revenues from the Truck, Parts and Other segment were $5.32 billion. The Zacks Consensus Estimate of revenues was $5.03 billion.

Segment Results

Revenues from the Truck, Parts and Other segment increased to $5.32 billion in first-quarter 2018 from $3.94 billion in first-quarter 2017. The segment’s pre-tax income increased to $591.9 million from $383.3 million, recorded a year ago.

Revenues from the Financial Services segment (comprising a portfolio of 187,000 trucks and trailers with total assets of $13.59 billion) rose to $332.2 million from $302.2 million a year ago. Pre-tax income increased to $67.5 million from $56.8 million in first-quarter 2017.

Financial Position

PACCAR’s cash and marketable debt securities amounted to $3.47 billion as of Mar 31, 2018, compared with $3.62 billion as of Dec 31, 2017.

Class 8 Truck Scenario & View

Class 8 truck industry orders more than doubled in first-quarter 2018, on a year-over-year basis. This indicates a robust economy and strong freight demand. The company raised estimates of 2018 Class 8 truck industry retail sales for the U.S. and Canada to 265,000-285,000 vehicles, up from the previous range of 235,000-265,000 trucks.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed an upward trend in fresh estimates. There have been five revisions higher for the current quarter compared to three lower.

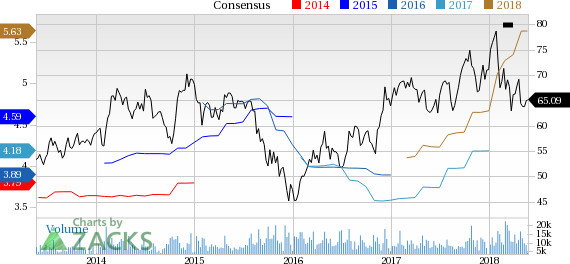

PACCAR Inc. Price and Consensus

PACCAR Inc. Price and Consensus | PACCAR Inc. Quote

VGM Scores

At this time, PCAR has a nice Growth Score of B and a grade with the same score on the momentum front. The stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for value investors than those looking for growth and momentum.

Outlook

Estimates have been broadly trending upward for the stock and the magnitude of these revisions looks promising. Notably, PCAR has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance