Why is Wright Medical (WMGI) Up 18.8% Since Its Last Earnings Report?

It has been about a month since the last earnings report for Wright Medical Group N.V. WMGI. Shares have added about 18.8% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is WMGI due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

Wright Medical reported first-quarter 2018 adjusted loss of a penny, significantly narrower than the Zacks Consensus Estimate of a loss of 7 cents. Notably, loss per share in the year-ago quarter was 9 cents.

First-quarter revenues came in at $198.5 million, which beat the Zacks Consensus Estimate by 2.6%. Revenues also improved 9.2% at constant currency (cc). Per management, it represents an estimated 250 basis points (bps) increase from the year-ago quarter.

Segment Details

Lower Extremities

This segment posted worldwide revenues of $72.2 million, up 4.4% year over year.

Sales in the United States totaled $56.8 million, while international sales came in at $15.3 million.

Per management, the U.S. lower extremity business witnessed an improvement of 2.5% after two straight years of flat sales. The upside can be attributed to 14% growth in total ankle and a return to growth in the core lower extremity business.

Furthermore, there has been continued progress in ORTHOLOC ankle and small bone fracture product launches.

Upper Extremities

Revenues in this segment totaled $92.2 million, up 24.1% from the prior-year quarter.

In the United States, sales totaled $67.7 million, while internationally, the segment raked in revenues worth $29.6 million.

Per management, growth was driven by 23.5% growth in the company’s U.S. shoulder business. The quarter also saw strong contribution from flagship products like SIMPLICITI shoulder and PERFORM Reversed Glenoid.

Management is positive about the BLUEPRINT acquisition, which is anticipated to drive growth in the shoulder line of products till 2019.

Biologics

Worldwide Biologics sales were $23.4 million, down 1.6% from a year ago. While international revenues of the segment rose to $5.3 million, U.S. sales dropped to $18.2 million.

Sports Med & Other

This segment posted worldwide sales of $5.7 million, down 3.2% on a year-over-year basis. However, the segment’s U.S. sales shot up to $2.1 million, while international sales sunk to $3.6 million.

Margins

In the quarter under review, gross margin was 79.7%, up 30 bps from the year-earlier quarter.

Operating expenses, however, rose 5.8% to $158.3 million on increased SG&A (selling, general and administrative) and R&D (research and development) expenses.

EBITDA margin expansion was 310 bps, which paves the way for improvement through 2018.

Balance Sheet Details

Wright Medical exited the first quarter of 2018 with cash and cash equivalents of $138.1 million.

Guidance

Wright Medical reiterated its revenue guidance at the band of $800-$812 million, representing growth of 9-11% at cc. For 2018, the Zacks Consensus Estimate for revenues is pegged at $808.4 million, within the given range.

The company expects 2018 adjusted loss per share within 16-23 cents. The Zacks Consensus Estimate for the same is pinned at 18 cents, which again is within the projected range.

Full-year adjusted EBITDA is anticipated in the range of $104-$111 million.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been three revisions higher for the current quarter compared to 11 lower.

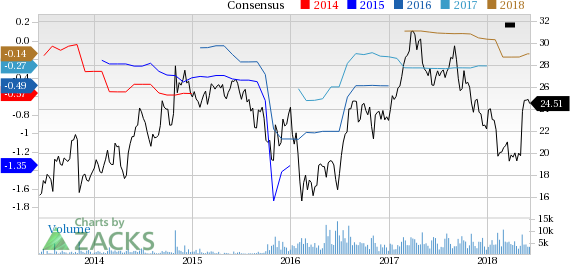

Wright Medical Group N.V. Price and Consensus

Wright Medical Group N.V. Price and Consensus | Wright Medical Group N.V. Quote

VGM Scores

At this time, WMGI has an average Growth Score of C, however its Momentum is doing a lot better with an A. The stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than growth investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, WMGI has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wright Medical Group N.V. (WMGI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance