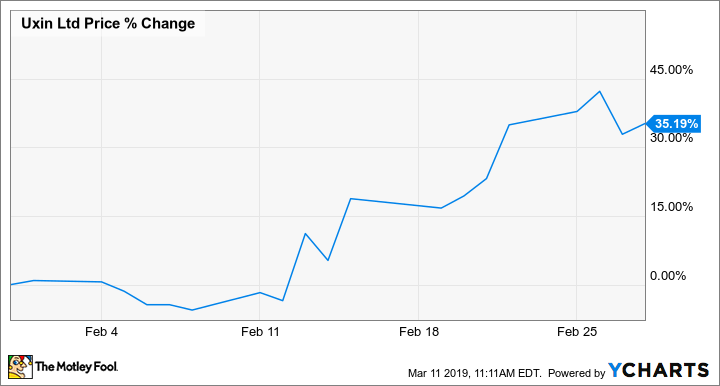

Why Uxin Stock Jumped 35% Last Month

What happened

Shares of Uxin (NASDAQ: UXIN) were surging last month as the Chinese online used-car platform caught a tailwind from positive steps in trade negotiations between China and the U.S. As a result, the stock finished February up 35%, according to data from S&P Global Market Intelligence.

Though there was little company-specific news out on Uxin, the stock has been highly sensitive to macro issues like Chinese economic growth and the ongoing trade negotiations. It got a boost in the second half of the month as the two sides seemed to make progress toward a favorable outcome.

So what

Uxin shares first started gaining on Feb. 13, rising 15%, when President Trump said that trade talks with China were going "very well" as representatives of both countries prepared for another round of talks. Two days later, the stock jumped another 13% when the two sides said talks would continue the following week and Trump hinted that he might extend a March 1 deadline to raise tariffs on Chinese goods from 10% to 25%.

Image source: Getty Images.

Finally, the stock rose 9.5% on Feb. 22 after Trump said he would extend the tariff deadline and that he planned to meet with China's President Xi in March.

Though Uxin is not directly exposed to U.S.-China trade, the fast-growing, loss-generating online car dealer is in an economically sensitive industry, and other Chinese e-commerce companies like Alibaba (NYSE: BABA) have already indicated that consumers are becoming reluctant to spend on big-ticket items like cars. A resolution in the U.S.-China trade dispute could help change that.

Now what

Uxin has been highly volatile in its brief history as a publicly traded company: The stock debuted at $9 a share last June, fell below $3 in December, briefly recovered all of those losses on news of a partnership with Alibaba's Taobao, and then fell again after that. Today, the stock trades at less than $5 a share despite last month's gains.

Uxin's volatility is likely to continue this month, as the company is set to report fourth-quarter earnings on Thursday morning, the third time it will report earnings as a public company. Uxin previously guided to revenue of $150 million to $160 million for the fourth quarter. Thursday's report will also be the company's first update after its partnership with Taobao began.

More From The Motley Fool

Jeremy Bowman owns shares of Uxin Ltd. The Motley Fool recommends Uxin Ltd. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance