Why the stock market’s surge may delay a U.S.-China trade deal

The stock market’s recent record highs may put less pressure on the U.S. to reach a trade deal with China at the upcoming G-20 meeting in Japan, where President Trump and China’s President Xi Jinping are set to meet.

That’s the assessment from Bank of America Merrill Lynch analysts.

“With the stock market near its all-time high, markets expecting a strong ‘Powell put’ and GDP growth running at more than 3% year-over-year, the U.S. is likely to try to drive a hard bargain,” the analysts, led by global economist Ethan Harris, wrote in a note to clients Tuesday. “Like it or not, the Fed’s dovish message of offsetting downside risks encourages trade war escalation.”

Last week, the S&P 500 (^GSPC) closed at a record high largely amid signals from the Federal Reserve that it will act as appropriate to keep the economy humming. Many investors expect the central bank to cut interest rates this year.

Still, regardless of the stock market, Bank of America acknowledges that there are other hurdles to a trade deal. “The Trump administration has already started to downplay hopes of a deal, likely because the two sides are still very far apart,” they noted.

While the analysts aren’t expecting a deal, they do expect a “ceasefire” that includes a postponement of additional tariffs.

“We think risk assets will react positively in the short run to a delay in the tail risk of a full-blown trade war, especially given the backdrop of increasingly accommodative global monetary policy,” they wrote. “In the medium term, however, the trade war will likely continue to erode business confidence, weighing on the U.S., China and regions caught in the crossfire, such as Asia-Pacific and Europe.”

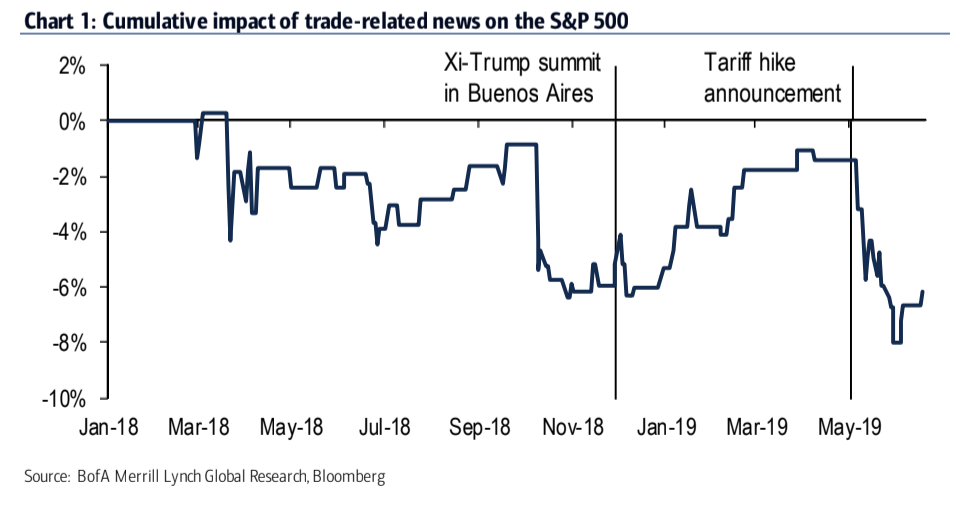

The tariffs on China have rattled global stocks for well over a year, as seen in this chart below:

Read the latest financial and business news from Yahoo Finance

Scott Gamm is a reporter at Yahoo Finance. Follow him on Twitter @ScottGamm.

More from Scott:

The earnings picture for 2019 is showing more signs of deterioration

The next rate cut is unlikely to be caused by weak growth, economist explains

What the plunging 10-year Treasury yield says about the economy and stock market

Why one top strategist is bullish on tech even with lingering trade worries

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance