Workday Inks Deal to Acquire Adaptive Insights for $1.55B

Workday, Inc. WDAY recently signed an agreement to acquire all outstanding shares of Adaptive Insights Inc for $1.55 billion in a cash-stock deal. The transaction is expected to culminate in the third quarter of 2019, subject to closing conditions.

The purchase is likely to aid Workday pursue its goal of emerging as an industry leader in better business decisions, operational expertise and evolve as a provider of enterprise-level software solutions for financial management as well as human resource domains. Together with Adaptive Insight, Workday aims to better plan, execute and help organizations to drive their financial and business changes.

The Purchase Consideration

The buyout will be made in cash and shares of Workday.

Adaptive Insightsemployees will receive roughly $150 million in unvested equity and balance in cash. The acquisition price reflects a large premium to Adaptive Insightsprice that was likely to go public this week.

Financing the Deal

Workday will deploy cash in hand from its balance sheet, and issue unvested equity to employees of Adaptive Insightsto finance the deal.

Rationale Behind the Transaction

Adaptive Insights is a provider of cloud platform for business planning. The company in its initial public offering was predicted to raise approximately $123 million. The company is valued at more than $600 million.

Workday enjoys the status of a leading provider enterprise cloud applications for finance and human resources to the organizations. Consequently, the company can leverage its portfolio with expertise to enhance operations.

Integration of Adaptive Insights into Workday’s portfolio will help the acquirer add capabilities to its portfolio. Further, the combined cloud-based platform will provide finance and HR solutions in a single system that will make easier for organizations to provide analytical insights and decision support.

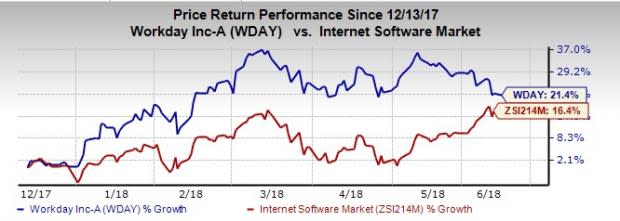

Share Price Movement

Notably, the stock has returned 21.5% in the past six months, substantially outperforming the 16.4% rally of its industry.

Last Words

Workday extended capabilities and tools in Workday HCM with new customer experience which is a positive. The company’s foray into the platform-as-a-service market by launching the Workday Data-as-a-Service Platform is expected to further boost the company’s top line growth.

Moreover, improving customer satisfaction rate bodes well for the company’s growth in the near term. Workday also partnered Duo Security and SkipFlag.

However, intensifying competition from peers and higher marketing expenditure are major headwinds in the near term.

Zacks Rank & Other Stocks to Consider

Currently, Workday carries a Zacks Rank #2 (Buy)

Amazon.com, Inc. AMZN, Texas Instruments Incorporated TXN and NVIDIA Corporation NVDA are stocks worth considering in the broader technology sector. All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Amazon, Texas Instruments and NVIDIA is currently pegged at 30.2%, 9.6% and 10.3%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance