This Is Why REACT Group PLC's (LON:REAT) CEO Compensation Looks Appropriate

Key Insights

REACT Group to hold its Annual General Meeting on 28th of March

Salary of UK£116.0k is part of CEO Shaun Doak's total remuneration

The total compensation is 49% less than the average for the industry

Over the past three years, REACT Group's EPS fell by 52% and over the past three years, the total loss to shareholders 36%

The performance at REACT Group PLC (LON:REAT) has been rather lacklustre of late and shareholders may be wondering what CEO Shaun Doak is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 28th of March. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for REACT Group

Comparing REACT Group PLC's CEO Compensation With The Industry

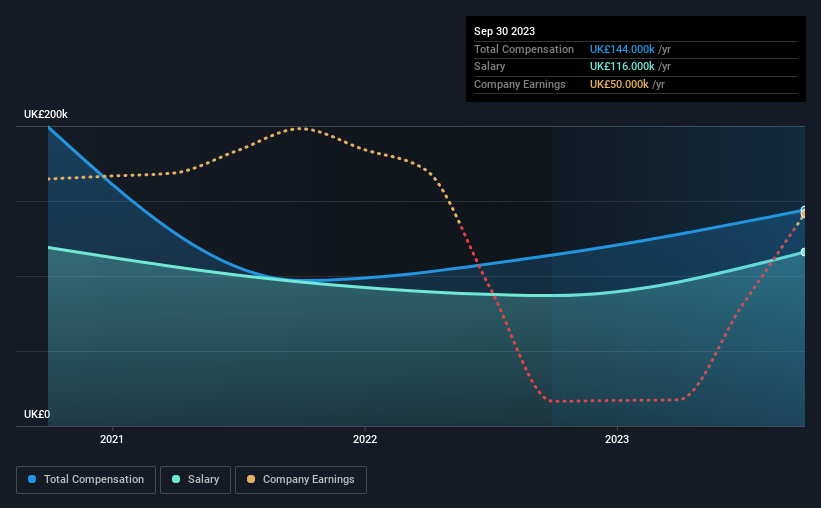

At the time of writing, our data shows that REACT Group PLC has a market capitalization of UK£14m, and reported total annual CEO compensation of UK£144k for the year to September 2023. That's a notable increase of 26% on last year. In particular, the salary of UK£116.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the British Commercial Services industry with market capitalizations below UK£158m, reported a median total CEO compensation of UK£282k. In other words, REACT Group pays its CEO lower than the industry median.

Component | 2023 | 2022 | Proportion (2023) |

Salary | UK£116k | UK£87k | 81% |

Other | UK£28k | UK£27k | 19% |

Total Compensation | UK£144k | UK£114k | 100% |

Talking in terms of the industry, salary represented approximately 64% of total compensation out of all the companies we analyzed, while other remuneration made up 36% of the pie. According to our research, REACT Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at REACT Group PLC's Growth Numbers

REACT Group PLC has reduced its earnings per share by 52% a year over the last three years. In the last year, its revenue is up 43%.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has REACT Group PLC Been A Good Investment?

Few REACT Group PLC shareholders would feel satisfied with the return of -36% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The loss to shareholders over the past three years is certainly concerning. The fact that earnings growth has gone backwards could be a factor for the downward trend in the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for REACT Group that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance