'Win-win': Airbus aims to expand in Britain post-Brexit

Guillaume Faury pauses for a moment before launching into a withering assessment of the state of air travel in Europe.

“Honestly, it’s a disaster,” says the boss of Airbus, the world’s largest plane-maker. “The situation is really bad. It’s uncoordinated. There’s a lot of constraints moving from one country to the other, not to mention the UK.”

Faury took the top job almost two years ago, having run the company’s dominant passenger jet division since early 2018. He’d got used to jetting off from the Toulouse base to Airbus sites around the world, but is now constrained to Europe.

“I continue to fly, mainly in France but also to Germany, Spain, the Netherlands, but it’s complex,” Faury says, referencing the Covid tests and self-isolation necessitated for such trips.

Visiting the UK, where Airbus designs and builds the wings for its airliners, is pretty much out of the question because of what he describes as Britain’s “pretty frightening” quarantine rules.

Coronavirus has hit Airbus hard. It has cut more than a tenth of its staff – 15,000 employees – and last year the commercial aircraft arm suffered a 37pc fall in revenues to €34bn (£30bn) and a loss of €1.3bn. Airlines reeling from the pandemic cancelled orders for 115 jets last year, taking net 268 orders for new aircraft – a third of 2019’s level.

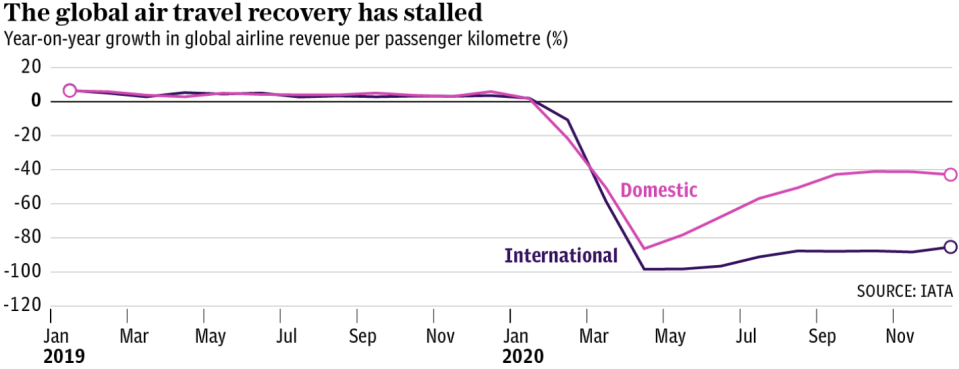

However, Faury says it is not all bad news. Air travel in China is “robust” and above pre-pandemic levels. India is about a quarter down, and the US is on a “strong trajectory”.

But Europe remains a massive problem and he wants something done about it. “We want, we expect, governments to have a coordinated response,” Faury says, calling for measures which are “of the same nature, and more importantly, predictable”.

Despite the financial hit – and passenger jet production being cut by 40pc in response – Airbus weathered 2020 “probably as well as we could” he says. Without certainty, this year could be much more difficult, Faury says.

“The amount of inefficiencies being put into a system like ours – and it’s not just Airbus I’m describing, but many international businesses – are just unsustainable.”

“Last year was about crisis, the brutality of the epidemic. But we had a clear direction and it was reduction,” he says. “2021 is full of ambiguity and contradictions of complexity. We need to find a way between the different situations.”

Hydrogen future

It seems odd, but Faury has set Airbus on a path to a new age of aerospace even in the depths of the crisis. In September he unveiled designs for hydrogen-powered aircraft with a pledge to have a zero-emission aircraft in service by 2035.

It’s likely to be an expensive and, “ambitious but extremely realistic” plan, according to Faury. Airbus probably doesn’t have a choice. Decarbonisation plans have aviation firmly in their sights. Air travel accounts for 2.5pc of all carbon emissions and less than a tenth of the total from all forms of transport. However, it’s a high-profile target of conspicuous consumption when 80pc of the world’s population do not fly.

The Airbus chief sets out a timeline for the plan. “We need five years to mature the technology, but those technologies are not rocket science,” he says, before quickly correcting himself. “Actually some are. We fly them on our rockets and satellites.”

He aims to get suppliers on board and launch the programme in earnest in 2027, with paying passengers on board by the middle 2030s.

“It’s a lot of work, but credible,” he says, adding guilt-free zero emissions flight is likely to be more expensive because of the technology involved. “But there will also be a price for carbon.”

Both Airbus and Boeing are working on aircraft that can fly on biofuels, but Faury has overseen a far more ambitious strategy around decarbonisation than its US rival.

Boeing to bounce back

He’s loth to criticise his competitor – despite Airbus having outsold Boeing for several years – calling it an engineering powerhouse. “One should never make the mistake of complacency or thinking others are not tough competitors,” Faury says. “The time will come when they will be very active.”

The blow of Boeing’s 737 Max – a direct competitor to the A320 – being grounded after two crashes, entailing massive upheaval and costs for the US manufacturer, means Airbus was better positioned to weather Covid.

But Faury adds coronavirus’s impact was “a hell of a challenge for everyone but we are probably emerging faster”.

He’s not just looking to Airbus’s rival in the decades-old aerospace duopoly as a competitor. China’s Comac is due to get its first jet certified soon and Faury expects the manufacturer bankrolled by the Beijing government to be a “strong player in the world in the next decade”.

It’s partly because of this he’s keen to settle the long-running WTO case between Airbus and Boeing about state subsidies worth billions over decades that have resulted in tariffs.

“I call them ‘thin subsidies’ compared to our turnover and investments. They are small compared to the way Comac is funded by public money in China.”

Faury’s argument is that if the US and EU cannot agree a deal then why should China play by WTO rules, effectively allowing Beijing to subsidise its nascent aerospace industry into becoming a world power.

Besides, he adds, transatlantic tariffs are a “lose-lose game that doesn’t make sense” when aerospace has been hammered by the pandemic.

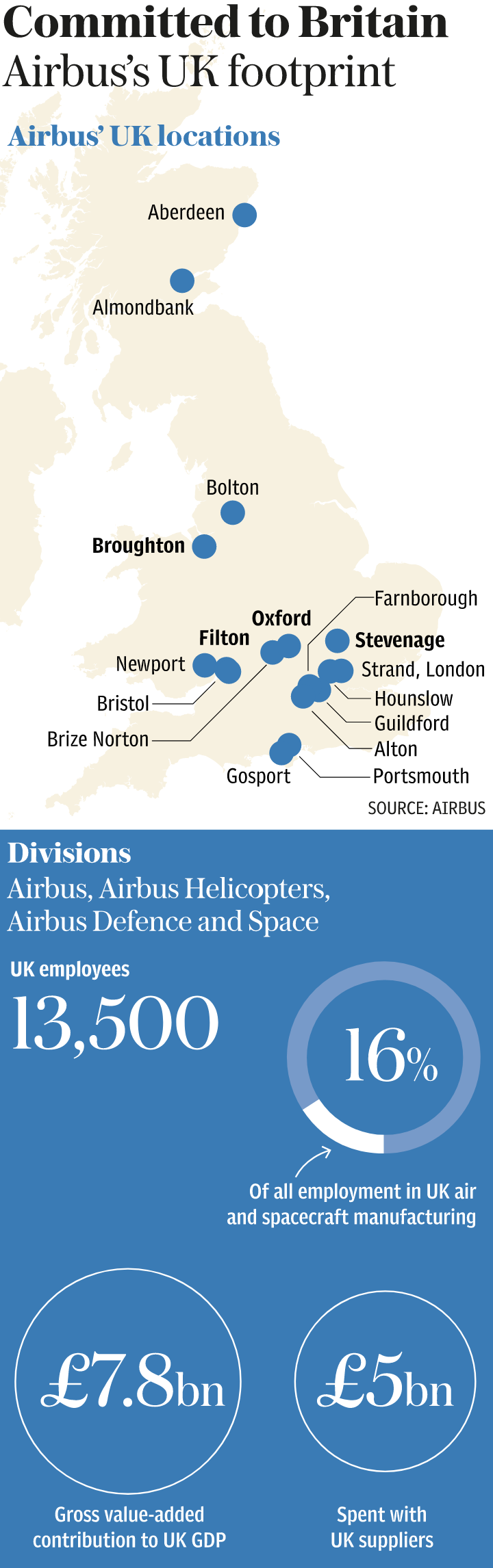

Also on his radar is Brexit. Airbus has had a difficult relationship with the UK since the referendum, being the most vocal international company to sound the alarm about risks from Britain crashing out without a deal.

Airbus’s blunt “Brexit impact assessment” in 2018 warned of the dangers posed to the company’s 15,000 UK staff and many more in the supply chain who feed into the company’s wing-making plant in Wales, and design centre near Bristol.

A hard Brexit would mean “severe disruption and interruption of UK production, forcing Airbus to reconsider its investments in the UK, and its long-term footprint in the country”.

Six months later the company doubled down, releasing a video with then chief executive Tom Enders – who Faury succeeded – warning of “potentially very harmful decisions”.

Leave activists labelled it as “Project Fear”. They could be right. Airbus is still firmly in the UK, although the company could not simply uproot overnight and move wing production elsewhere.

“It was a different time in the long and painful process of Brexit,” says Faury. He says the company was “very clear on Brexit’s risks” and is “very happy” a trade deal was reached.

Suggestions that Airbus’s stance might have damaged the company are dismissed. “Tom is Tom and Guillaume is Guillaume,” he says referring to his predecessor’s approach, adding his “own messaging to the UK has been a different nature”. Britain offers a very competitive environment, supported by an ecosystem of suppliers, and a government offering R&D support, such as backing for the next-generation “wing of tomorrow”.

But this position can’t be taken for granted. “As long as the ecosystem is competitive we are happy to be here, but that rule applies to the rest of the world,” says Faury. “Everybody has to bring their share, including governments.”

But while he takes with one hand, Faury seems willing to give with the other. The UK defence review announced a replacement fleet of helicopters, which Airbus also makes. For it to win such a contract would require something in return, such as a commitment to make them in Britain.

Faury laughs when asked about the possibility of moving production out of Britain. “We want to grow in the UK. We will be willing to do more than we are doing to today, to have a win-win for the UK and Airbus.”

Yahoo Finance

Yahoo Finance