World Acceptance Corp (WRLD) Exceeds Q4 Net Income Expectations, Misses on Revenue Projections

Net Income: Reached $35.1 million for Q4 FY 2024, up from $24.6 million in Q4 FY 2023, surpassing the estimate of $25.08 million.

Earnings Per Share: Increased to $6.09 in Q4 FY 2024 from $4.20 in the same quarter the previous year, exceeding the estimated $4.35.

Revenue: Totaled $159.3 million in Q4 FY 2024, a slight decrease from $160.8 million in Q4 FY 2023, but still surpassed the estimated $149.35 million.

Provision for Credit Losses: Decreased to $29.3 million in Q4 FY 2024 from $45.4 million in Q4 FY 2023, reflecting improved credit performance.

Net Charge-offs: Decreased to $47.4 million in Q4 FY 2024 from $64.4 million in the same quarter of the previous year, indicating better loan recovery.

Customer Base: Saw a decrease in unique borrowers by 6.2% year-over-year as of Q4 FY 2024, showing a contraction in the customer base.

Same-Store Gross Loans: Decreased by 6.7% over the twelve-month period ending March 31, 2024, compared to a decrease of 2.3% in the previous year, indicating reduced activity in established branches.

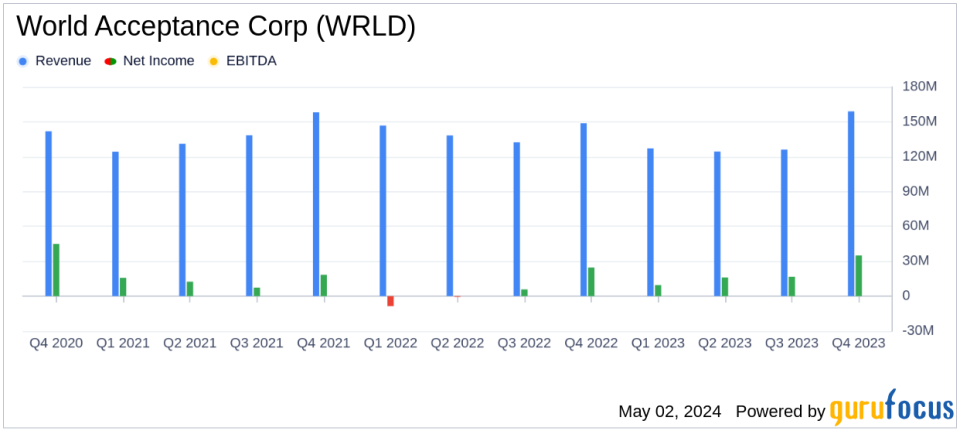

On May 2, 2024, World Acceptance Corp (NASDAQ:WRLD) disclosed its financial outcomes for the fourth quarter of fiscal 2024 and the full year in its 8-K filing. The company, known for its consumer finance business offering loans and tax preparation services, reported a notable increase in quarterly net income, surpassing analyst estimates, but saw a slight decline in revenue compared to the previous year.

Fiscal Quarter Financial Highlights

For the quarter ended March 31, 2024, World Acceptance Corp achieved a net income of $35.1 million, or $6.09 per diluted share, significantly higher than the $24.6 million, or $4.20 per share reported in the same quarter last year. This performance notably exceeded the analyst's quarterly estimate of $4.35 per share. However, total revenues for the quarter stood at $159.3 million, a decrease of 1.0% from $160.8 million in the prior year, slightly missing the estimated revenue of $149.35 million.

Annual Financial Overview

For the full fiscal year 2024, World Acceptance reported a substantial increase in annual net income to $77.3 million, or $13.19 per diluted share, up from $21.2 million, or $3.60 per diluted share in the previous year. This result significantly surpasses the annual EPS estimate of $11.49. Total annual revenue was reported at $573.2 million, down 7.0% from $616.5 million in fiscal 2023, yet slightly above the estimated $563.30 million.

Operational and Strategic Developments

The company highlighted its conservative approach to lending and focus on credit quality as key drivers of its strong financial performance. Despite a decrease in gross loans outstanding by 8.1% year-over-year to $1.28 billion, the company improved its gross yield to expected loss ratio and maintained a robust underwriting environment. Notably, the net charge-offs decreased significantly, contributing to the lower provision for credit losses which stood at $29.3 million, down from $45.4 million in the comparable quarter last year.

Challenges and Market Position

World Acceptance Corp faced challenges including a shrinking customer base and a competitive market environment that pressures revenue streams. The company's strategic adjustments in lending practices and focus on high-quality credit allocations have been crucial in navigating these challenges effectively.

Looking Forward

As World Acceptance Corp moves into fiscal 2025, it remains focused on sustaining its credit quality and exploring growth opportunities within its operational framework. The management's commitment to strategic investments in customer relationships and operational efficiency is expected to support the company's performance in a fluctuating economic landscape.

The company's financial health and strategic maneuvers provide a mixed yet cautiously optimistic outlook for investors and stakeholders, reflecting a resilient model in the face of industry-wide pressures.

About World Acceptance Corp

Founded in 1962 and headquartered in Greenville, South Carolina, World Acceptance Corporation operates over 1,000 branches across 16 states, offering a range of loan products and tax preparation services. The company primarily serves customers who lack access to mainstream credit sources, emphasizing responsible lending and financial management support.

For further insights and detailed financial metrics, stakeholders are encouraged to view the full earnings report and participate in the upcoming conference call.

Explore the complete 8-K earnings release (here) from World Acceptance Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance