WIX Q1 Earnings & Revenues Beat Estimates, Increase Y/Y

Wix.com Ltd WIX reported non-GAAP diluted earnings per share (EPS) of $1.29 for first-quarter 2024, which exceeded the Zacks Consensus Estimate of $1.03.The company had reported EPS of 91 cents in the year-ago quarter.

Total revenues increased 12% year over year to $419.8 million and beat the Zacks Consensus Estimate of $417.7 million.

At the end of Mar 31, 2024, registered users were 268 million.

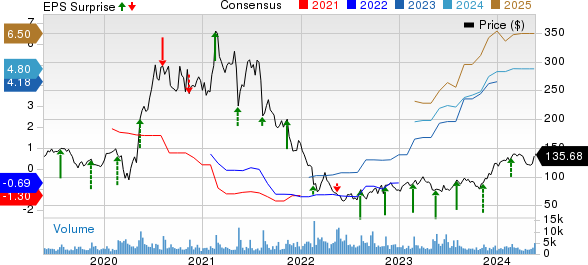

Wix.com Ltd. Price, Consensus and EPS Surprise

Wix.com Ltd. price-consensus-eps-surprise-chart | Wix.com Ltd. Quote

Quarter in Detail

Creative Subscriptions’ revenues (75.6% of total revenues) increased 9% year over year to $304.3 million. Business Solutions’ revenues (24.4% of total revenues) rose 20% to $115.5 million.

In first-quarter 2024, Creative Subscriptions annualized recurring revenues were $1.24 billion, up 10% year over year.

Bookings of $457.3 million improved 10% year over year. Creative Subscriptions’ bookings increased 7% year over year to $334.6 million. Business Solutions’ bookings rose 21% to $122.6 million.

Region-wise, North America, Europe, Asia and others, and Latin America contributed 60%, 25%, 11% and 4% to the first quarter of 2024 revenues, up 11%, 13%,12% and 9% year over year, respectively.

Operating Details

Non-GAAP gross margin expanded 100 basis points to 68%, driven by improving gross margins across Creative Subscriptions and Business Solutions segments.

Wix reported a non-GAAP operating income of $69.4 million compared with $48.5 million in the year-ago quarter.

Balance Sheet & Cash Flow

As of Mar 31, 2024, Wix had cash and cash equivalents of $513.3 million. Long-term debt was $570.5 million compared with $569.7 million as of Dec 31, 2023.

Cash flow provided from operations amounted to $113.8 million compared with $45.9 million in the year-ago quarter.

Capital expenditures totaled $8.1 million. Free cash flow was $105.7 million.

Outlook

For second-quarter 2024, revenues are expected to be between $431 million and $435 million, suggesting 11-12% growth from the prior-year quarter's reported figure. The Zacks Consensus Estimate is pegged at $434.4 million.

The company anticipates 2024 revenues to grow 11-13% and in the range of $1.73-$1.76 billion.

Non-GAAP operating expenses are expected to be in the range of 50%-51% of revenues for 2024.

Wix estimates free cash flow (excluding HQ capital expenditure) in the range of $445-$455 million, representing about 26% of revenues.

Zacks Rank & Stocks to Consider

Currently, Wix carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology space are Woodward WWD, Arista Networks ANET and Super Micro Computer SMCI. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 earnings per share (EPS) has moved up 9.3% in the past 60 days to $5.76. WWD’s long-term earnings growth rate is 16.3%.

Woodward’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 26.1%. WWD shares have risen 62% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 0.9% in the past 60 days to $7.53. ANET’s long-term earnings growth rate is 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 13.3%. Shares of ANET have gained 127.3% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2024 EPS has improved 8.3% in the past 60 days to $23.51. SMCI’s long-term earnings growth rate is 52.3%.

SMCI’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 6.9%. Shares of SMCI have risen 481% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance