Why Proto Labs Stock Dropped 10.3% in July

What happened

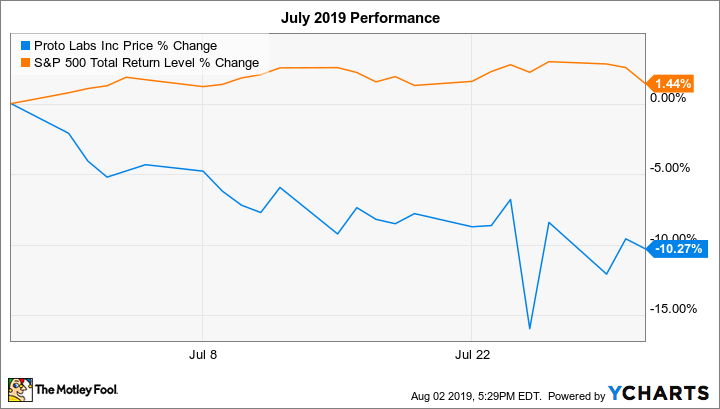

Shares of quick-turn contract manufacturer Proto Labs (NYSE: PRLB) fell 10.3% in July, according to data from S&P Global Market Intelligence.

For context, the S&P 500 returned 1.4% last month.

Image source: Getty Images.

So what

We can attribute Proto Labs stock's weak July performance largely to a continuation of the downward momentum it's experienced throughout 2019. This downward movement stems from the company turning in quarterly earnings reports, beginning with the one for the fourth quarter of 2018, that have disappointed investors.

Even before Proto Labs released its second-quarter 2019 results on July 25, shares were in the red 6.8% for the month.

Data by YCharts.

Proto Labs stock reacted a bit unusually after the company announced its Q2 results. On July 25, shares dropped 9.8%, but then jumped 9% the next day. The net effect was that the stock moved 1.7% lower in the two trading days following the release and then drifted down a bit more through the end of the month. We can speculate that some market participants probably thought the initial sell-off was overdone.

In Q2, Proto Labs' revenue rose 5.7% (or 7% in constant currency) year over year to $115.9 million and earnings adjusted for one-time items slipped 3% to $0.71 per share. Wall Street had been looking for adjusted earnings per share (EPS) of $0.70 on revenue of $116.5 million. So, Proto Labs slightly missed the expectation on the top line and slightly beat it on the bottom line. The thing that most rattled investors was likely Q3 guidance, as it came in much lower than analysts had been projecting.

A main driver of the earnings decline was weakness in the company's Rapid Manufacturing business, which it acquired in December 2017. This business also negatively impacted overall revenue growth by about two percentage points in constant currency. It's still relatively early in the integration process, so investors shouldn't be overly concerned at this point.

Now what

For the third quarter, Proto Labs' outlook is as follows:

Revenue between $116 million and $122 million, representing growth of 1% to 6% year over year.

Adjusted EPS between $0.69 and $0.77, representing a decline of 10% to 20% from the year-ago period.

CFO John Way said the company was "taking a cautious approach" with respect to guidance because economic growth has slowed and management has "limited visibility."

More From The Motley Fool

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Proto Labs. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance