Should Wincanton plc (LON:WIN) Be Part Of Your Dividend Portfolio?

Dividend paying stocks like Wincanton plc (LON:WIN) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

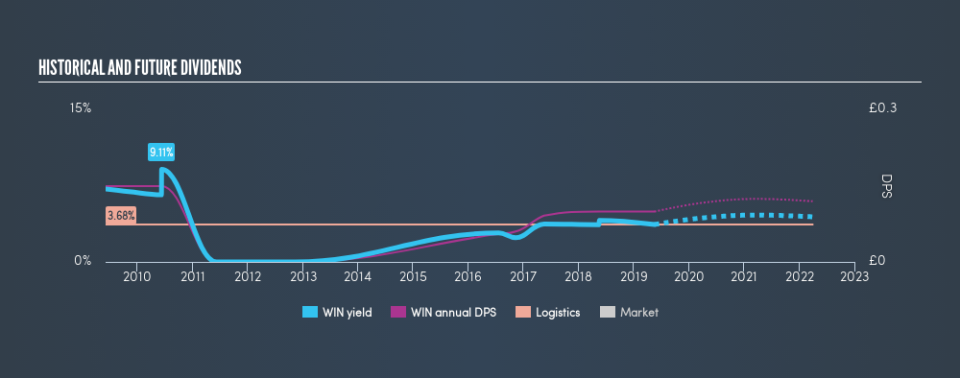

In this case, Wincanton likely looks attractive to investors, given its 3.7% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. The company also bought back stock during the year, equivalent to approximately 0.5% of the company's market capitalisation at the time. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to be form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Wincanton paid out 20% of its profit as dividends. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. The company paid out 84% of its free cash flow as dividends last year, which is adequate, but reduces the wriggle room in the event of a downturn.

Consider getting our latest analysis on Wincanton's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Wincanton has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. While its dividends have not been hugely volatile, its most recent dividend is still meaningfully below where it was ten years ago. During the past ten-year period, the first annual payment was UK£0.15 in 2009, compared to UK£0.099 last year. The dividend has shrunk at around -4.0% a year during that period.

We struggle to make a case for buying Wincanton for its dividend, given that payments have shrunk over the past ten years.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Earnings have grown at around 7.9% a year for the past five years, which is better than seeing them shrink! With a decent amount of growth and a low payout ratio, we think this bodes well for Wincanton's prospects of growing its dividend payments in the future.

Conclusion

To summarise, shareholders should always check that Wincanton's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Wincanton's dividend payout ratios are within normal bounds, although we note its cash flow is not as strong as the income statement would suggest. Earnings growth has been limited, but we like that the dividend payments have been fairly consistent. Wincanton has a number of positive attributes, but it falls slightly short of our (admittedly high) standards. Were there evidence of a strong moat or an attractive valuation, it could still be well worth a look.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 5 Wincanton analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance