Why Is Take-Two Interactive (TTWO) Up 4.8% Since Its Last Earnings Report?

A month has gone by since the last earnings report for Take-Two Interactive Software, Inc. TTWO. Shares have added about 4.8% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is TTWO due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Recent Earnings

Take Two Interactive Software reported earnings of 77 cents per share for the fourth quarter of fiscal 2018, which declined13.5% from the year-ago quarter. Adjusted earnings came in at 69 cents per share compared with 83 cents in the year-ago period. The Zacks Consensus Estimate was pegged at 64 cents.

The company's net revenues came in at $450.3 million, declining 21.2% from the year-ago period. Underperformance of NBA 2K was a dampener.

However, continued increase in digital revenues and strength in games like Grand Theft Auto V, Grand Theft Auto Online, WWE 2K18 and WWE SuperCard, Sid Meier’s Civilization VI, and Dragon City and Monster Legends remain positives.

Quarter Details

Net bookings of $411.4 million increased 1% on a year-over-year basis. Digitally delivered net bookings (81% of total net bookings) grew 11.6% to $380 million, driven by Grand Theft Auto Online, Grand Theft Auto V, NBA 2K18, Sid Meier’s Civilization VI, WWE 2K18 and WWE SuperCard.

Bookings from Physical retail and other segments plunged 28% to $78.2 million. Recurrent consumer spending net bookings increased 42% and represented 44% of total net bookings.

In the free-to-play games space, Social Point's mobile games Dragon City and Monster Legends contributed meaningfully to net bookings. Social Point is also expected to provide a long-term growth opportunity to the company.

Per the company, digital revenues (67% of total revenue) increased 8.1% to $301.4 million while revenues from Physical retailer and other segments (33% of total revenue) were down 49.2% to $148.9 million.

Region-wise, revenues from the United States (57% of total revenue) were down13.6% to $255.7 million. International markets revenues (43%) declined 29.4% to $194.6 million.

On the basis of platform, revenues from console (81%) dropped 29.4% to $194.6 million. Revenues from PC and other (19%) declined 5.2% to $86.8 million.

Margins

Take Two’s gross margin of 58% expanded 1310 basis points (bps) year over year due to a decline in software development costs.

Operating expenses grew 19% to $173 million on the back of higher R&D expense and cost associated with Social Point. As a result, income from operations declined 21% year over year to $87.8 million.

Operating margin of 19.5% remained flat on a year-over-year basis.

Balance Sheet

As of Mar 31, 2018, Take Two had $1.42 billion in cash and short-term investments, compared with $1.32 billion as of Dec 31, 2017.

The company repurchased 1.51 million shares of its common stock for $154.8 million in fiscal 2018.

Outlook

For the first quarter, the company expects net bookings to be in the band of $215–$265 million, driven by Grand Theft Auto Online, Grand Theft Auto V and NBA 2K18 as well as the acquisition of Social Point. GAAP net revenues are projected in the band of $345–$395 million.

The company projects operating expenses to be in the range of $190 million to $200 million, up 12% at mid-point due to higher expenses for R&D and stock compensation. The company projects GAAP income per share in the range of 53–63 cents.

For fiscal 2019, net bookings are projected in the band of $2.67–$2.77 billion. The company expects Red Dead Redemption 2 (to launch on Oct 26) and NBA 2K to drive growth. Launch of NBA 2K19 and WWE 2K19 in fall 2018 is expected to boost the top line in the fiscal year.

However, lower net booking from Grand Theft Auto V and Grand Theft Auto Online will remain a drag.

Net bookings from current consumer spending are expected to witness modest increase while digitally-delivered net bookings are projected to increase 15%. The company expects Rockstar Games to contribute 55% of net bookings, followed by 2K with 40% and the rest from Social Point and others.

GAAP net revenues are likely to be in the band of $2.50–$2.60 billion. The company now projects earnings per share in the range $1.53-$1.80.

The company projects operating expenses to be in the range of $885-$925 million, which reflects an increase of 19% at mid-point, owing to higher marketing, personnel and software development costs.

Operating cash flow is reiterated to be around $710 million.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been five revisions lower for the current quarter.

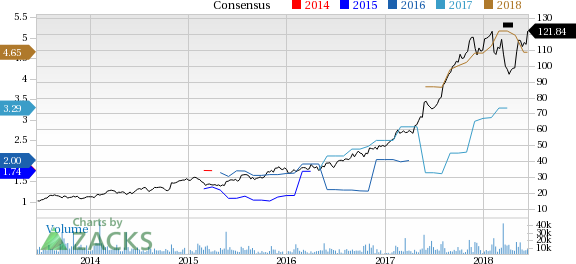

Take-Two Interactive Software, Inc. Price and Consensus

Take-Two Interactive Software, Inc. Price and Consensus | Take-Two Interactive Software, Inc. Quote

VGM Scores

At this time, TTWO has a strong Growth Score of A, though it is lagging a lot on the momentum front with a D. The stock was allocated a grade of F on the value side, putting it in the bottom 20% quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for growth based on our style scores.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. It's no surprise TTWO has a Zacks Rank #5 (Strong Sell). We expect a below average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Take-Two Interactive Software, Inc. (TTWO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance