Winners And Losers Of Q1: ADT (NYSE:ADT) Vs The Rest Of The Specialized Consumer Services Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at ADT (NYSE:ADT) and the best and worst performers in the specialized consumer services industry.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 0.6%. while next quarter's revenue guidance was in line with consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and while some of the specialized consumer services stocks have fared somewhat better than others, they collectively declined, with share prices falling 4.9% on average since the previous earnings results.

ADT (NYSE:ADT)

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE:ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

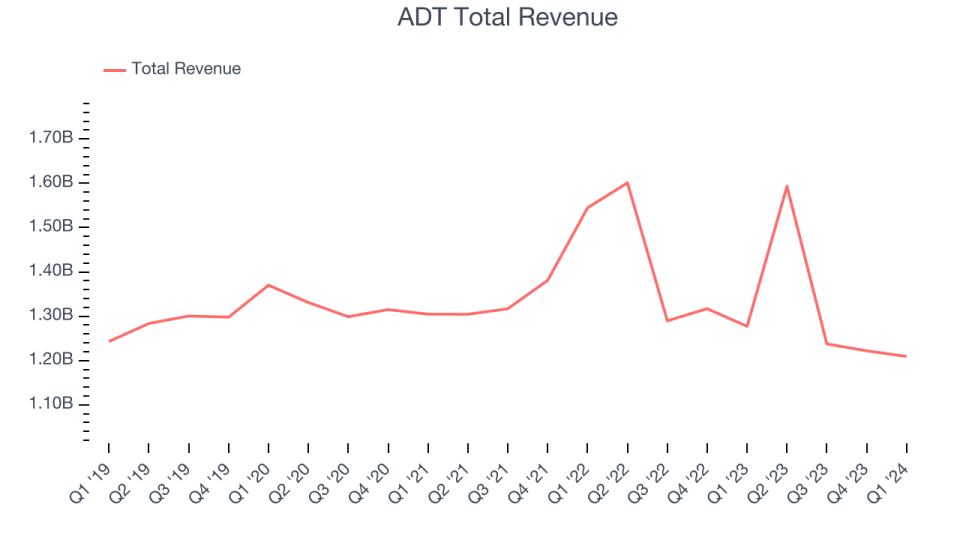

ADT reported revenues of $1.21 billion, down 5.3% year on year, in line with analysts' expectations. It was a decent quarter for the company with an impressive beat of analysts' earnings estimates but a miss of analysts' customers estimates.

“We are off to a strong start in 2024 with continued momentum in CSB segment revenue and Adjusted EBITDA as well as cash flow growth. During the quarter, we continued rolling out our new professionally installed ADT+ platform, positioning us to expand nationally in the coming months. We are excited about this new platform, related innovative use cases, and more diverse and flexible offerings for our customer base,” said ADT Chairman, President, and CEO, Jim DeVries.

The stock is up 11.2% since reporting and currently trades at $7.07.

Is now the time to buy ADT? Access our full analysis of the earnings results here, it's free.

Best Q1: WW (NASDAQ:WW)

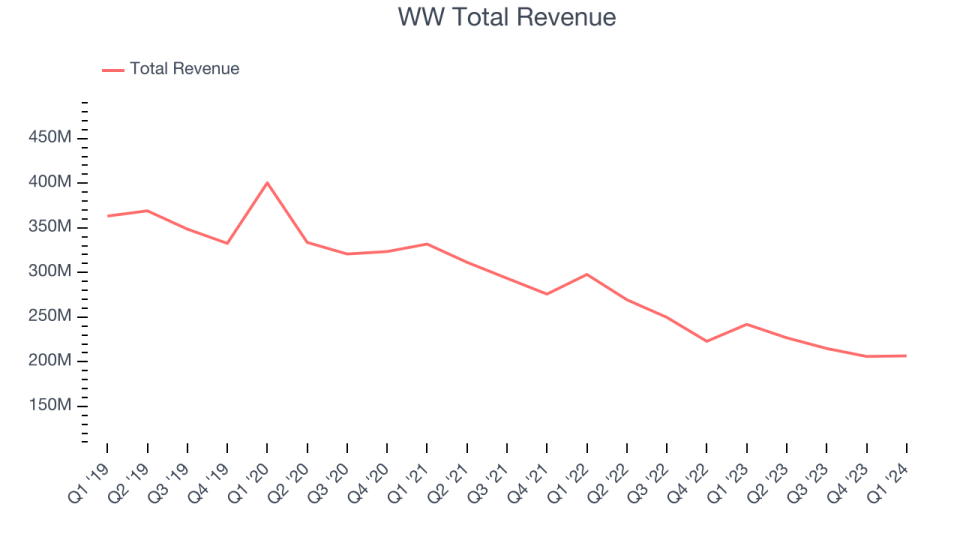

Formerly known as Weight Watchers, WW (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

WW reported revenues of $206.5 million, down 14.6% year on year, outperforming analysts' expectations by 3.6%. It was a strong quarter for the company with an impressive beat of analysts' earnings estimates.

Although it had a great quarter compared its peers, the market seems unhappy with the results as the stock is down 40.2% since reporting. It currently trades at $1.13.

Is now the time to buy WW? Access our full analysis of the earnings results here, it's free.

Weakest Q1: LKQ (NASDAQ:LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ:LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.70 billion, up 10.6% year on year, falling short of analysts' expectations by 1.6%. It was a weak quarter for the company with a miss of analysts' earnings and organic revenue estimates.

As expected, the stock is down 13.6% since the results and currently trades at $42.25.

Read our full analysis of LKQ's results here.

1-800-FLOWERS (NASDAQ:FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $379.4 million, down 9.1% year on year, falling short of analysts' expectations by 1.2%. Looking more broadly, it was a weak quarter for the company with a miss of analysts' earnings estimates.

The stock is up 4.9% since reporting and currently trades at $9.48.

Read our full, actionable report on 1-800-FLOWERS here, it's free.

Matthews (NASDAQ:MATW)

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $471.2 million, flat year on year, falling short of analysts' expectations by 1.6%. Looking more broadly, it was a solid quarter for the company with an impressive beat of analysts' earnings estimates.

Matthews had the weakest performance against analyst estimates among its peers. The stock is down 11.2% since reporting and currently trades at $24.05.

Read our full, actionable report on Matthews here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance