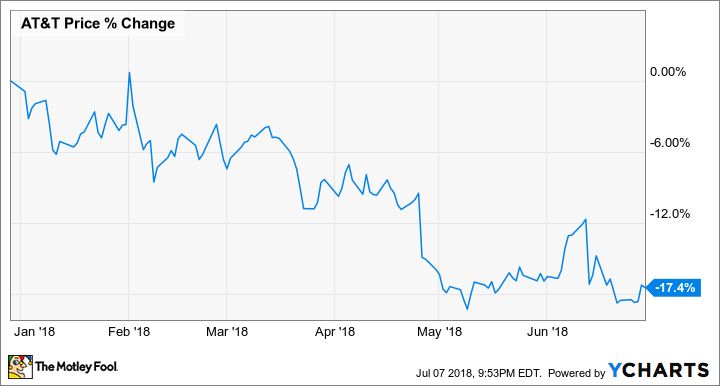

Why AT&T Stock Fell 17.4% in the 1st Half of 2018

What happened

Shares of AT&T (NYSE: T) reached the half-year mark of 2018 down 17.4%, according to data provided by S&P Global Market Intelligence .

The telecom company saw significant sell-offs stemming from disappointing quarterly results and uncertainty surrounding the Department of Justice's (DOJ) challenge to its acquisition of Time Warner and whether the merger will actually work to its benefit.

Image source: AT&T.

So what

AT&T stock climbed at the beginning of February thanks to better-than-expected fourth-quarter earnings and promising guidance. However, the gains were short lived, and the stock gave up all of its post-earnings gains in the next day of trading amid a broader market sell-off. Shares then continued to see significant downward momentum in the middle of March, corresponding with the beginning of the DOJ antitrust suit that would determine the legality the Time Warner merger.

AT&T stock then took another big hit in April following the release of disappointing first-quarter results. Both sales and earnings came in below the market's expectation, prompting the company's valuation to decline by 7% in the day of trading that followed the April 25 earnings release.

The Washington D.C. district court issued its ruling on June 12, approving AT&T's merger with Time Warner without any conditions that could have required the combined company to sell off assets like DirecTV or the Turner networks. However, AT&T shares lost roughly 7% of their value in the next week's trading -- seemingly due to investor concerns that the deal makes the company too debt heavy.

Now what

AT&T's share price has dipped a roughly 2% more since the beginning of July, with sell-offs coming on the heels of recent news that the DOJ would be challenging the Time Warner merger ruling in appeals court. Management has stated that it doesn't see the appeals case changing anything with regard to the merger, but it will cause the company to incur additional legal expenses and put it on the hook for the costs of splitting from Time Warner -- if the ruling is reversed and that winds up being the final decision on the matter.

AT&T's poor stock performance over the last decade and 34-year history of annual dividend growth have created a situation that has the company's dividend yielding roughly 6.3%.

With the company valued at roughly nine times this year's expected earnings, a likely long-term tailwind from the passage of the Tax Cuts and Jobs Act of 2017, and a market position that points to significant opportunities in 5G and the Internet of Things, income-seeking investors willing to weather some uncertainty should consider adding AT&T to their portfolios.

More From The Motley Fool

Keith Noonan owns shares of AT&T.; The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance