Why Is Praxair (PX) Down 4.7% Since its Last Earnings Report?

A month has gone by since the last earnings report for Praxair PX. Shares have lost about 4.7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to its next earnings release, or is PX due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Fourth-Quarter 2017 Earnings Highlights

Praxair reported impressive results for fourth-quarter 2017, with a positive earnings surprise of 2.7%. Including the fourth-quarter outperformance, the company's average earnings surprise for the four quarters of 2017 is a positive 3%.

Adjusted earnings in the quarter came in at $1.52 per share, beating the Zacks Consensus Estimate of $1.48. Also, the bottom line increased 7.8% from the year-ago tally of $1.41. Earnings were driven by healthy sales growth in all business segments, partially offset by rise in cost of sales and operating expenses.

Adjusted earnings in the quarter exclude approximately $1.41 per share of charges related to proposed Praxair-Linde merger and the tax reform introduced in the United States.

For 2017, the company's adjusted earnings were $5.85 per share, increasing 6.8% from the year-ago tally of $5.48. Also, the figure surpassed the Zacks Consensus Estimate of $5.81.

Revenues Driven by Solid Segmental Business

Praxair's sales in the quarter totaled $2,953 million, increasing 11.7% year over year. The improvement was driven by 7% gain from volume growth, 1% from favorable pricing, 1% from cost pass-through and 3% positive impact from currency translation. Businesses in manufacturing, healthcare, electronics, chemicals, metals, energy and food and beverage end markets were strong.

Also, the top line exceeded the Zacks Consensus Estimate of $2.85 billion.

Backlog was $1.5 billion at the quarter end.

The company operates through five business segments. Their top-line results for the quarter are briefed below:

Revenues generated in North America grew 10.4% year over year to $1,542 million. The segment's revenues represented 52.2% of total revenues.

Revenues in Europe, representing 14% of total revenues, increased 17.4% to $412 million.

In Asia, revenues increased 19% to $470 million and represented 15.9% of total revenues.

Surface Technologies revenues were $159 million, above $149 million in the year-ago quarter. The segment's revenues represented 5.4% of total revenues.

Revenues from South America increased 5.1% to $370 million. It represented 12.5% of total revenues.

For 2017, the company's sales were $11,437 million, reflecting year-over-year growth of 8.6%. Also, the figure surpassed the Zacks Consensus Estimate of $11.3 billion.

Margins Dip on High Costs & Expenses

In the quarter, Praxair's costs of sales increased 12.3% year over year. It represented 56.2% of fourth-quarter sales versus 55.9% in the year-ago quarter. Gross margin declined 30 bps to 43.8%. Selling, general and administrative expenses were $316 million, up 16.2% year over year. Research and development expenses were $24 million.

Adjusted operating profit in the quarter grew 9% year over year to $653 million while adjusted operating margin decreased 60 bps to 22.1%.

Balance Sheet & Cash Flow

Exiting the fourth quarter, Praxair had cash and cash equivalents of $617 million, above $607 million in the preceding quarter. Long-term debt decreased 5.6% sequentially to $7,783 million.

In the quarter, the company generated net cash of $836 million from its operating activities, up 15.2% year over year. Capital spent on purchase of property, plant and equipment totaled $339 million, down from $409 million in the year-ago quarter.

During the quarter, Praxair paid dividends of $226 million and repurchased shares worth $1 million.

Outlook

For 2018, Praxair anticipates benefitting from a strengthening end markets, sound product portfolio and new project wins. Also, new tax reform is anticipated to stimulate capital investments and benefit companies like Praxair.

Also, the company is working on its business combination deal with Linde AG, having received its shareholders' approval about the deal during the third quarter. It anticipates that the merger will be complete in the second half of 2018.

For the first quarter of 2018, the company anticipates earnings to be within the $1.53-$1.58 per share range. The projection reflects year-over-year growth of 12-15% and includes 5 cents of gain the recent tax reform in the country. Tax rate in the quarter is predicted to be within 23-25%.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed an upward trend in fresh estimate. There has been one revision higher for the current quarter

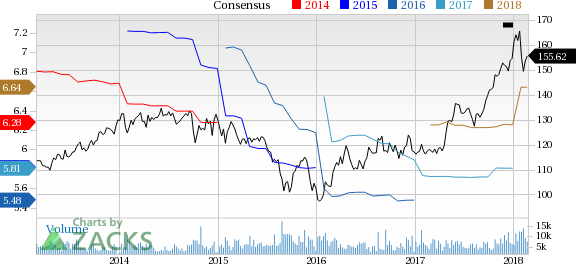

Praxair, Inc. Price and Consensus

Praxair, Inc. Price and Consensus | Praxair, Inc. Quote

VGM Scores

At this time, PX has a nice Growth Score of B, a grade with the same score on the momentum front. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for growth and momentum investors.

Outlook

While estimates have been broadly trending upward for the stock, the magnitude of these revisions has been net zero. The stock has a Zacks Rank #2 (Buy). We are looking for an above average return from the stock in the next few months

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Praxair, Inc. (PX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance