Winners And Losers Of Q2: KLA Corporation (NASDAQ:KLAC) Vs The Rest Of The Semiconductor Manufacturing Stocks

As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the semiconductor manufacturing industry, including KLA Corporation (NASDAQ:KLAC) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 2.7% below.

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Semiconductor manufacturing stocks have held steady amidst all this with average share prices relatively unchanged since the latest earnings results.

KLA Corporation (NASDAQ:KLAC)

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ:KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

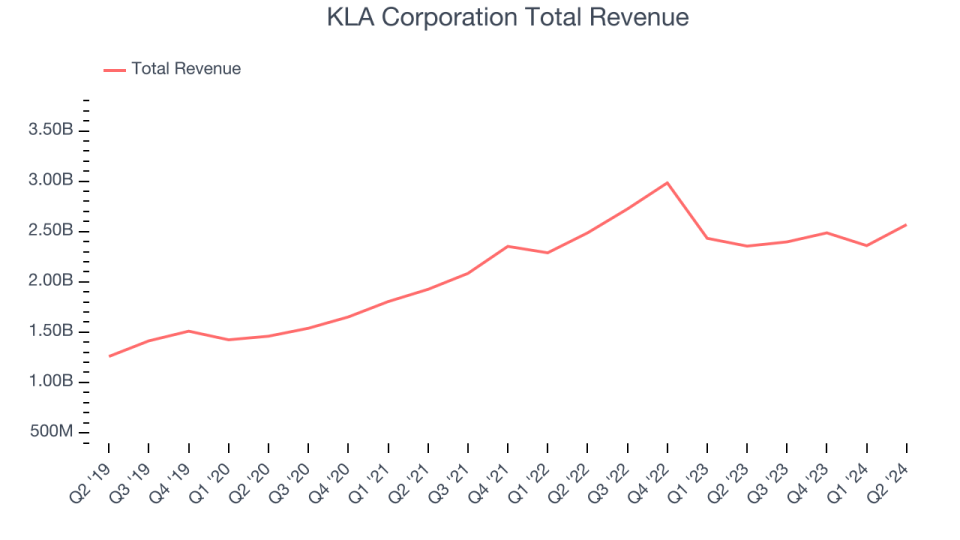

KLA Corporation reported revenues of $2.57 billion, up 9.1% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates and an improvement in its operating margin.

"KLA's June quarter results exceeded expectations, including revenue, gross margin and EPS, which were all above their respective guidance midpoints, demonstrating the enduring power and differentiation of the KLA portfolio," said Rick Wallace, President and CEO, KLA Corporation.

Interestingly, the stock is up 6% since reporting and currently trades at $801.

Best Q2: Nova (NASDAQ:NVMI)

Headquartered in Israel, Nova (NASDAQ:NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $156.9 million, up 27.8% year on year, outperforming analysts’ expectations by 5.9%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a significant improvement in its operating margin.

Nova achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 15.3% since reporting. It currently trades at $209.09.

Is now the time to buy Nova? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Photronics (NASDAQ:PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $211 million, down 5.9% year on year, falling short of analysts’ expectations by 6.2%. It was a softer quarter as it posted underwhelming revenue guidance for the next quarter and a miss of analysts’ EPS estimates.

Photronics delivered the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $24.03.

Read our full analysis of Photronics’s results here.

Amkor (NASDAQ:AMKR)

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ:AMKR) provides outsourced packaging and testing for semiconductors.

Amkor reported revenues of $1.46 billion, flat year on year. This result met analysts’ expectations. Zooming out, it was a mixed quarter as it also produced a significant improvement in its gross margin but underwhelming revenue guidance for the next quarter.

The stock is down 15.5% since reporting and currently trades at $31.75.

Read our full, actionable report on Amkor here, it’s free.

Amtech (NASDAQ:ASYS)

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ:ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Amtech reported revenues of $26.75 million, down 13% year on year. This print topped analysts’ expectations by 10.8%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EPS estimates and a significant improvement in its operating margin.

Amtech achieved the biggest analyst estimates beat among its peers. The stock is up 13.4% since reporting and currently trades at $6.

Read our full, actionable report on Amtech here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.