Why you are getting 0% back on your money and what to do about it

In the current low rate environment, big banks do not have the motivation to pay depositors the premium interest rate for checking or savings accounts. Bank depositors are getting paid only a fraction of 1% on their savings.

“Even when interest rates were rising, and the Fed raised rates nine times in a three year span, the average payout on a savings account, as well as an interest checking account, didn’t budge,” Bankrate Chief Financial Analyst Greg McBride told Yahoo Finance.

According to McBride, the biggest banks with the largest market share have the most pricing power. “They [banks] don’t have to compete for deposits. By virtue of habit, the branch networks have ATMs all over the place, it’s like a big catchers mitt — it brings in all the deposits they need. The last thing they’d be motivated to do is raise payouts to bring in more.”

The possibility of negative interest rates in the U.S. is not off the table, said McBride, due to the Fed having “limited tools” to work with during a possible recession. In Europe, where negative interest rates are already a reality, consumer deposits aren’t impacted.

“It’s institutional deposits that have been impacted by that. I still think, even in a negative interest rate environment, there is still a buffer as it pertains to the consumer,” he said.

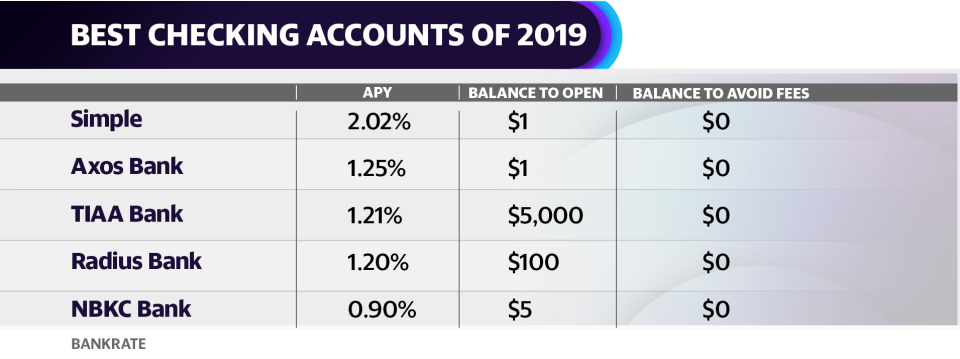

The top yielding savings accounts are upwards of about 2.5%, according to Bankrate, while most pay 1% or less. The highest rates, according to McBride, may come down a bit if the Fed cuts rates as expected.

‘Get your money out’ of low interest bank accounts

“Measure yourself against inflation. Inflation is still running below 2%, which is why the Fed is cutting rates in the first place,” McBride said. “Get your money out of that bank that is paying 0.1%, put it somewhere where you’ll earn 2%-2.5%, stay ahead of inflation, and preserve the buying power of your hard earned savings.”

Better options for your money exist, but they will not just “land in your lap.” McBride suggests the following: “take action and look for a better yielding account.” McBride stated that depositors do not need to move their entire banking relationship; instead, he recommends opening an online savings account and linking it to the depositors’ current checking account.

“You can easily move money back and forth whenever you need it,” he said. “You will earn a much better rate of return for your savings and preserve the buying power of your money.”

Taylor Locke is a producer for Yahoo Finance. You can follow her on Twitter @itstaylorlocke.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews,LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance