William Hill boss dealt bloody nose from investors over £600,000 salary

The boss of William Hill has been hit with a shareholder backlash after nearly a third revolted against his improved pay package.

Plans to boost chief executive Philip Bowcock’s salary by 9pc to £600,000 was met with investor ire, as 30.71pc voted against the proposal.

While the remuneration report was overwhelmingly backed at 69.29pc, the opposition proved an embarrassing moment for the CEO.

Shareholder advisor firms Glass Lewis and ISS had called on investors to vote against the report ahead of the firm’s annual general meeting.

The agencies claimed his base pay was nearly 10pc above that of his predecessor and his promotion from interim to full-time boss was “not directly linked to performance”.

In a statement William Hill said: “The board has noted the concerns of shareholders, and while on balance we remain of the view that the CEO remuneration is justified in the context of the key events and ongoing industry challenges we commit to engage fully with shareholders and advisory bodies in advance of any key remuneration decisions in the future.”

It comes as William Hill chalked up rising sales at the start of the year after the group was boosted by an “unprecedented run” of favourable results.

The betting firm saw group net revenues rise 3pc for the 17 weeks to April 24, underpinned by “very strong” horse racing and football results.

Online sales climbed 12pc over the period, helping to offset a 4pc drop in high street takings as the firm grappled with 15pc of UK and Irish horse racing fixtures being abandoned.

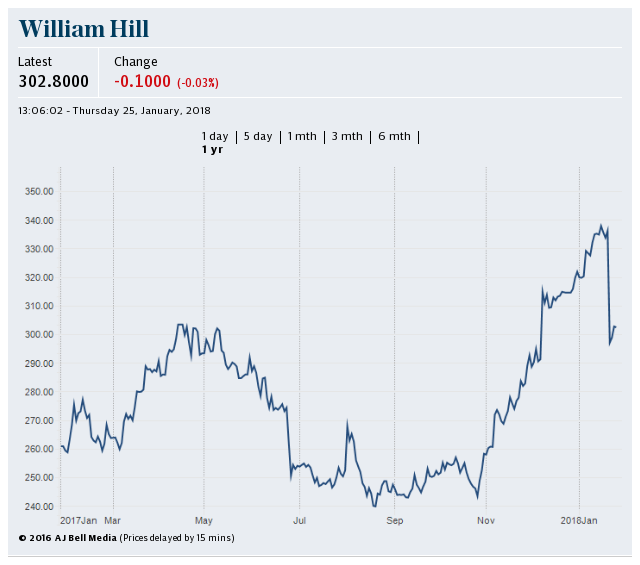

Shares in the group rose 0.6pc to close at 280.6p on Tuesday.

Mr Bowcock said the move to sell its Australian business for £173m to Melbourne-based CrownBet had helped strengthen its balance sheet.

He added: "William Hill has had a positive start to 2018.

“In the UK, an unprecedented run of bookmaker-friendly sporting results led to unusual wagering and gaming trends, which we expect to normalise over time.”

While margins were higher, William Hill noted that punters were less likely to "recycle" their winnings into fresh bets.

The group’s US arm enjoyed a stellar run, lifting 45pc, following a triple boost from strong bets on basketball, the introduction of in-play betting on tennis and a jump in wagering on ice hockey.

Bookies including William Hill are hoping for a change of the laws surrounding sports betting in the US this year, given the Supreme Court will issue a ruling on the future of the Professional and Amateur Sports Protection Act (Paspa).

Nicholas Hyett, equity analyst at Hargreaves Lansdown, said success in America would be a “big prize” for William Hill.

He added: “It’s worth bearing in mind though that the group is still feeling the effects of the last time it rolled the dice on international expansion and lost.

“The Australian business has now been sold, but has been a source of repeated downgrades in recent years.

“Having cost the group something in the region of £500m, the group will be glad to see the back of it, even at today’s sale price of a little over £170m.”

Yahoo Finance

Yahoo Finance