Your Wirecard E-Cash Was Safe Until It Wasn’t

(Bloomberg Opinion) -- The collapse of fintech darling Wirecard AG into insolvency proceedings is a total embarrassment for Germany, whose regulatory apparatus and corporate-governance system failed to properly scrutinize the company’s accounting practices even as red flags kept being waved.

But it’s also a serious problem for the U.K., where a burgeoning fintech industry grew up around Wirecard. The German company’s British subsidiary, Wirecard Card Solutions, has an “e-money” license, which allows it to handle digital cash without fully becoming a deposit-taking bank. As a member of Mastercard and Visa's payment networks, the unit is able to issue cards under those brands.

Fintech startups unwilling or unable to go through the regulatory hoops to do it all themselves flocked to Wirecard over the years as a cheap and convenient way to offer digital wallets, money transfers and widely-accepted payment cards.

Last Friday, the U.K. Financial Conduct Authority slapped a temporary halt on Wirecard Card Solutions. Those handy cards suddenly stopped working for customers at firms with names like Curve, Pockit and ANNA (whose acronym stands for Absolutely No Nonsense Admin). The freeze was lifted late on Monday, marking a pretty long blackout for 21st-century finance. In racing to protect the money of millions of people and ensure the U.K. is isolated from woes in Germany, British regulators have exposed a lack of trust in the system that consumers won’t soon forget.

These weren’t full-blown bank accounts, and in many cases users had fallback options, so disruption was obviously far less severe than in financial crises such as the Northern Rock or Lehman Brothers failures. Some companies, like Curve, were even able to set up alternatives to Wirecard over the weekend, but they were exceptions. Wirecard Card Solutions said that after “intensive work” with the regulator the FCA was satisfied that its client money is safe.

Still, it was a far cry from the marketing campaigns promoting these cards as an easy way to shop, save or get special deals from merchants. The reality of catering to the “unbanked” meant that people on government benefits couldn’t access their money. Hip startup founders in t-shirts found themselves trying to explain the inner workings of payments to enraged customers who wondered why they hadn’t stuck with old brick-and-mortar banks.

This is an expensive lesson in cheap banking: Nothing is risk-free and the convenience of e-money also brings fewer protections than regulated bank deposits (such as government-guaranteed schemes).

But there’s something additionally alarming about this situation. This isn’t a typical tale of greedy borrowers who failed to read the small print. Here, the small print literally said not to worry. For example, Pockit’s terms state, “In the unlikely event that Wirecard Card Solutions Limited becomes insolvent, your e-money is protected and held at a regulated credit institution.” Those are the official rules for non-bank companies handling digital cash: Customer funds have to be safeguarded in an authorized account. That’s what helps keep trust in the system. Indeed, last year, when fintech app Loot went bust, its cards could still be used — because customer funds had been safeguarded by its payments partner, Wirecard.

Today, though, regulators don’t seem so confident in high-flying fintechs’ commitment to the rules. The FCA’s freeze was apparently intended to make sure customer money was where it was supposed to be. After all, Wirecard AG had just admitted that it couldn’t locate 1.9 billion euros ($2.1 billion) of cash. There was perhaps an additional fear of U.K. customer funds becoming mixed up in insolvency proceedings.

But the freeze also symbolizes a breakdown of faith in German regulators, who have taken over and ring-fenced Wirecard’s banking operations. In imposing the freeze, the FCA’s list of demands to Wirecard’s U.K. subsidiary included safeguarding customer funds at a bank authorized in Britain, something industry folks say is a new development in what is supposed to be a harmonized European system. This potential “Wirecard Effect” raises huge questions about the future of Britain as a fintech hub, and also about regulation of e-money institutions across Europe, according to payments consultant David Parker.

Clearly, regulators are in a bind. They have been trying to encourage consumer-friendly financial innovation since the 2008 crisis, but the payments sector’s rapid growth and potential riskiness have outpaced supervisors’ ability to police it. If fintech is to survive, it will need more regulation. This isn’t just about buying coffee: Wirecard and many of its peers’ roots lie in processing payments for pornography and gambling websites, and Financial Times reporting indicates those relationships are still a lucrative part of business.

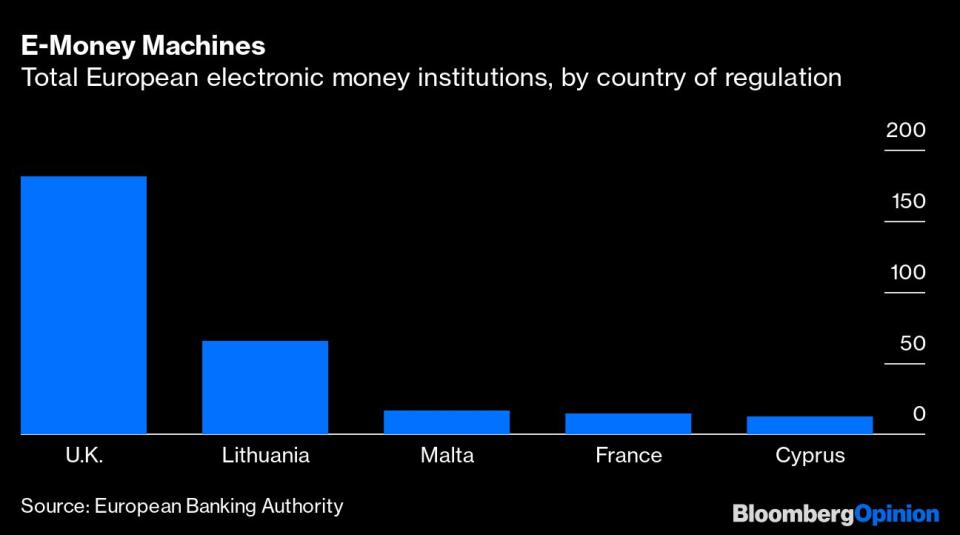

Yet in scrambling to bolster confidence in the U.K.’s fintech ecosystem — the biggest in Europe, at least by number of e-money institutions — the FCA is giving good reasons to simply shun the deceptive convenience of digital cash. It’s reminiscent of the dark days of the 2007 crisis, when the collapse of Icelandic banks had ripple effects for their British customers. At the time, 77% of Brits said they would never save with an overseas bank again. Judging by the comments of frustrated fintech consumers, one of whom said, “I’m going back to (Spain-headquartered bank) Santander,” the irony is that maybe today banks have the upper hand.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Lionel Laurent is a Bloomberg Opinion columnist covering Brussels. He previously worked at Reuters and Forbes.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Yahoo Finance

Yahoo Finance