Why Stamps.com Stock Just Dropped 7%

What happened

Shares of postage payment facilitator Stamps.com (NASDAQ: STMP) dropped as much as 11% in early trading Monday, before reviving to book "only" a 7.1% loss as of 12:15 p.m. EST. Stamps.com hasn't reported anything noteworthy today, nor are its earnings out just yet.

So what

Instead, I think you can blame Amazon.com (NASDAQ: AMZN) for this one.

Three months ago, Stamps.com reported a big earnings beat, but said Amazon was bringing some of its "Fulfillment by Amazon" postage billing in-house and that might affect Stamps.com's business going forward. "Fulfillment by Amazon [is] just another one of the carriers that we support," said Stamps.com CEO Kenneth McBride, and so presumably Amazon's move wouldn't doom Stamps.com's business.

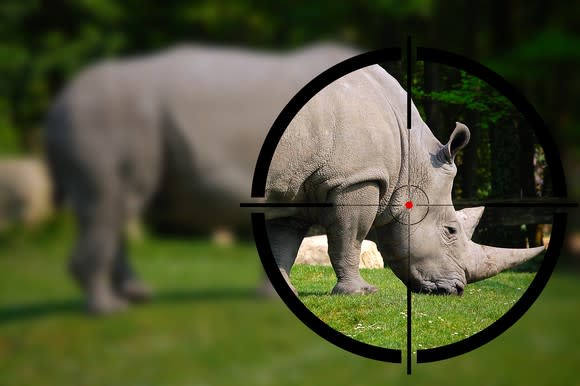

Amazon targets companies with big margins -- and Stamps.com may have gotten caught in the crossfire. Image source: Getty Images.

But investors were not reassured -- and sold off Stamps.com stock.

Today, I think Stamps.com's latest sell-off can likewise be traced back to Amazon and its announcement last week that it's launching a "Shipping With Amazon" service to deliver packages for businesses that sell goods on its website -- and eventually for businesses that don't even sell on its website. That news torpedoed the stocks of shipping companies FedEx (NYSE: FDX) and UPS (NYSE: UPS). It only makes sense that it would affect Stamps.com's stock as well.

Now what

Is Amazon trying to drive out of business every other company involved in shipping packages from Point A to Point B? Maybe, maybe not. But one thing's for sure: Amazon.com CEO Jeff Bezos is famous for his mantra:"Your margin is my opportunity."

That makes Stamps.com, which sports a 34.5% operating profit margin, look like a big fat opportunity for Bezos.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Rich Smith owns shares of Stamps.com. The Motley Fool owns shares of and recommends Amazon and Stamps.com. The Motley Fool recommends FedEx. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance