Workday (WDAY) Adds New Features to Workday Extend Offering

Workday WDAY recently announced that the company added new functionalities to its Workday Extend offering. The new features include orchestration, data and logic capabilities that will assist clients to ramp up digital acceleration and increase administrative responsiveness.

Workday Orchestrate can be utilized by app developers to support “orchestration of processes” that run within Workday core apps and third-party systems. Using this feature, developers can design orchestrations by leveraging Orchestration Builder.

Orchestration Builder is a “drag-and-drop user interface” that offers easy to understand low-code developer experiences to drive map data and perform transformations, noted the company. The feature is offered as part of Workday Extend subscription.

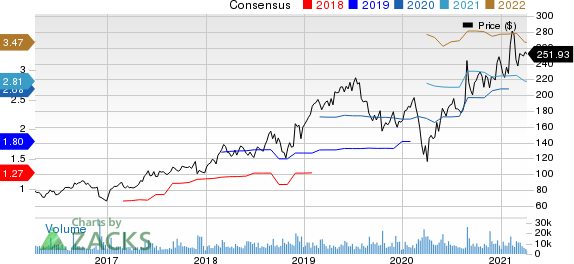

Workday, Inc. Price and Consensus

Workday, Inc. price-consensus-chart | Workday, Inc. Quote

Further, Workday added support for new data and logic components to the Workday Extend offering. This feature enables developers to create customized business objects and business processes to store and manage Workday Extend app data, added the company.

Workday Extend solution, earlier known as Workday Cloud Platform, facilitates users to create, deploy and manage new business apps and capabilities within Workday core applications. By leveraging Workday Extend, IT management can reduce technology stack complexity and contain costs.

The latest features are expected to drive demand for Workday Extend app, which is currently leveraged by the likes of Accuride, IBM, Flex and Netflix NFLX.

Notably, shares of Workday, carries a Zacks Rank #3 (Hold), have increased 73.3% in the past year compared with the industry’s rally of 99.7%.

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Increasing Demand for Workday Solutions Bode Well

Workday’s revenue growth continues to be fueled by healthy demand for its cloud-based human capital management (HCM) solutions and financial management offerings.

According to a Mordor Intelligence report, HCM software market is anticipated to hit $24.64 billion by 2026 at a CAGR of 6.7% between 2021 and 2026.

In the last reported quarter, Workday’s HCM solutions were selected by the likes of Cox Enterprises, First Rank Bank, Nike, ABB, Anthem, Cognizant Worldwide, among others.

Moreover, pandemic-triggered accelerated digital transformation of enterprises, globally, is driving adoption of Workday Adaptive Planning, Workday Prism Analytics and Business Planning Cloud offerings.

Further, Workday People Experience, Workday People Analytics and Workday Extend, integrated with enhanced capabilities, is likely to witness healthy uptake going ahead.

Workday’s acquisitions (Scout RFP, TrustedKey and Adaptive Insights to name a few) have also contributed to the top line growth. The company recently acquired Peakon, a Denmark-based Human Resource (HR) company that specializes in improving employee engagement by converting employee feedback into actionable insights.

Nonetheless, Workday needs to watch out for stiff competition in the HCM and financial management software space from the likes of Oracle ORCL, SAP and Automatic Data Processing ADP .

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance