Why Shopify Stock Climbed 50.8% in the First Half of 2018

What happened

Shares of Shopify (NYSE: SHOP) climbed 50.8% through the first six months of the year, according to data provided by S&P Global Market Intelligence. The stock rallied as the company reported strong earnings results, gave encouraging guidance, and forged some interesting partnerships that helped counter bearish sentiment.

SHOP 2018 price change. Data source: YCharts.

Shopify faced an increase in short interest toward the tail end of 2017 that was kicked off by Andrew Left's Citron Research. This negative sentiment combined with the more favorable news from the company created a recipe for the e-commerce stock to post big gains in the first half of 2018, and its strong performance has continued in July.

Image source: Getty Images.

So what

Shopify stock started 2018 with a bang, climbing roughly 27% in January thanks to favorable retail and e-commerce trends and a meeting with Apple CEO Tim Cook. The company's shares then saw substantial upward pricing movement leading up to and following the publishing of its first-quarter results on Feb. 15. Sales for the period climbed 71% year over year to land at $222.8 million, coming in ahead of the average analyst estimate's call for sales of $209.5 million. Growth for sales from the company's Shopify Plus service offering targeted at larger businesses was also encouraging. Shopify also announced that it was partnering with the city of Ontario for online marijuana sales. Shares closed out February up roughly 8%.

The stock continued to move upward through the first half of March, but then saw big sell-offs following another round of bearish coverage from Citron Research. This time, Citron argued that Shopify was likely to get caught up in the data-harvesting scandal that was, at the time, weighing on Facebook's share price and outlook. The stock saw some recovery toward the end of April and then posted big gains on the heels of its first-quarter results in May.

Sales for the March-ended quarter rose 68% year over year to reach $214.3 million and the company posting adjusted earnings per share of $0.04 -- up from a $0.04 per share loss in the prior-year quarter. The stock continued to climb thanks, at least in part, to the strong earnings report, reaching a new high in June before selling off on news that Facebook was cracking down on e-commerce ads delivered through its platform.

Now what

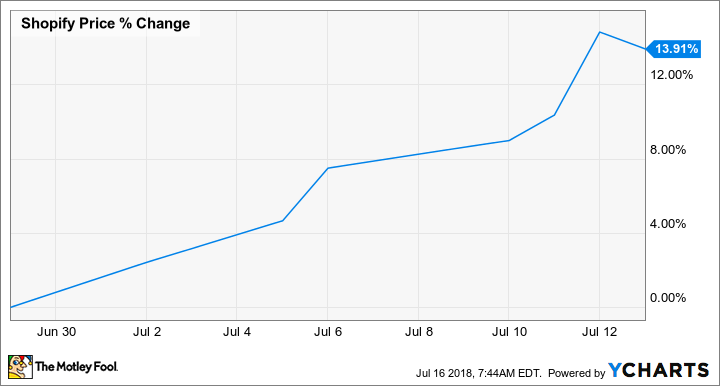

Shopify stock has since rebounded from the sell-offs that occurred late in the latter half of June and are up roughly 14% in July as of this writing.

SHOP July price change. Data source: YCharts.

The overall e-commerce market looks poised for sustained growth, and it's likely that a growing number of small businesses will increase their efforts in the online retail space.

Those are trends that look very favorable for Shopify's business, but investors should also take a look at competitive pressures and some of the criticisms that have recently been levied against the company in order to determine whether the stock fits their desired risk profile at current prices. Shares trade at roughly 17 times this year's expected sales.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Facebook and Shopify. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance