World faces permanently higher interest rates, warns Bank of England official

Consumers face the prospect of permanently higher interest rates amid geopolitical tensions and “slower globalisation”, a Bank of England official has warned.

Megan Greene, an external member of the Monetary Policy Committee, said the last mile of slowing down the pace of inflation would be the hardest as she spoke during an event hosted by the IIF in Washington.

It comes after inflation fell less than expected to 3.2pc in March, prompting money market traders to predict that the Bank of England will only cut interest rates once this year, compared to forecasts of five cuts at the start of 2024.

Policymakers have raised interest rates to 16-year highs of 5.25pc to quell demand in the economy as inflation spiked to a 41-year peak of 11.1pc in October 2022.

Higher interest rates have forced up the cost of mortgages for thousands of home owners and made borrowing harder for consumers.

Ms Greene warned the world could be returning to a period of greater “volatility and uncertainty,” which could push prices higher.

She said: “It could mean…when the dust settles…actually rates will need to be a bit higher than we thought before.”

Ms Greene said uncertainty about the economy had led to businesses holding back investment.

“The more I go around and talk to people, particularly around the UK…we hear about volatility and volatility is causing people to just stay on the sidelines.

“If you actually look at historical context [volatility] isn’t actually that high so I think it’s mostly just this concern that there’s certainly, that causes companies, individuals to deploy capital differently.”

Ms Greene also described the jobs market as “one of the biggest puzzles that we’re grappling with” in the UK and more widely.

“The labour market is so tight,” she said, adding that its implications for higher productivity were so far unknown.

“For example, if it’s a result of just freakishly strong labour demand then that can raise productivity growth. If it’s just a reflection of labour hoarding because firms were traumatised by having to rehire and recruit after the economy opened up that actually saps productivity.”

Read the latest updates below.

06:43 PM BST

Signing off...

Thanks for joining us today - we’ll be back ahead of the markets opening tomorrow morning.

06:07 PM BST

Microsoft’s investment in OpenAI to escape an EU investigation

Microsoft’s $13bn (£10bn) investment into OpenAI looks set to avoid a formal probe by the EU, Bloomberg has reported, curbing fears that the two organisations could be forced apart.

Bloomberg said sources had indicated that the European Commission believes that the deal does not merit an investigation because it falls short of a takeover and that Microsoft doesn’t control OpenAI.

05:38 PM BST

Stock market sell-off could ‘easily return’

After many of the major stock market indexes in Europe rose today, Chris Beauchamp, chief market analyst for IG, notes:

The world has spent four days waiting for an Israeli response to Iran’s weekend attacks, and none has yet materialised.

The wave of selling across global markets has subsided for now, though we suspect it could easily return should Tel Aviv opt for a major retaliatory action.

05:12 PM BST

Boeing whistleblower testifies at US Congress

Engineer Sam Salehpour is testifying at the US Congress today. He has previously said that Boeing’s global fleet of 787 Dreamliner jets should be grounded for safety checks after manufacturing errors left them structurally unsound.

Christopher Jasper has the details.

05:06 PM BST

Ex-Ministry of Defence base to be used for Scottish movie studios

Big-budget productions for Netflix and Amazon could be filmed in Stirling after plans were revealed for a major film and televisions studio hub in the Scottish city.

A former MoD base is to be used as part of a £214m partnership between Stirling and Clackmannanshire Councils, the University of Stirling and the UK and Scottish Governments.

Stirling council said that the project could create over 4,000 jobs in 25 years.

The council’s leader, Chris Kane said:

Stirling Studios brings one of those rare moments in Stirling’s history which offers the potential to be truly transformational.

We have an opportunity to embed an industry in our city which will bring thousands of high-skilled jobs, put us on a global creative map and deliver a significant economic boost to the region over many decades.

04:56 PM BST

FTSE 100 partly rebounds after Middle East worries

The FTSE 100 rose 0.4pc today, with Anglo America the biggest riser, up by 3.6pc. The second-biggest riser was another minser, Fresnillo, up 2.9pc. The biggest faller was industrial estate owner Segro, down 2pc, followed by pensions company Phoenix, down 1.8pc.

The FTSE 250 closed virtually unchanged, despite rising in the morning. The biggest riser was Royal Mail owner International Distributions Services, up 28.9pc after a takeover approach. It was followed by miner Ferrexpo, up 4.8pc. The biggest faller was IT firm Kainos, down 6.4pc, followed by Auction Technology, down 5pc.

04:39 PM BST

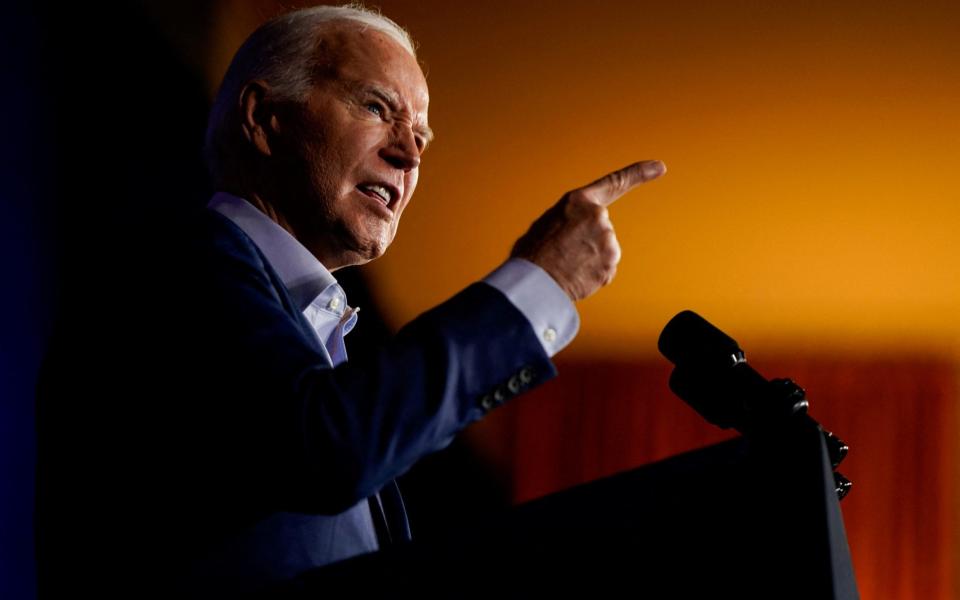

Biden seeks higher tariffs on Chinese steel as he courts union voters

President Joe Biden wants to triple tariffs on steel from China to protect American producers from a flood of cheap imports, as he campaigns to win over steelworkers in the electoral battleground of Pennsylvania.

In addition to boosting steel tariffs, Mr Biden also will seek to triple levies on Chinese aluminum. The current rate is 7.5pc for both metals.

The administration also promised to pursue antidumping investigations against countries and importers that try to saturate existing markets with Chinese steel and said it was working with Mexico to ensure that Chinese companies can’t circumvent the tariffs by shipping steel there for subsequent export to the US.

Biden is understood to be set to announce that he is asking the US Trade Representative to consider tripling the tariffs during a visit to United Steelworkers union headquarters in Pittsburgh.

04:34 PM BST

AI to consume more energy than India, warns Arm boss

The huge energy use of artificial intelligence services poses a “critical challenge” for the environment, the boss of British chip designer Arm has said.

Rene Haas said:

Today’s data centers already consume lots of power: globally 460 terawatt-hours (TWh) of electricity are needed annually. That’s equivalent to the entire country of Germany.

The rise in AI is expected to increase this figure 3x by 2030, more than the total power consumption of India, the most populated country in the world.

Mr Haas’s comments come weeks after National Grid chief John Pettigrew warned that AI could cause a massive rise in energy use. “Demand from commercial data centres will increase six-fold, just in the next ten years, and in homes, there will be an increasing shift towards heat pumps and electric vehicles,” he said.

In January, OpenAI boss Sam Altman said an energy breakthrough was necessary to support artificial intelligence, such as through greater investment in nuclear fusion.

Mr Haas has skin in the game: Arm chips are known for using less energy than rivals.

04:17 PM BST

Saga investors send shares down after it announces continued loss

Saga shares have dipped 4.6pc today after announcing a pre-tax loss of £129m for the year to January 31.

It said that the loss was made up of “£104.9m impairment of insurance goodwill, restructuring costs of £40.3m and other smaller one-off below-the-line items”.

The seller of insurance and holidays to the over-50s has been seeking an external partner for its ocean cruise business as it seeks to escape from a mountain of debt. It told investors today that it was “accelerating” this.

Mike Hazell, chief executive, said:

Saga has delivered a strong financial performance with underlying revenue growth of 13pc and an underlying profit that was more than double that of the prior year.

We have also continued to generate significant positive cash flows and reduced our net debt by £74.5m over the past 12 months. Off the back of this strong performance, we are now also taking action to position the business for long-term success.

03:54 PM BST

What Tesla’s chairman has told investors in push to rescue Musk’s $56bn pay deal

Tesla chairman Robyn Denholm asked the company’s investors - ahead of an AGM - urging them to back a proposal to approve the pay agreement after it was torn up by a US judge. Matthew Field has the details:

Mr Musk’s massive share award was originally agreed in 2018. However, this was challenged by a shareholder, who argued investors were misled when voting on the package and that the company’s directors were not truly independent of Mr Musk. In January, a Delaware judge called the deal “unfathomable” and declared it was not a “fair price”.

In the wake of the ruling, Mr Musk vowed to move Tesla’s legal incorporation from Delaware to Texas. Shareholders will also be asked to vote on the move.

In a letter to shareholders, Ms Denholm said the company disagreed with the court’s decision, adding: “We do not think that what the Delaware Court said is how corporate law should or does work.” At the time, 73pc of shareholders aside from Mr Musk approved the deal.

Ms Denholm said: “Because the Delaware Court second-guessed your decision, Elon has not been paid for any of his work for Tesla for the past six years that has helped to generate significant growth and stockholder value. That strikes us - and the many stockholders from whom we already have heard - as fundamentally unfair.”

She said a vote in favour would “restore Tesla’s stockholder democracy”.

In a US stock market filing, Tesla said four of its top 10 shareholders had sought a meeting with Ms Denholm to say they disagreed with the court ruling. One of its biggest shareholders, T. Rowe Price, has sent a letter of support for a new vote on the deal.

Tesla is now worth $490bn, a huge increase on its valuation compared to 2018, when the deal was first agreed, and Mr Musk still enjoys a loyal following of Tesla enthusiasts.

However, shareholders are currently smarting from a 60pc fall in the company’s valuation since 2021, when the company was worth over $1 trillion.

03:46 PM BST

Chip giant’s shares dive amid trade spat with China

Shares in Dutch tech giant ASML, which supplies chip-making machines to the semiconductor industry, have slumped today after the firm reported a drop in net profits and orders amid a high-tech trade spat between China and the West.

It made €1.2bn (£963m) in the first quarter of 2024, compared to €2bn the firm reported in the fourth quarter of last year.

Company shares slumped nearly 7pc on the Amsterdam Stock Exchange, compared to the Dutch AEX index which is down by 0.6pc overall.

ASML is one of the leading manufacturers of equipment to make state-of-the-art semiconductor chips, which power everything from mobile phones to cars.

But the semiconductor industry has become a geopolitical battleground as the West seeks to restrict China’s access over fears the chips could be used for advanced weaponry.

ASML announced this year that it had been blocked from exporting “a small number” of its advanced machines to China, amid reports of US pressure on the Dutch government.

Peter Wennink, chief executive, said the firm was still upbeat for the second half of 2024, which ASML has identified as a “transition” year before a stronger 2025.

Overall sales in the first quarter came in at €5.3bn, lower than the €7.2bn from the fourth quarter but in the range the company had forecast.

03:37 PM BST

Sweden hit by surge in cyber attacks after joining NATO

Sweden has suffered a spike in cyber attacks since joining Nato as Russia steps up electronic disruptions in northern Europe. Our technology editor James Titcomb reports:

A report from the cybersecurity company Cloudflare reported that distributed denial of service (DDoS) attacks, which seek to overload or slow down computer systems by flooding them with traffic, rose by 466pc after it joined Nato in March.

Cloudflare has a unique insight into the global state of such attacks because of its role protecting much of the internet’s infrastructure from DDoS efforts.

Russia was not named as the source of the increase in attacks, but hackers linked to Moscow have been accused of launching repeated attacks against Sweden.

Finland was hit with a similar increase in DDoS attacks in the run-up to the country joining Nato last year, with attempted cyber attacks at one point accounting for more than 80pc of internet traffic in the country.

Last year, Swedish cyber security company Truesc found that a hacking group claiming to be made up of Islamists from Sudan was in fact linked to Russia.

The Anonymous Sudan group, which hit Swedish airports and banks, was likely to have been created as part of an attempt to thwart Nato’s accession to Nato, Truesec said.

DDoS attacks typically involve hacking software taking control of millions of unsecured devices connected to the internet and directing traffic to the target’s servers.

Cloudflare said it had detected and stopped 4.5m such attacks in the first three months of 2024, up 50pc on a year ago.

03:36 PM BST

Pictured: Giant octopus outside mining summit

Greenpeace put a giant inflatable octopus outside the Canary Wharf Hilton in London as the 12th annual Deep Sea Mining Summit got underway today.

Campaigners are calling for an end to deep sea mining which damages oceans and threatens their ability to fight climate change.

I’m heading off at this point, but our coverage will by no means be taking a dive as Alex Singleton steps in to provide you with live updates.

03:16 PM BST

Oil prices slip as Israel tensions simmer

Oil prices has fallen despite the continuing tensions in the Middle East following Iran’s attack on Israel.

Brent crude, the international benchmark, has dropped 0.9pc towards $89 a barrel after ending little changed on Tuesday.

Israel has vowed to respond against Tehran for the drone and missile attack, while Britain and the US have urged restraint.

Oil prices have dipped after the American Petroleum Institute reported a gain in US stockpiles.

West Texas Intermediate was down 0.9pc below $85 a barrel.

02:56 PM BST

FTSE 100 bounces back as metal prices surge

The FTSE 100 has rebounded from steep declines as calls for tougher sanctions against China from Joe Biden helped push up metal prices.

The UK’s flagship stock market suffered its steepest fall in nine months on Tuesday amid rising tensions in the Middle East and concerns that interest rate cuts may be pushed back in the US.

The FTSE 100 was last up 0.9pc as it was boosted by mining stocks like Anglo American, Rio Tinto and Antofagasta.

Miners rose on the back of rising iron ore prices amid hopes that China’s steel mills will start up after Rio Tinto said it expects steel exports from the world’s second largest economy to remain elevated.

Meanwhile, steel and aluminium prices rose after Joe Biden called for higher tariffs on the metals from China over “unfair competition”.

Joshua Mahony, chief market analyst at Scope Markets, said: “European markets have enjoyed a welcome reprieve from the selling pressure that has dominated much of the week.”

02:36 PM BST

Wall Street opens higher as Amazon and Microsoft rise

The main US stock indexes opened higher as they were bolstered by gains in megacap growth Microsoft and Amazon.

The Dow Jones Industrial Average rose 150.70 points, or 0.4pc, at the open to 37,949.67.

The S&P 500 opened higher by 17.56 points, or 0.4pc, at 5,068.97, while the Nasdaq Composite gained 77.03 points, or 0.5pc, to 15,942.29 at the opening bell.

Microsoft rose by 0.8pc as trading began, while Amazon gained 0.4pc.

02:21 PM BST

We face permanently higher interest rates, warns Bank of England official

Consumers face the prospect of permanently higher interest rates amid geopolitical tensions and “slower globalisation”, a Bank of England official has warned.

Our economics editor Szu Ping Chan in Washington has the latest:

Megan Greene told a panel discussion hosted by the IIF: “It could mean…when the dust settles…actually rates will need to be a bit higher than we thought before.”

She said uncertainty about the economy had led to businesses holding back investment.

“The more I go around and talk to people, particularly around the UK…we hear about volatility and volatility is causing people to just stay on the sidelines.

“If you actually look at historical context [volatility] isn’t actually that high so I think it’s mostly just this concern that there’s certainly, that causes companies, individuals to deploy capital differently.”

Ms Greene also described the jobs market as “one of the biggest puzzles that we’re grappling with” in the UK and more widely.

“The labour market is so tight,” she said, adding that its implications for higher productivity were so far unknown.

“For example, if it’s a result of just freakishly strong labour demand then that can raise productivity growth. If it’s just a reflection of labour hoarding because firms were traumatised by having to rehire and recruit after the economy opened up that actually saps productivity.”

02:04 PM BST

Hunt risks missing debt target after National Insurance cuts, warns IMF

Jeremy Hunt’s pre-election tax cuts will keep Britain’s debt rising until the end of the decade, according to the International Monetary Fund (IMF), jeopardising the Chancellor’s goal of getting it down within five years.

Our economics editor Szu Ping Chan in Washington has the latest:

The IMF said it was “critical” that the UK do more to reduce borrowing as it warned that the “significant” reductions in National Insurance (NI) announced by Mr Hunt in the Spring Budget and Autumn Statement would “worsen the debt trajectory”.

The IMF now expects Britain’s debt share to be almost equal to the size of the economy by the end of the decade, hitting 98pc of GDP in 2029.

Debt is expected to rise every year until then, hitting 97.2pc of GDP in 2028, which is significantly higher than the 96.5pc it expected in October.

The chart shows how Government borrowing is forecast to rise.

01:49 PM BST

World returning to ‘volatility and uncertainty,’ warns Bank of England policymaker

A period of greater volatility in world politics poses a threat to inflation, Bank of England official Megan Greene has said.

Our economics editor Szu Ping Chan is in Washington for her appearance at the meeting of the IIF:

While Ms Greene said she was encouraged by the latest inflation data, she said she remain concerned about events in the Middle East.

“It does pose a risk, so I am worried about an energy price shock and other supply side shock that would obviously follow a number of supply side shocks,” she said.

Ms Greene added that the global economic backdrop was darkening and people were living in a more shock-prone world.

“It feels like we’re in really unprecedented times with incredible uncertainty,” she said, adding there was a risk that the “Great Moderation” period between the 1980s and 2007 which saw robust growth and steady inflation was a thing of the past.

“Maybe we’re returning to the volatility and uncertainty that we’ve actually had for decades.”

01:42 PM BST

Google employees arrested after protesting against tech giant’s work with Israel

A group of Google workers have been arrested after they held a sit-in protest to challenge the tech giant’s work for the Israeli government.

Our senior technology reporter Matthew Field has the details:

Employees from the No Tech For Apartheid movement organised a 10-hour sit-in at Google’s offices in New York and California on Tuesday.

During the protest, activists targeted the office of Thomas Kurian, the chief executive of Google Cloud, amid a row over a $1bn (£800m) contract with Israel.

Videos posted on social media showed nine protesters subsequently being removed by police.

Watch here and see more images.

01:23 PM BST

Lowering inflation will be a ‘bumpy ride,’ says Bank of England official

Inflation faces a “bumpy ride” on its journey to the Bank of England’s 2pc target, one of its interest rate setters has warned.

Megan Greene, an external member of the Monetary Policy Committee, said the last mile of slowing down the pace of price rises would be the hardest as she spoke at the IIF meeting in Washington.

She said there had been “encouraging news” on inflation, which fell less than expected to 3.2pc in March.

01:14 PM BST

Bank of England will cut rates in June despite inflation surprise, says Deutsche Bank

Some economists still think the Bank of England will cut interest rates this summer, despite inflation falling less than expected in March.

Deutsche Bank had still been holding out for a May cut but said he had shifted his view after the consumer prices index fell to 3.2pc, which was higher than the 3.1pc predicted by analysts.

The lender still expects the Bank’s Monetary Policy Committee (MPC) to announce three interest rate cuts this year, which it now thinks will start in June.

Economist Sanjay Raja said:

We still see the MPC delivering three quarter point rate cuts this year (June, Sep, Dec).

But we now expect the MPC to deliver only four rate cuts next year (Feb, May, Aug, Nov), sticking to a quarterly pace through 2025 (previously, we saw six rate cuts in 2025).

We expect two further rate cuts in H1-26 taking the terminal rate to 3pc.

Meanwhile, lender BNP Paribas said it is also still expecting summer interest rate cuts, although it thinks it will not begin until August.

In an update to clients, it said: “We expect Bank Rate to end 2024 at 4.5pc and 2025 at 3.5pc (compared with our previous 4.25pc and 3.25pc, respectively).”

01:03 PM BST

Mortgages rise as hopes of summer rate cuts are dashed

Mortgages are going up as higher than expected inflation figures cast doubt over the likelihood the Bank of England will cut interest rates before the summer.

Our senior money writer Fran Ivens has the latest:

Coventry Building Society is raising all of its fixed rates on its residential mortgages for new and existing customers from April 18, it has announced.

Similarly, Principality Building Society is increasing its fixed rates for customers buying a property by up to 0.21pc.

Consumer price inflation fell to 3.2pc in March, down from 3.4pc in February, dashing hopes of a 3.1pc drop. Traders think the Bank of England will now cut interest rates just once this year.

Read how swap rates – the main pricing mechanism for fixed rate mortgages – have been slowly increasing.

12:45 PM BST

Wall Street on track to rise at opening bell

US stock indexes are on track to rise at the opening bell later amid gains by megacap stocks.

Microsoft, Amazon and Tesla - members of the so-called Magnificent Seven stocks on Wall Street - advanced between 0.5pc and 1.1pc in premarket trading.

The rebound comes after the benchmark S&P 500 and the Nasdaq closed lower on Tuesday amid rising Treasury yields.

It followed comments from Federal Reserve chairman Jerome Powell that “recent data have not given greater confidence in inflation,” suggesting a push back in the timing of interest rate cuts.

Money markets imply about a 43pc chance the central bank could begin cutting rates in July, according to the CME FedWatch tool.

Later in the day, investors will watch for the Fed’s release of the “Beige Book” report, to assess the state of the world’s largest economy.

In premarket trading, the Dow Jones Industrial Average was up 0.3pc, the S&P 500 had gained 0.4pc and the Nasdaq 100 was up 0.3pc.

12:34 PM BST

Thames Water considers controversial debt raise in scramble to avoid collapse

Thames Water is poised to unveil a rescue plan this week as it scrambles to shore up its finances and stave off nationalisation.

Our reporter James Warrington has the details:

Board members at the struggling utility company are due to meet on Thursday, with a fresh five-year spending plan expected to be published on Friday.

The company’s proposals are understood to include a debt raise as it hunts for new cash to secure its future.

However, any attempt to return to debt markets would raise eyebrows as Thames struggles under a debt pile of £18bn.

Its parent company Kemble has already defaulted on a £400m loan, while it has warned it will miss a deadline to repay £190m to lenders at the end of the month.

Read how Thames has been plunged into crisis.

12:10 PM BST

Tesla seeks shareholder approval for Musk’s blocked $56bn pay package

Tesla will ask shareholders to vote again on a $56bn (£45bn) pay package for its chief executive Elon Musk after a Delaware court voided the award.

The world’s largest electric vehicle maker also said it would seek shareholder approval to move the company’s state of incorporation to Texas, from Delaware.

The company will hold its annual general meeting on June 13.

The announcements come after a judge in Delaware ruled that Mr Musk is not entitled to the landmark compensation package awarded by Tesla’s board of directors in 2018.

Mr Musk’s wealth has plummeted this year as the share price of Tesla has plunged by about 40pc amid weakening demand for electric vehicles.

He has already been overtaken as the world’s richest man this year by LVMH boss Bernard Arnault and Amazon founder Jeff Bezos, and would fall below Facebook founder Mark Zuckerberg if the $56bn pay award is annulled.

11:57 AM BST

Křetínský takeover bid rejected by Royal Mail owner

The owner of Royal Mail has rejected an initial takeover bid by the Czech billionaire Daniel Křetínský, who aims to hold talks with the company about a possible deal.

EP Group, which is owned by the energy tycoon known as the “Czech Sphinx,” said it had “submitted a non-binding indicative proposal” to International Distributions Services (IDS), which was turned down.

However, it said it aims to continue “to engage constructively with the board” and views the Royal Mail parent as an “important national asset that would benefit from being able to take a longer-term view”.

Earlier this month, it emerged that second class letters will be delivered just three times a week under new proposals submitted by Royal Mail.

EP Group said it “recognises that Royal Mail is in a challenging situation,” with “increasing competition from multinational companies in the UK postal market”.

IDS shares have gained 15.7pc following the news.

11:31 AM BST

Royal Mail owner’s shares rocket as Czech billionaire prepares bid

Shares in the owner of the Royal Mail have leapt higher after Czech billionaire Daniel Křetínský was named as preparing a takeover bid.

International Distributions Services shares jumped more than 18pc amid reports that the lawyer-turned-energy tycoon, known as the “Czech Sphinx,” could try to buy the company.

The Royal Mail owner was privatised between 2013 and 2015 and Mr Křetínský has built a 27.5pc stake in the company through his Vesa Equity Investment vehicle.

Křetínský’s other investments include stakes in Sainsbury’s, French newspaper Le Monde and West Ham United.

The Financial Times reported his potential takeover bid.

11:11 AM BST

LVMH sales grow amid rising spending by Chinese shoppers

The world’s largest luxury group LVMH revealed rising sales in the first three months of the year, allaying concerns about a wider slump in the high-end retail market.

Shares have risen 4.5pc after the owner of brands like Moet, Hennessy and Louis Vuitton reported that sales for the first quarter rose 3pc on an organic basis to €20.7bn (£17.7bn), matching analysts’ expectations.

Investors in Europe’s second-largest listed company, which is worth nearly €400bn, had been concerned about a deep slump in the luxury sector amid as consumers grapple with high interest rates.

LVMH said its Asia sales, excluding Japan, were down 6pc, but that purchases by Chinese shoppers globally had grown 10pc.

Mario Ortelli, of luxury advisory firm Ortelli, said: “The market environment is challenging, especially in China, and LVMH was able to navigate it in line with expectations.”

10:49 AM BST

Gas prices fall despite Middle East tensions

Wholesale gas prices have eased back after a surge amid rising concerns about a conflict between Israel and Iran.

Europe’s benchmark contract has fallen as much as 3.4pc after surging more than 20pc since last Wednesday.

Prices rose amid rising tensions in the Middle East which saw Iran launch an unprecedented attack on Israel at the weekend. Israel has vowed to respond.

However, Dutch front-month futures, the continent’s benchmark contract, have eased off as traders feared it had been overbought.

Analysts at EnergyScan said: “Prices are weakening slightly this morning, probably on profit taking.”

The UK equivalent gas contract has fallen as much as 3.3pc.

10:33 AM BST

Biden pushes for higher tariffs on Chinese steel and aluminium

Joe Biden has called for a tripling of tariffs on Chinese steel and aluminium over “unfair competition” as he seeks to win blue-collar votes in November’s election.

The US President is preparing to address steelworkers in Pittsburgh on the second day of a three-day trip through the crucial swing state of Pennsylvania.

Both he and his election rival Donald Trump are competing for vital blue-collar voters, promising to revive American manufacturing.

The White House said in a statement: “Chinese policies and subsidies for their domestic steel and aluminium industries mean high-quality US products are undercut by artificially low-priced Chinese alternatives produced with higher emissions.”

It comes as the US Trade Representative (USTR) announced it is launching a probe into China’s trade practices in the shipbuilding, maritime and logistics sectors in response to a recent petition by five US unions.

10:26 AM BST

Eurozone inflation slows to 2.4pc ahead of expected June rate cut

Eurozone inflation slowed across the board last month, reinforcing expectations for a European Central Bank interest rate cut in June.

Inflation in the 20 nations sharing the euro slowed to 2.4pc last month from 2.6pc in February, in line with a preliminary estimate released earlier this month.

Meanwhile underlying price growth, which filters out volatile food and energy prices dipped to 2.9pc from 3.1pc, despite services inflation holding steady at an uncomfortably high 4pc.

Inflation has fallen quickly over the past year, opening the way for interest rate cuts starting in June, even if the next few months are likely to bring choppy price growth data and a drawn-out return to the 2pc target.

Investors now see only 75 basis points of rate cuts this year, or two moves after June, a retreat compared to two months ago when between four and five cuts were being priced into the market.

Euro area annual #inflation at 2.4% in March 2024, down from 2.6% in February 2024 https://t.co/9jqBgGskMG pic.twitter.com/3GJl5SxzvH

— EU_Eurostat (@EU_Eurostat) April 17, 2024

10:09 AM BST

Sunak: Falling inflation shows our plan is working

The Prime Minister hailed today’s inflation figures, saying they demonstrated his economic plan is working.

He told broadcasters:

Today’s figures show that after a tough couple of years, our economic plan is working and inflation continues to fall.

Having been 11pc when I became Prime Minister, it’s now fallen to just over 3pc, the lowest level in two-and-a-half years.

We have also seen energy bills falling, mortgage rates falling and, just this week, data showed people’s wages have been rising faster than inflation for nine months in a row.

He added: “My simple message would be: if we stick to the plan, we can ensure that everyone has a brighter future.”

09:58 AM BST

Rents increase at record pace as Gove reforms backfire

Private renting costs increased at a record pace last month, official figures show, as Michael Gove’s crackdown on landlords pushed more to quit the market.

Average UK rents rose by an estimated 9.2pc in the 12 months to March, up from 9pc in the 12 months to February, according to the Office for National Statistics.

It was the highest annual percentage change since this UK data series began in January 2015 and means a typical monthly rent in England stands at £1,285.

One in ten landlords are expected to sell up as a result of Levelling Up Secretary Michael Gove’s end to so-called no-fault evictions, a survey by the National Residential Landlords Association (NRLA) trade body found.

Average UK house prices fell by 0.2pc in the 12 months to February, slowing from a decrease of 1.3pc in the 12 months to January, according to the Office for National Statistics (ONS).

Across the UK, the average house price was £281,000.

In the 12 months to February, average house prices fell in England to £298,000 (a 1.1pc decrease), were down in Wales to £211,000 (a 1.2pc fall), but increased in Scotland to £188,000 (a 5.6pc rise).

Average house prices increased by 1.4pc to £178,000 in the year to the fourth quarter of 2023 in Northern Ireland.

Average UK private rents increased by 9.2% in the 12 months to March 2024 (provisional estimate).

This was up from 9.0% in the 12 months to February 2024 (revised estimate) pic.twitter.com/sbFb7ywwYx— Office for National Statistics (ONS) (@ONS) April 17, 2024

09:37 AM BST

Pound gains as inflation proves persistent

The pound has made gains after the weaker-than-expected decline in inflation pushed back expectations for the first interest rate cuts.

Sterling has risen 0.4pc against the dollar to $1.248, having hit its lowest level since November on Tuesday.

The dollar had strengthened after US Federal Reserve chairman Jerome Powell indicated that US interest rates could stay higher for longer.

Mr Powell had warned in Washington:

The recent data have clearly not given us greater confidence and instead indicate that is likely to take longer than expected to achieve that confidence,” he warned Tuesday in Washington.

Given the strength of the labour market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us.

The pound was up 0.1pc against the euro, which is worth 85p.

09:06 AM BST

FTSE 100 rises after worst day in nine months

The FTSE 100 has risen after a sharp sell-off on Tuesday, despite inflation slowing less than expected in a blow to hopes of interest rate cuts.

The blue-chip index has gained 0.2pc after suffering its worst day in nine months in the previous session, tumbling 1.8pc.

The mid-cap FTSE 250 was flat after also posting steep losses on Tuesday.

Industrial metal miners have gained as much as 1.8pc, with shares of Rio Tinto up 2.1pc after iron ore futures climbed to their highest levels in more than five weeks.

08:39 AM BST

Gatwick owner buys Edinburgh Airport for £1.3bn

The French owner of Gatwich airport has struck a deal to buy a majority stake in Edinburgh Airport for around £1.27bn.

Infrastructure group Vinci has acquired a 50.01pc stake in the Scottish airport from Global Infrastructure Partners (GIP), which has owned the airport since 2012.

GIP will retain the remaining 49.99pc stake and form a strategic partnership with Vinci.

Edinburgh Airport’s chairman Sir John Elvidge and chief executive Gordon Dewar will remain in their roles following the deal.

Edinburgh Airport chief executive Gordon Dewar said:

The leadership team - which remains in place - is wholly committed to working with our investors to improve customer service, accelerate our decarbonisation plans and strengthen Scotland’s connectivity with the world, which ultimately drives the country’s international competitiveness and prosperity.

I should thank the whole team at Edinburgh Airport for the contribution they have made to our success over the last 12 years since GIP acquired the airport and look forward to working with them to write a new, exciting chapter in the airport’s story.

08:17 AM BST

Food inflation falls to lowest level in two and a half years

The drop in inflation was heavily linked to a slowdown in food price inflation, which was also its lowest for over two years.

Inflation for food and non-alcoholic drinks dipped to 4pc for the month, from 5pc in February, to reach its lowest level since November 2021.

The increased slowdown was partly driven by a fall in meat prices and lower rises for bread and cereals, the Office for National Statistics (ONS) said.

Furniture and household goods prices also contributed to the fall, with prices in the sector down 0.9pc in March compared with the same month last year.

Elsewhere in retail, clothing and footwear inflation also slowed to 4pc for the month, from 5pc in February, after women’s clothing stores increased prices by less than normal for this time of year.

The largest upwards pressure came from motor fuels, after the average price of petrol rose by 2.6p per litre between February and March 2024 to stand at 144.8 pence per litre, according to the ONS.

Still some UK food disinflation to come (3.9% YoY is 29-month low). Food PPI now flat, and whilst concern in pockets (El Nino) the world food price index remains down YoY. I spoke with @seanfarrington on @BBCr4today this AM speculating whether GBP weakness mutes this passthrough https://t.co/Hfak0fhGIM pic.twitter.com/ahuRzVv6wI

— Simon French (@Frencheconomics) April 17, 2024

08:04 AM BST

UK markets fall as inflation proves persistent

Stock markets edged down as trading began in London after inflation fell less than expected last month.

The FTSE 100 was down 0.1pc to 7,813.76 while the domestically-focused FTSE 250 was also down 0.1pc to 19,325.70.

07:57 AM BST

Asos losses deepen despite turnaround efforts

In corporate news, online fashion retailer Asos has revealed widening losses after half-year sales plunged by nearly a fifth as it presses ahead with “necessary action” to turn the business around.

The group posted underlying pre-tax losses of £120m for the six months to March 3 against losses of £87.4m a year ago.

Like-for-like sales fell 18pc on an adjusted basis in the first half and the group confirmed it still expects sales to fall by up to 15pc over the full year.

The group said underlying earnings in the 2024-25 financial year are set to be “significantly” higher than the previous two years as it cuts costs and slashes stock levels.

Chief executive Jose Antonio Ramos Calamonte said 2023-24 “is about taking the necessary action to get us to that path”.

07:52 AM BST

June interest rate cut still in play, say economists

An interest rate cut in June is still a possibility despite inflation remaining stronger than expected, according to economists.

Thomas Pugh, economist at RSM UK, said:

Slightly higher-than-expected inflation in March (3.2pc actual vs 3.1pc expected by the Bank of England) will raise fears that inflation is proving stickier than expected.

However, the early Easter this year played a part in boosting services inflation and core inflation still dropped significantly.

In any case, the big move down to 2pc is still likely to occur in April as last year’s huge price rises drop out of the annual comparison.

We still think that the door is open to the first rate cut happening in June. By the June meeting inflation should be below 2pc, the MPC will have seen the impact of the minimum wage increase, and the labour market will have loosened further.

That should provide all the cover the MPC needs to start cutting interest rates in the summer. The big risk now is that the Bank holds interest rates in restrictive territory longer than necessary, crimping the economic recovery.

Ruth Gregory, deputy chief UK economist at Capital Economics, said: “The chances of interest rates being cut for the first time in June are now a bit slimmer.”

07:44 AM BST

Services and core inflation fall less than expected

Although inflation figures have fallen almost across the board, according to the ONS, the declines are less than analysts had expected.

This has added to worries about the timing of the first interest rate cuts by the Bank of England.

Many economists are concerned about the impact of the National Living Wage on services inflation, which fell less than expected from 6.1pc to 6pc in March.

Meanwhile, core inflation, which strips out volatile food and energy prices, fell less than expected from 4.5pc to 4.2pc, having been forecast to drop to 4.1pc.

⚠️ UK core CPI hotter-than-expected (4.2% YoY vs. 4.1% exp). Rules out a May BoE cut. But under the hood things were weaker (trimmed mean CPI soft). Upside driven by just a few things (housing costs & phone apps). Still on track for several BoE cuts starting June $GBP pic.twitter.com/66jkwubWJo

— Viraj Patel (@VPatelFX) April 17, 2024

Ongoing widening spread between goods inflation (0.8% YoY) & services (6.0% YoY). This is the challenge for a single narrative about inflation - rather depends on your sector exposure & whether your principle input is goods, or labour. Set to continue in Q2 with 9.8% NLW increase https://t.co/xVukOol7lG

— Simon French (@Frencheconomics) April 17, 2024

07:36 AM BST

Inflation blow leaves Britain facing just one rate cut this year

Traders think the Bank of England will cut interest rates just once this year after inflation fell less than expected.

Money markets indicate that policymakers could wait as late as November before beginning to reduce borrowing costs.

Traders are now pricing in just one interest rate cut this year, compared to expectations of five cuts at the start of 2024.

Derivatives trades had implied on Tuesday that a first cut would come by September, and indicated there would be at least three cuts this year just a few weeks ago.

It comes after inflation fell to 3.2pc in March, according to the Office for National Statistics, which was a two-and-a-half year low but less than forecasts of a fall from 3.4pc to 3.1pc.

Services inflation, which is closely watched by policymakers at the Bank of England, fell from 6.1pc to 6pc in March, which was higher than analysts’ predictions of 5.8pc.

Inflation is still expected to fall heavily next month when the impact of the falling Ofgem price cap takes effect in the data.

Bank of England governor Andrew Bailey signalled on Tuesday that interest rates remain on course to fall in the coming months but economists have warned that there are risks to inflation.

Neil Birrell, chief investment officer at Premier Miton Investors, said:

UK inflation remained a little higher than hoped in March, reflecting the strength of the economy, particularly the consumer sector, which is in pretty good shape.

Inevitably everyone will be wondering what this means for interest rate cuts. The answer is probably not much, as this is just a case of inflation not slowing as quickly as hoped.

However, the data does mean it’s unlikely the Bank of England will move to the top of the starting grid when it comes to who cuts first; them, the Fed or the ECB.

07:27 AM BST

Minimum wage and oil prices pose risk to inflation, warn economists

Yael Selfin, chief economist at KPMG UK, said that “inflation could soon return to target, but risks remain”. She said:

The overall outlook for inflation remains broadly positive, however there are several risks which could cause a setback. Oil prices have rallied over the past month which has led to an increase in prices at the pump for consumers.

Also, the hike in the National Living Wage could potentially contribute to persistence in services inflation which remains elevated.

Today’s data are unlikely to move the needle for the Bank of England. We expect inflation to return to target later this spring, which raises the prospect of interest rate cuts from June onwards. Fewer rate cuts by the Fed are unlikely have a major impact given the more favourable inflation outlook and the ongoing weakness in the UK economy.

Headline inflation continued to cool in March, falling to 3.2pc, as the rate of food price increases eased further. However, services inflation remained elevated at 6pc.

07:22 AM BST

Reeves: Working people are worse off

Rachel Reeves, Labour’s shadow chancellor, said:

Conservative ministers will be hitting the airwaves today to tell the British people that they have never had it so good. However, after 14 years of economic failure under the Conservatives working people are worse off.

Prices are still high in the shops, monthly mortgage bills are going up and inflation is still higher than the Bank of England’s target. At the same time Rishi Sunak risks crashing the economy again with his Liz Truss-backed £46 billion unfunded tax plan to abolish national insurance.

The truth is Rishi Sunak is too weak to fix the economy his party broke and too out of touch to deliver for working people. It’s time for change. Only Labour has a long-term plan to grow our economy, cut people’s bills and make working people better off.

07:15 AM BST

Hunt: The plan is working

As inflation fell to 3.2pc, Chancellor Jeremy Hunt said:

The plan is working: inflation is falling faster than expected, down from over 11pc to 3.2pc, the lowest level in nearly two and a half years, helping people’s money go further.

This welcome news comes on top of our cuts to national insurance, which save the average worker £900 a year, so people should start to feel the difference as well as see it in their pay cheques.

07:14 AM BST

Rising fuel prices limited falls in inflation, says ONS

The Office for National Statistics’ chief economist Grant Fitzner said:

Inflation eased slightly in March to its lowest annual rate for two and a half years.

Once again food prices were the main reason for the fall, with prices rising by less than we saw a year ago.

Similarly to last month, we saw a partial offset from rising fuel prices.

07:09 AM BST

Inflation falls to 3.2pc

The rate of consumer prices index measure of inflation fell to 3.2pc in March from 3.4pc in February, the Office for National Statistics said.

The fall was less than analysts expectations of a drop to 3.1pc but still took inflation to its lowest level since September 2021.

In the year to March 2024:

▪️ Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 3.8%, unchanged from February

▪️ Consumer Prices Index (CPI) rose by 3.2%, down from 3.4% in February.

➡️ https://t.co/nCQnoLmeo5 pic.twitter.com/3cwyIBnHxH— Office for National Statistics (ONS) (@ONS) April 17, 2024

07:02 AM BST

Good morning

Thanks for joining me. Inflation has fallen to 3.2pc, official figures show, in a boost/blow to hopes for interest rate cuts.

The latest figures from the Office for National Statistics come after Bank of England Governor Andrew Bailey said he saw “strong evidence” that inflation was coming down in the UK.

5 things to start your day

1) Last-minute deal saves Britain’s biggest train factory from closure | Alstom secures vital new order after crunch talks with Transport Secretary

2) Champagne sales slump amid flat demand for French fizz | Moët & Chandon owner LVMH suffers post-pandemic hangover with 16pc drop in sales

3) New nuclear power plant expected to kill 46 tonnes of fish a year | EDF building £50m nature reserve near Hinkley Point to compensate for loss of life

4) Greensill administrators threaten to seize Sanjeev Gupta’s assets after he fails to repay £472m | Collapsed lender in ongoing negotiations with steel magnate to recover unpaid funds

5) Ambrose Evans-Pritchard: Gold is sniffing out monetary and geopolitical dystopia | ‘Never seen before’ levels of buying could be the makings of a war chest

What happened overnight

Asian shares were trading mixed as expectations resurfaced that US interest rates may stay high for a while.

Japan’s benchmark Nikkei 225 dipped 0.5pc in afternoon trading to 38,296.69.

Australia’s S&P/ASX 200 edged up less than 0.1pc to 7,618.50. South Korea’s Kospi was little changed, inching down to 2,608.93.

Hong Kong’s Hang Seng slipped 0.2pc to 16,219.84, while the Shanghai Composite gained 1.1pc to 3,040.72.

The mixed reaction came after Federal Reserve Chairman Jerome Powell said at an event Tuesday that the central bank has been waiting to cut its main interest rate, which is at its highest level since 2001, because it first needs more confidence inflation is heading sustainably down to its 2pc target.

In America, the Dow Jones Industrial Average rose 0.2pc, to 37,798.77, the S&P 500 lost 0.2pc, reaching 5,051.38, and the Nasdaq Composite index 0.1pc, to 15,865.25.

Yields for 10-year US Treasury bonds hit a new five-month high on diminishing expectations of Fed policy easing this year, and after stronger-than-expected economic data from China revived worries that inflation could reaccelerate. They fell to yield 4.66pc, from 4.63pc late on Monday.

Yahoo Finance

Yahoo Finance