Here’s why I think the Lloyds share price recovery will continue

Keen followers of the Lloyds (LSE:LLOY) share price will have noticed that it’s done well lately. Since the start of February, it’s risen by 30%. This makes it the seventh-best performer on the FTSE 100.

But compared to five years ago, its performance has been less impressive. Since May 2019, it’s fallen by 18%.

However, I think there are reasons to believe that Lloyds’ shares will continue to outperform the wider market.

An interesting perspective

At first glance, my optimism might appear misplaced given that most economists believe interest rates have currently peaked. Although nobody is predicting a return to the near-zero base rate of the past decade or so, most are anticipating a series of small reductions over the next two years.

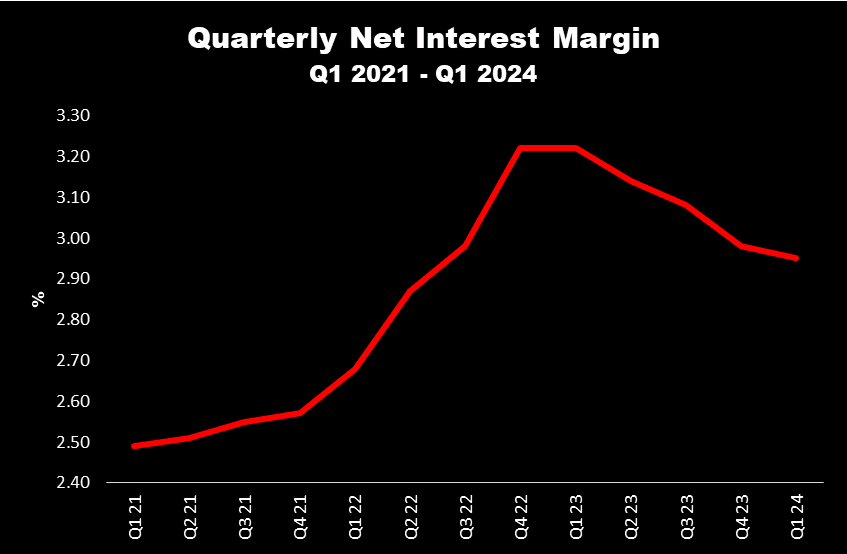

And that’s not good for Lloyds as it will impact its net interest margin (NIM). This is the difference between the interest charged on loans and that paid on deposits, expressed as a percentage of interest-earning assets.

The chart below shows the bank’s quarterly NIM since the start of 2021. Predictably, it’s followed the Bank of England’s upwards movements in the base rate. But it’s fallen recently as mortgage markets have stabilised and become more competitive.

An improving picture

However, there’s another consequence of a higher interest rate environment. And that’s an increased chance that borrowers will default on their loans.

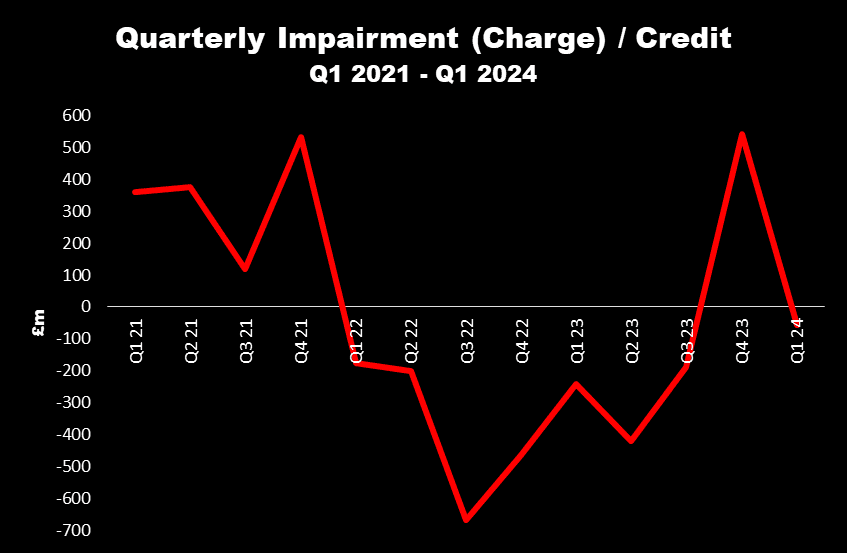

Each quarter, Lloyds makes an assessment of its potential credit losses. If the situation is improving then a credit (income) is booked in its accounts. Otherwise, a charge (cost) is recorded.

And as the following chart illustrates, throughout 2022 and for the first three quarters of 2023, it booked total losses of £2.36bn. For context, this is equivalent to 28.7% of its profit after tax for the period.

I don’t think it’s a coincidence that during most of this time the bank’s NIM was rising. This implies an increase in borrowing costs — squeezing incomes — for those with variable rate loans.

However, with the UK economy expected to grow this year, I’m hopeful that we are now entering a period of stability.

This should help improve the quality of Lloyds’ loan book, which will more than compensate for the anticipated reduction in its interest income.

It might also persuade previously sceptical investors to consider taking a position.

Final thoughts

But investing in the bank does carry some risks. With its heavy exposure to the domestic mortgage market, Lloyds’ earnings are particularly sensitive to the health of the UK housing sector.

And investors quickly lose confidence in financial institutions whenever a bank collapses, irrespective of where it occurs, or the particular circumstances that led to its demise.

We saw that in the first half of 2023, when three of the four biggest bank failures in US history happened. During this period, Lloyds shares tumbled which was unfair given its balance sheet strength and solvency. But it’s a sector-specific risk that potential investors need to be aware of.

Overall, I continue to remain positive about Lloyds’ prospects.

For 2024, analysts are expecting earnings per share of 6.2p. This implies a forward price-to-earnings ratio of 8.4, which is lower than when the bank’s shares were last above 60p, in January 2020. This suggests to me that despite its recent good performance, there’s still value in the share price.

The post Here’s why I think the Lloyds share price recovery will continue appeared first on The Motley Fool UK.

More reading

James Beard has positions in Lloyds Banking Group Plc. The Motley Fool UK has recommended Lloyds Banking Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance