Why Tesco joined the online grocers gold rush

The rush of orders for online grocery deliveries during lockdown threatened to overwhelm even the country’s largest and best-prepared supermarkets.

Ocado, which presents itself as a high-tech digital supermarket, even had to stop accepting online orders from new customers at the height of lockdown panic-buying.

The rapid change in customer behaviour caused by lockdown has convinced many supermarkets to speed up their plans to embrace online grocery deliveries.

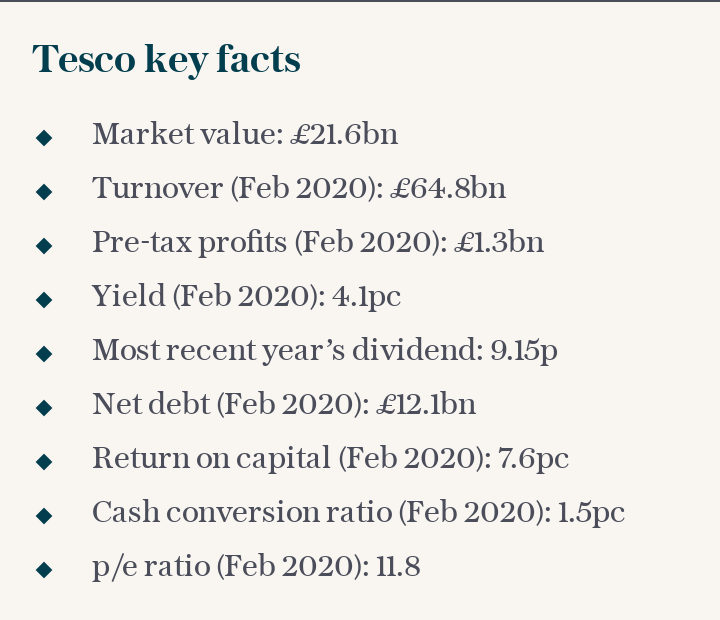

On Monday, Tesco announced that it will hire 16,000 permanent employees to help it cope with substantial growth in online orders.

The supermarket said it is now handling 1.5 million online orders per week, up from 600,000 before lockdown began. It expects online sales this year to jump to £5.5bn.

“They've doubled the size of that business in a very short space of time,” says retail analyst Richard Hyman.

The supermarket’s announcement that it will hire 10,000 “pickers” to seek out online orders directly from supermarket shelves, as well as 3,000 new drivers, was not a surprise to analysts who have observed the explosion in online orders.

Monday’s announcement places Tesco squarely into the fold of companies doubling down on online grocery deliveries. The shift to online groceries was expected to take years by many market watchers, but coronavirus has supercharged that growth.

The latest news follows The Telegraph's revelation earlier this month that it will also offer free delivery to members of its Clubcard Plus loyalty scheme.

Experts say Tesco’s jump in online orders and its hiring of thousands of staff could allow it to leapfrog digital-only rivals like Ocado.

In July, Ocado boasted that it was the country’s fastest growing grocer thanks to a new partnership with Marks & Spencer which is set to begin in September.

“The world as we know it has changed," said chief executive Tim Steiner. “We have seen years of growth in the online grocery market condensed into a matter of months; and we won't be going back.”

But Ocado’s recent success risks being overshadowed by Tesco’s rapid online ordering expansion which it has managed to carry out relatively cheaply, experts say. Tesco's aggressive expansion also comes in marked contrast to Ocado's partner M&S, which slashed 7,000 jobs last week.

“It's actually Tesco that's growing a lot faster than Ocado in the online grocery market at the moment, from a much bigger base,” says Clive Black, the head of research at Shore Capital.

“Ocado's business model is very capital-intensive. It costs several hundred million pounds to put down an automated warehouse,” he adds. “Whereas Tesco has been able to double its capacity in three months at no capital cost apart from leasing some vans.”

Ocado’s years of investments into robotic technology, which automatically pick up items from warehouse shelves, bag them and load them into trucks, means that the business faces high expansion costs that risk slowing down its growth.

Tesco’s people-powered approach to hire thousands of new employees may also be costly, but it gives the business a head start over Amazon as the e-commerce business plans to expand its own free grocery delivery scheme across the country by the end of the year.

Amazon’s plan to dominate grocery delivery in the UK has been clear for years, but Tesco will hope that its customers will remain loyal. “Amazon is a tremendously strong, successful business but it's not brilliant at everything,” Hyman says. “There are some things that Tesco is much better at, and one of them is food retailing.”

“Tesco has already got a very substantial online food business, it's really for Amazon to try and chip away at them. It's going to take Amazon quite a while to build.”

With its 26pc market share of UK groceries, according to Kantar, Tesco may also see its expansion into online as a way to cement its lead against discount rivals such as Aldi and Lidl, which have 8pc and 6pc respectively. Tesco's share of online groceries is thought to be greater still, around 33.5pc, bringing to an end a long decline of losing customers to the deep-discounting Germans.

Despite Tesco’s evident success in bringing in more online orders, experts warn that the economics of online versus in-store orders isn’t rosy as everyone may believe.

“No-one really makes money retailing food online,” Hyman says. “This is the biggest elephant in the room.”

Switching from a model where a customer picks their own items from shelves and drives them home themselves to one that’s far more costly for supermarkets has squeezed margins like never before.

But lockdown has transformed the economics of online grocery deliveries to make it more attractive to supermarkets like Tesco. “Until most recently, for most of the retailers it was marginally loss-making to breakeven at best,” Shore Capital's Black says. “It's now profitable.”

That’s because supermarket delivery vans are currently operating at maximum capacity during lockdown and supermarkets don’t need to entice shoppers in with discount coupons. “The industry is at full capacity at the minute,” Black says.

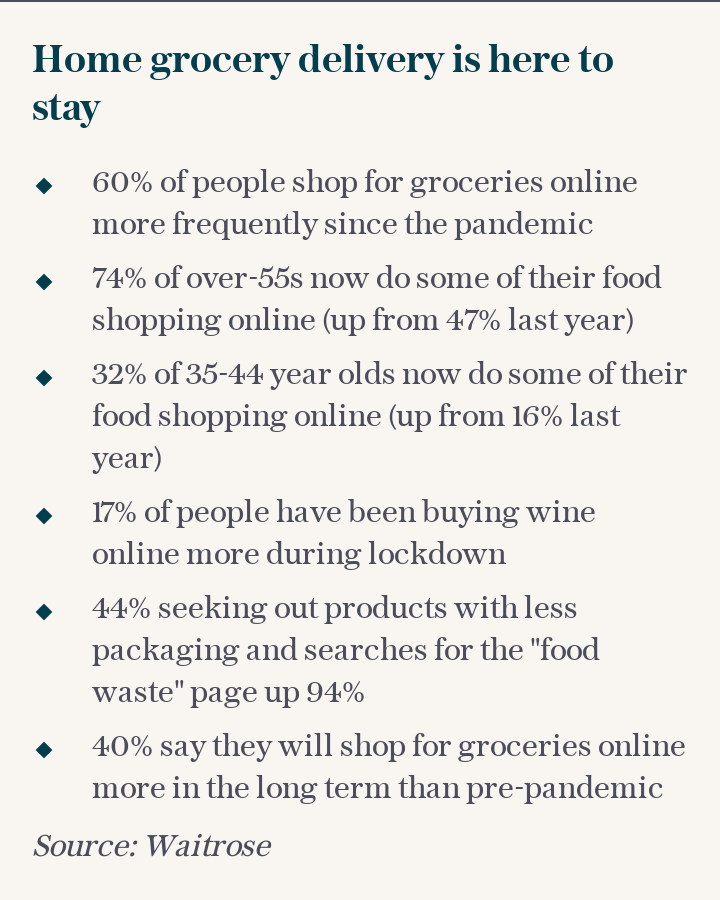

But it remains to be seen how many of the shoppers who switched to online ordering during lockdown will continue to prefer having their groceries brought to their door.

Tesco is clearly confident that online grocery shopping is here to stay, with the chain even leaving the door open to hiring more employees.

But industry insiders question whether supermarkets will still be operating at full capacity once lockdown is lifted. There’s a risk that demand for online grocery deliveries dips, leaving supermarkets with an increased reliance on a loss-making division.

For now, at least, analysts welcome Tesco’s hiring announcement. Ocado and Amazon are likely to have a far less positive reaction to the news, however.

Yahoo Finance

Yahoo Finance