Why Starbucks Stock Has Lost 15% in 2018 (So Far)

What happened

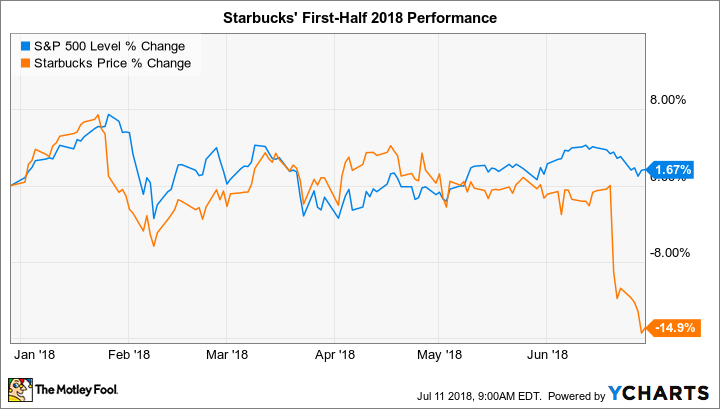

Starbucks (NASDAQ: SBUX) stock has trailed the market through the first six months of 2018 by shedding 15%, compared to a 2% uptick in the S&P 500, according to data provided by S&P Global Market Intelligence.

The slump has left shares just below the broader market over the past five-year period, but Starbucks remains well ahead of the S&P 500 since 2008.

So what

The 2018 underperformance was sparked by surprisingly weak sales-growth trends. Rather than rising by over 3%, as management initially targeted, revenue will only inch higher by between 1% to 2% this year, executives warned in late June. The coffee chain is struggling with weak customer-traffic trends that have been amplified by consumer shifts away from products like Frappuccino drinks, which aren't selling as quickly as they used to.

Image source: Getty Images.

Now what

Starbucks has major advantages in its corner as it seeks to get growth back on track after two years of disappointing results. These include a valuable brand, a huge addressable market in both the U.S. and China, and one of the world's biggest digital rewards programs. Meanwhile, as investors wait for the results of its turnaround efforts, they can expect to see larger cash returns in the form of stock buybacks and a dividend payout that recently jumped 20%.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of Starbucks. The Motley Fool owns shares of and recommends Starbucks. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance