Why a new union is the least of Disney's problems

Disenchanted: the media and entertainment giant's major conflicts

Gilbert Carrasquillo/GC Images

There's trouble afoot in the Magic Kingdom. The Walt Disney Company may have just celebrated its 100th year but it's also facing multiple problems, from box office bombs to waning public approval.

In fact, new research commissioned by the website Puck has found that Disney is one of the least-liked Hollywood studios, with an unfavourability rating of 21%. That makes it one of the least popular companies among 29 major American businesses.

Meanwhile, a new workers' union has sprung up at one of its resorts amid allegations Disney is failing to pay some staff a living wage. But that's far from the only problem the entertainment giant is grappling with.

Read on for a round-up of Disney's biggest issues in 2024, and what it's doing to solve them.

All dollar amounts in US dollars.

Disney's streaming strife

Ivan Marc/Shutterstock

Disney shocked Wall Street in November 2022 when it reported a painful $1.5 billion (£1bn) in losses at its flagship streaming division Disney+, with the bad news made worse by disappointing profits overall. These troubling tidings were the latest in a long line of issues characterising Bob Chapek's rocky two-and-a-half-year tenure as CEO, during which Disney's share price tanked after hitting an all-time high in February 2021.

Disney's streaming strife

Gerardo Mora/Getty Images

Disney responded by firing Chapek (shown here on the left) and reinstating his predecessor Bob Iger (seen on the right) as CEO. Iger is going all out to revive the flagging company and take on its competitors and critics, with Disney+ reportedly his "number one priority", according to a VideoWeek report.

The streaming service thrived during the height of the COVID-19 pandemic but has since faltered. In February 2023, the firm announced the first-ever decline in subscribers to the platform, having lost 2.4 million during the fourth quarter of 2022.

Disney's streaming strife

Ivan Marc/Shutterstock

According to Forbes, this decrease was more than analysts had anticipated. During that same quarter, arch-rival streaming service Netflix exceeded Wall Street expectations by adding 7.7 million subscribers, a boost partly attributed to the launch of its lower-cost ad-supported tier.

Disney+ has since debuted its own cut-price advert-supported package, Disney+ Basic, a clear sign it's working hard to keep up with the competition.

Disney's streaming strife

JC Olivera/Getty Images

The relatively poor performance of Disney+ prompted Iger to announce a major restructure in February 2023. The company was reorganised into three core segments: Entertainment, ESPN, and Parks, Experiences & Products.

The restructuring was accompanied by massive job cuts, with 7,000 roles scrapped by late May last year after three rounds of layoffs. Disney was hoping to make about $5.5 billion (£4.3bn) in cost savings overall. But has the restructuring paid off?

Disney's streaming strife

Chinnapong/Shutterstock

The answer isn't clear cut. The drop in Disney+ subscriber numbers was pinned entirely on losses incurred by Disney+ Hotstar, the Southeast Asian version of the service. In 2019 it acquired the streaming rights for Indian Premier League cricket games but lost them, along with a swathe of subscribers, in 2022.

Meanwhile, subscriber numbers continued to drop, with figures confirming the loss of another 4 million in Q1 2023, although Disney maintained it was still the live sports fans who were leaving. The service added 900,000 new subscribers in other regions over the same period, but despite having finally turned a profit on its eponymous streaming service, the situation plunged to new lows this month...

Disney's streaming strife

Associated Press / Alamy Stock Photo

On 7 May, Disney suffered its worst stock trading day in 18 months thanks to Wall Street scepticism, which sent shares down by more than 9%.

Although Disney+ and Hulu brought in $47 million (£38m) for the company, the first profit Disney's ever made on its streaming services, falling subscriber numbers and dwindling cash reserves at ESPN+ – which is also owned by Disney and contributed to an overall loss of $18 million (£14m) across its streaming services – have apparently spooked investors.

Disney's ESPN troubles

Kristoffer Tripplaar/Alamy

In fact, ESPN has long caused problems for Disney, with Bob Iger's decision to reorganise ESPN into a separate division within the Disney empire pointing to the issues the sports cable channel faces. Incidentally, 80% of the channel is owned by Disney subsidiary ABC, with the remaining 20% under the ownership of media and business information conglomerate Hearst Communications.

Disney's ESPN troubles

AhmadDanialZulhilmi/Shutterstock

ESPN is Disney's principal legacy TV asset, generating more than $12 billion (£9.6m) a year. But the cable channel is in long-term decline, with viewers cancelling subscriptions in their droves.

A decade ago, 100 million people were signed up to the service. As of 2022, that figure sat at around 76 million, with a whopping eight million subscribers jumping ship in 2021 alone, accounting for a hefty 10% of the channel's overall subscriber base. It's not clear how many cable subscribers ESPN has in 2024, but according to Forbes, a record 2.3 million people cancelled their cable subscriptions in the first quarter of last year alone.

Disney's ESPN troubles

Kaspars Grinvalds/Shutterstock

Meanwhile, the channel's streaming service ESPN+ has been gaining subscribers – but they pay a lot less than those who are signed up to the traditional cable TV service, and figures from Statista suggest subscriber numbers may have reached their peak. (By the end of last year, 26 million people subscribed to ESPN+. This number dropped to 24.8 million by the end of Q2 2024.)

While ESPN is a valuable asset for Disney, it's also incredibly expensive to run. Sports rights don't come cheap, and Disney has splurged billions on securing deals with the NBA and other leading franchises over the years.

Disney's ESPN troubles

Leonard Zhukovsky/Shutterstock

ESPN is also grappling with falling advertising revenues. In 2022, speculation was rife that Disney could spin off the sports cable channel, with activist investors like Dan Loeb calling on the company to offload the lucrative yet troubled asset.

Indeed, ousted Disney CEO Bob Chapek was said to have been exploring the idea of selling ESPN to the highest bidder.

Disney's ESPN troubles

RB/Bauer-Griffin/GC Images/Getty Images

However, Bob Iger has made it clear that ESPN isn't up for sale – for now, at least. Following the announcement that the sports channel was to become a distinct unit separate from other parts of Disney's business, Iger addressed the speculation that ESPN would be ditched during a call with investors.

"We were fairly certain that when we created this structure, and broke ESPN out on its own, that it would lead to questions like this", he told the stakeholders.

Disney's ESPN troubles

Matthew Kaiser/Shutterstock

During the same call, Disney's returning CEO told investors: "[ESPN] continues to create real value for us. It is going through some obviously challenging times because of what’s happened in linear programming – but the brand of ESPN is very healthy, and the programming of ESPN is very healthy. We just have to figure out how to monetize it in a continuing, disrupting world. That’s it. But we’re not engaged in any conversations right now or considering a spinoff of ESPN."

We now know that select ESPN programmes will be added to Disney+ by the end of this year, while the company prepares to launch an "enhanced stand-alone ESPN streaming service in the fall of 2025", Iger revealed to Wall Street analysts earlier this month. So far, the new offering has been nicknamed "Spulu" and will feature an aggregation of 14 sports feeds.

Boardroom coup

Romain Maurice/Getty Images

Disney's overhaul temporarily quelled activist investor (and father-in-law of Brooklyn Beckham) Nelson Peltz, who was engaged in a proxy fight with Disney over concerns about how the company was being led. "We wish the very best to Bob, this management team, and the board," said Peltz during an appearance on CNBC’s Squawk on the Street in February 2023.

"We will be watching. We will be rooting. The proxy fight is over".

Boardroom coup

INSTAR Images LLC / Alamy Stock Photo

But (spoiler alert) it wasn't over. This year Peltz reignited the fight, claiming the company hadn't kept the promises it made in 2023. Returning to Squawk on the Street in April, Peltz – who has tried and failed to secure a seat on the Disney board – said: "I hope this is not a redo of last year where we pulled out, gave management a chance and the stock went down... I hope Bob can keep his promises. I hope they can do all the things they assured us they were going to do and we'll only watch and wait."

Peltz's unsuccessful boardroom coup gained support from Elon Musk, who claimed the investor would "significantly improve Disney's share price." The owner of X, formerly Twitter, became a vocal critic of Disney after the company joined an advertising boycott of the social network.

The Magic Kingdom may have fought off Peltz's proposed boardroom coup, but the victory didn't come cheap; according to The Guardian, it's believed to have spent $40 million (£32m) on the battle. Since then, Peltz has reportedly offloaded his entire Disney stake.

Disney's TV and movie studio woes

Jerome Kundrotas/Shutterstock

Disney's new entertainment division also encompasses its impressive array of TV and movie studio assets, which include – deep breath – ABC, 20th Television, FX, National Geographic, Walt Disney Studios, Pixar, Marvel Studios, Lucasfilm, and 20th Century Studios.

Regarding its TV output, Disney has been criticised for focusing too much on its streaming platforms at the expense of its legacy US cable channels. Forbes even published an article entitled "ESPN Starting A Streaming Service Is The Beginning Of The End Of Cable" in June 2023.

Disney's TV and movie studio woes

Tada Images/Shutterstock

This complacency could see the company lose out to competitors such as Comcast. Carriage disputes with online and satellite providers have also plagued the company, including a row with Dish Network over Disney raising its fees in October 2022, which led to Disney channels being temporarily removed.

Bloomberg reported in February 2023 that Disney was considering selling more of its original TV and movie content to rivals to generate additional revenue and ease its debts. However, this could result in the company losing some of its edge over the competition.

Disney's TV and movie studio woes

Leonardo Munoz/VIEWpress/Getty Images

Disney triumphed at the global box office in 2022, with its roster of movies grossing a staggering $4.9 billion (£4bn). The company was also number one domestically thanks to receipts of $2 billion (£1.6bn), while its movie Avatar: The Way of Water generated more revenue than any other film that year.

However, 2023 and 2024 have not looked quite as award-winning. While the studio released a whopping seven blockbusters in 2019 that made $1 billion (£800m) at the box office each, not a single Disney movie crossed that milestone last year.

Disney's TV and movie studio woes

chingyunsong/Shutterstock

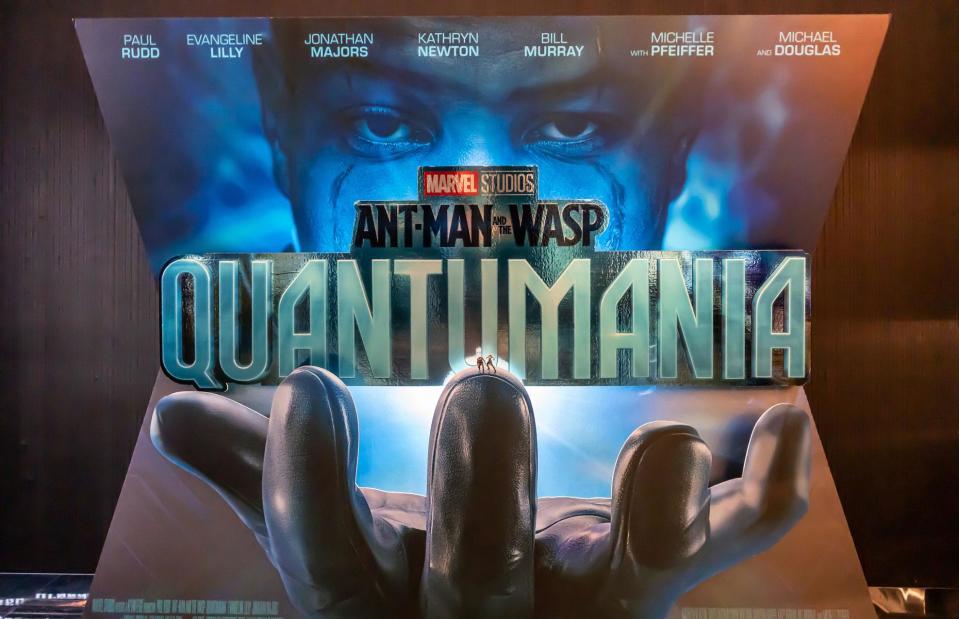

The net losses of Disney's four biggest box office bombs in 2023 resulted in a grand total of $628 million (£503m), with the Marvel movie Ant-Man and the Wasp: Quantumania seeing the sharpest decline in ticket sales from its opening to second weekend in the history of the Marvel Cinematic Universe.

The news came amid speculation that Marvel, and superhero movies in general, were beginning to dip in popularity with viewers. Indeed, Bob Iger has since confirmed that he's "been working hard with the studio to reduce output and focus more on quality," adding that's "particularly true with Marvel".

Disney's TV and movie studio woes

Araya Doheny/FilmMagic/Getty Images

In contrast, Disney's key Hollywood rival, Comcast-owned Universal Pictures, flourished in 2023. Universal Pictures' quirky horror-comedy Cocaine Bear was an undeniable box office smash. The movie, which stars Keri Russell and the late Ray Liotta, was made with a budget of $35 million (£28m), a stark contrast to the $200 million (£161m) spent on the Ant-Man sequel.

Similarly, the Universal Pictures film The Super Mario Bros. Movie – which has been described by Screen Rant as "Disney's biggest nightmare" – obliterated box office records when it opened over the Easter weekend last year, taking $377 million (£304m) worldwide. It's perhaps no surprise, then, that Universal Pictures snatched Disney's crown at the box office in 2023, making global revenues of almost $5 billion (£4bn).

By contrast, Disney made $1.89 billion (£1.5bn) in its biggest market (North America).

Problems with Parks, Experiences & Products

VIAVAL TOURS/Shutterstock

Disney's Parks, Experiences & Products division hasn't been without its struggles either, with issues dating from Bob Chapek's stint as CEO. The company has been battling with its theme park customers – or "guests" as the company refers to them – mainly due to the steep price hikes Chapek introduced.

Problems with Parks, Experiences & Products

Konstantin Yolshin/Shutterstock

Chapek was also seen as denigrating super fan annual pass holders when he bemoaned Disney's profits as being "partially offset by an unfavourable attendance mix". The implication was that pass holders didn't spend as much money as other guests, who will typically splash out on hotels, Disney dining experiences, and more.

Bob Iger, whose reinstatement as CEO was warmly welcomed by super fans, swiftly reversed some of the price hikes.

Problems with Parks, Experiences & Products

V_E/Shutterstock

Several reports suggested the "magic" was vanishing from Disney's theme parks, with the company struggling to restore pre-pandemic attendance levels. Online searches for Disney's theme parks were also down, and adding further to the gloom were the attendance figures for rival Universal Studios Theme Parks, which showed that Disney's key competitor was catching up in terms of visitor numbers.

Problems with Parks, Experiences & Products

ZUMA Press Inc/Alamy

Another problem facing the new Parks, Experiences & Products division was the disappointing number of bookings for its Star Wars: Galactic Starcruiser interactive hotel experience. Prices were eye-wateringly high for the two-night choose-your-own-adventure experience – approximately $5,000 (£4k) for two people, according to Esquire – and the cost clearly put off potential guests.

Barely a year after opening, Disney abruptly announced the hotel would close in September 2023.

Problems with Parks, Experiences & Products

Chuck Wagner/Shutterstock

Prices for Disney Cruise Line packages are also significantly higher than the fees that competitors like Royal Caribbean and Carnival charge. With the launch of its fun-packed Icon of the Seas cruise ship, which welcomed its first customers earlier this year, Royal Caribbean is certainly looking to attract families that would otherwise holiday in Orlando and spend their dollars with Disney.

Problems with Parks, Experiences & Products

Gilbert Carrasquillo/GC Images

Amid allegations of failing to pay a living wage, Disneyland performers have recently formed a union – Magic United. While the majority of workers at the California resort enjoy some level of union representation, the actors who meet and greet visitors and perform in parades while dressed as Disney’s iconic characters have, until now, been left out.

The president of the Actors' Equity Association, which will represent the group, has pledged to push for improvements to health and safety, wages, benefits, and working conditions. Parade performers earn a base pay of $24.15 (£19) an hour, and Magic United is likely to lobby for a significant increase.

Problems with Parks, Experiences & Products

Matt Stroshane/Walt Disney World Resort via Getty Images

To top it all off, a lawsuit filed against Disney on 30 June 2023 alleged the entertainment company owed $150 million (£117m) to female workers who were underpaid. An analysis of data from 2015 to 2022 shows women received around 2% less than their male counterparts. The lawsuit concerned around 10,000 women employed at parks and resorts and other Disney divisions (though not entities like ESPN and Hulu).

According to the complaint, Disney continued collecting information from interviewees about previous salaries, even after a 2018 California law made the practice illegal. A lawyer for Disney denied the allegations.

Problems with Parks, Experiences & Products

Tom Stack / Alamy Stock Photo

It's not all been doom and gloom, though. According to Disney's Q2 2024 earnings report, the company's revenue increased to $22.1 billion ($17.7bn) from $21.8 billion (£17.4bn) in the prior-year quarter, with this growth principally attributed to its Experiences division.

Within the US, the company highlighted an increase in operating income at the Walt Disney Resort and its Disney Cruise Line, thanks to higher average ticket prices and spending due to inflation. Internationally, it credited higher spending at its Hong Kong Disneyland Resort, which celebrated the grand opening of its new Frozen-themed zone in November 2023.

A more magical future?

Imaginechina Limited / Alamy Stock Photo

Iger is certainly bullish about the business' prospects. In a recent statement, he said: "[Disney's] results were driven in large part by our Experiences segment as well as our streaming business."

"Looking at our company as a whole, it’s clear that the turnaround and growth initiatives we set in motion last year have continued to yield positive results. We are turbocharging growth in our experiences business with a number of near- and long-term strategic investments."

But with higher takings partly attributed to now-softening inflation, a series of box office bombs under its belt, and growing investor unrest, can Disney deliver?

Now discover 21 Disney movies that epically flopped at the box office

Yahoo Finance

Yahoo Finance