Why Is Valeant (VRX) Up 4.3% Since Its Last Earnings Report?

It has been about a month since the last earnings report for Valeant Pharmaceuticals International, Inc. VRX. Shares have added about 4.3% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is VRX due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Valeant Misses On Q4 Earnings

The company’s adjusted earnings per share of $0.98 missed the Zacks Consensus Estimate of $0.99 by a penny and was down from $1.11 per share in the year-ago quarter.

However, total revenues of $2.16 billion topped the Zacks Consensus Estimate of $2.20 billion but declined 10% from the year-ago quarter.The impact of the discontinuation of divestitures and lower volumes in the Diversified Products segment along with the loss of exclusivity for a basket of products, and the Ortho Dermatologics business led to the disappointing results. Revenues were also negatively affected by the unfavorable impact of foreign exchange.

The decline was partially offset by higher volumes and increased international pricing in Bausch + Lomb/International segment, primarily the U.S. Consumer Products business.

Quarter in Detail

Revenues in the Bausch + Lomb / International segment were $1.2 billion, down 5% year over year. Excluding the impact of discontinuation of divestitures, primarily the skin care divestiture, and foreign exchange, the Bausch + Lomb/International segment organically grew by approximately 4% year over year driven by increased volumes in the global Consumer, International and Global Vision Care businesses.The Branded Rx segment revenues were $602 million, down 19% due to a decrease in sales which primarily reflects lower volumes in the Ortho Dermatologics business and the loss of sales due to the divestiture of Dendreon Pharmaceuticals LLC. This was partially offset by increased sales in Salix.

The U.S. Diversified Products segment revenues were $335 million, down 16% year over year due to decreases in volume and price attributed to the previously reported loss of exclusivity for a basket of products.

Research and development expenses were $90 million in the reported quarter, down 3.2% from the year-ago quarter.Selling, General and Administrative costs were $632 million compared with $658 million in the year-ago quarter.

The company received clearance for the Thermage FLX System to non-invasively smooth skin on the face, eyes and body. Earlier, the company received the FDA filing acceptance for the NDA for Plenvu (NER1006), a novel, low volume polyethylene glycol-based bowel preparation for colonoscopies. The FDA also approved its new psoriasis treatment, Siliq, following which the drug was launched. The company also obtained FDA approval of Vyzulta, a treatment option for glaucoma. The FDA also approved Lumify, the over-the-counter eye drop with low-dose brimonidine for the treatment of eye redness.

Valeant has completed 13 divestitures since the beginning of 2016, including skin care brands (CeraVe, AcneFree and AMBI), Dendreon Pharmaceuticals, iNova Pharmaceuticals, Obagi Medical Products and Sprout Pharmaceuticals.

2017 Results

Revenues declined 10% to $8.7 billion in 2017 from a year ago.

2018 Guidance

The company expects total revenues in the range of $8.10-$8.30 billion.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month. There has been one revision higher for the current quarter compared to one lower. In the past month, the consensus estimate has shifted downward by 20.5% due to these changes.

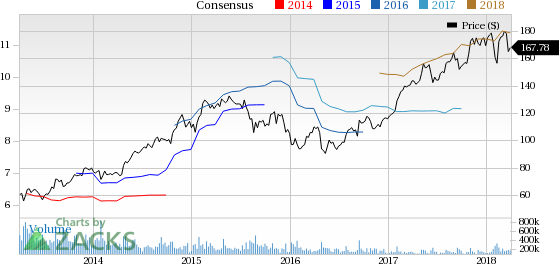

Valeant Pharmaceuticals International, Inc. Price and Consensus

Valeant Pharmaceuticals International, Inc. Price and Consensus | Valeant Pharmaceuticals International, Inc. Quote

VGM Scores

At this time, VRX has a subpar Growth Score of D, though it is lagging a bit on the momentum front with an F. However, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value based on our styles scores.

Outlook

VRX has a Zacks Rank #4 (Sell). We expect a below average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valeant Pharmaceuticals International, Inc. (VRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance