Dow Jones surges and Nasdaq smashes 6,000 for first time ever ahead of Trump's 'big tax reform' announcement

Macron-inspired rally continues

Euro steadies below five-month high

World stocks set fresh record high for second straight session

Nasdaq smashes 6,000 for first time ever on Trump's tax talk

UK deficit falls to lowest level since before the financial crisis

Market report: Goldman turns bearish on UK miners, five months after adopting positive stance

UK-listed miners came under pressure after Goldman Sachs adopted a “tactically bearish stance” on the sector, just five months after turning positive on mining shares.

Despite a stellar performance last year and continued strong economic data from China, the US investment bank downgraded BHP Billiton and Antofagasta to “sell” and lowered Anglo American’s rating to “neutral” as it believes shares have started to underperform following a sharp fall in commodity prices.

Analyst Eugene King said: “While we expected a fade in commodity prices, the pace surprised us.”

Iron ore prices, in particular, have come under significant pressure in recent weeks due to an unclear demand outlook, high inventories and falling exports. “We see iron ore as having the worst outlook,” Mr King added.

With around 50pc of BHP Billiton’s earnings derived from iron ore and coal, Goldman thinks the weakness in commodities could drive consensus downgrades. Mr King added: “With the steel market in China starting to show signs of weakness, there is a chance that iron ore prices could undershoot the marginal cost of production.”

The bank also predicted iron ore price weakness would weigh on Anglo American, while Antofagasta could come under pressure in the near term if the reflation trade continues to lose steam.

In its wake, shares in BHP Billiton fell 8p to £12.07, Antofagasta lost 2.5p to 838p, and Anglo American finished 6p lower at £11.23.

Other laggards included precious metal miners Randgold Resources and Fresnillo, which came under pressure as gold prices dropped 1pc to a two-week low of $1,261.91 an ounce as investors continued to shun safe-haven assets in favour of riskier plays following centrist Emmanuel Macron’s victory in the first round of the French presidential election. Shares in Randgold Resources dropped 185p to £67.85 and Fresnillo slipped 13p to £15.03.

Whitbread suffered its worst day since the Brexit vote after its full-year results revealed weak sales at its Costa Coffee business as inflation begins to bite. Berenberg analyst Stuart Gordon said: “This will be taken negatively, despite the fact that the company remains comfortable with current expectations for the year.” The FTSE 100 stock tumbled 307p to £40.

B&Q owner Kingfisher, which rallied on Monday due to its French exposure, retreated today, closing down 10.8p at 326.4p.

Meanwhile, on the wider market, the FTSE 100 nudged up 10.96 points, or 0.15pc, to 7,275.64, as the relief rally triggered by Macron’s victory in the first round of the French presidential election dissipated.

Pharma group Hikma was the biggest riser, up 63p to £19.05, as it benefitted from M&A activity in the sector, after Fresenius snapped up US firm Akorn and an arm of Merck.

Elsewhere, US-focused equipment hire group Ashtead climbed 22p to £16.47 on a price target upgrade from Berenberg, while Hammerson edged up 7.5p to 602.5p after HSBC lifted its price target to 668p from 658p.

Away from the blue-chip index, specialty chemicals group Elementis popped 15.6p to a record high of 314p on a robust first-quarter trading update. It also said it remains on track to grow operating profit in all three divisions this year.

Elsewhere, a rating upgrade from JP Morgan lifted shares in Weir 77p higher to £20.80. Analysts at the bank said: “While demand in Weir’s two main end markets - oil & gas and mining equipment - has been improving for some months, the pace of improvement has been more dynamic than expected.”

Finally, small-cap Carpetright plunged 19.8p, or 8.1pc, to 225.3p, after it warned that its full-year profits would come in at the lower end of market expectations due to tough trading conditions.

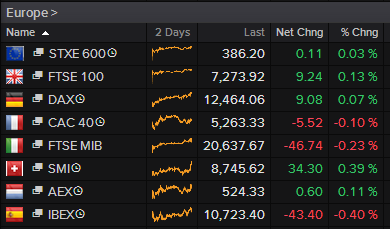

European bourses end the day higher

European bourses enjoyed modest gains as the Macron-inspired relief rally continued for a second day.

By close of play:

FTSE 100: +0.15pc

DAX: +0.14pc

CAC 40: +0.13pc

IBEX: +0.22pc

However, all eyes were on the US as the Nasdaq smashed 6,000 points, 17 years after hitting 5,000, and the Dow Jones crossed 21,000 again ahead of Trump's 'big tax reform' announcement.

Joshua Mahony, of IG, said: "US markets are leading the way higher today, as the excitement over Donald Trump’s corporate tax cuts have taken the mantle from the French elections. As Trump tells his aides to prepare for a 15pc corporation tax, the big announcement tomorrow is being front run by markets, with the Nasdaq hitting 6000 for the first time today.

"Despite the optimism of Trumps tax plan, we are seeing the FX trends on yesterday come back into play, with extended gains for the euro ahead of Thursday’s ECB meeting. While much of the focus has been upon a rate raising Fed, the political cloud that is gradually being lifted over the Eurozone is likely to start putting pressure on Draghi and co."

Party like its 1999: Nasdaq at 6,000 and Dow Jones back above 21,000

Wall Street is enjoying a stellar rally today, with the Nasdaq smashing 6,000 barrier - some 17 years after hitting 5,000 - and the Dow Jones back at 21,000 points, buoyed by Trump's tax talk and a continued relief rally following Sunday's first round French vote.

Neil Wilson, of ETX Capital, said: "Tech is leading again as the Nasdaq composite continues its outperformance against the other major indices in 2017. Amazon, Apple, Facebook, Google, Microsoft, which combined account for something a tenth of US market cap and keep notching up one record high after the next, are in charge. All are at or close to all-time highs. They’re the big beneficiaries of proposed tax reform so we’re seeing continued strength in these giants. Markets are all getting plenty worked up about the tax reforms and details – as such as they will be – should appear tomorrow."

But are stocks getting too expensive?

With the Nasdaq hitting all-time highs thoughts instantly return to the dotcom bubble, Wilson added.

"But we are a long way off the kind of multiples seen back then. That should offer some comfort. Meanwhile the Shiller PE Ratio for the S&P 500 is still well short of the level it hit at that time. Approaching 30, it’s very high historically but has a lot further to run to breach the 44 level it scaled before it all fell apart at the start of the noughties."

"For now it’s time to party like it’s 1999,” he concluded

Party like it's 1999! Nasdaq Composite tops 6k for the first time ever. pic.twitter.com/hV4LRrcOmO

— Holger Zschaepitz (@Schuldensuehner) April 25, 2017

Nasdaq hits 6,000 points, 17 years after touching 5,000

It has taken 17 years for the Nasdaq to climb from 5,000 points to 6,000.

17 years after hitting 5,000 points, the Nasdaq hits 6,000. pic.twitter.com/DYPTVYyDlb

— Jamie McGeever (@ReutersJamie) April 25, 2017

Dow Jones flirts with 21k again

The Dow Jones is flirting with 21,000 again, as it enjoys triple digit gains for a second consecutive day.

Connor Campbell, of SpreadEx, explains the reason behind today's move:

Impressive updates from McDonald’s, which saw some super-sized, all day breakfast-charged like-for-like sales, and Caterpillar, which posted Q1 EPS of $1.28 against the 62 cents expected, added a chunk of growth, the companies climbing 4.1pc and 6.4pc respectively.

Investors are getting all hot under the collar for the promised reveal of Donald Trump’s tax plan tomorrow, an announcement abuzz with the President’s trademark haphazardness.

Europe's Stoxx 600 hits highest level since August 2015

And the rally continues. Back in Europe, the Euro Stoxx 600 has touched its highest level since August 2015.

It's currently trading up 0.4pc on the day as markets continue to enjoy a relief rally following Macron's first round victory in the French election.

Nasdaq smashes 6,000 for first time at opening bell

Boom! The Nasdaq smashed the 6,000 barrier for the first time ever when the opening bell sounded on Wall Street this afternoon, buoyed by a raft of strong corporate earnings and Trump tax talk.

At the opening bell:

Dow Jones: +0.75pc

S&P 500: +0.33pc

Nasdaq: +0.34pc

Nasdaq Composite Index passes 6,000 for first time https://t.co/MoLNQP0oP0pic.twitter.com/FZiqj4sGAU

— Bloomberg Markets (@markets) April 25, 2017

Oil prices nudge higher, snapping six-day losing streak

Oil snapped its six-day losing streak as prices nudged up 8 cents at $51.68 a barrel.

However, concerns about Opec's ability to reduce global crude inventories limited gains.

WTI Crude #oil finding some support below $49/b. Trading less than one dollar away from the dangerzone #OOTTpic.twitter.com/qpZRcr3xDR

— Ole S Hansen (@Ole_S_Hansen) April 25, 2017

Trump tax talk back on the agenda

Trump tax talk is firmly back on the agenda, and could dominate moves in US markets when Wall Street opens in an hour's time.

With political risk easing in Europe following Macron's victory in the first round vote, investors are now shifting focus to Donald Trump's promise to announce " a big tax reform and tax reduction" tomorrow.

Here are the US opening calls courtesy of IG:

US Opening Calls:#DOW 20905 +0.67%#SPX 2378 +0.19%#NASDAQ 5518 +0.19%#IGOpeningCall

— IGSquawk (@IGSquawk) April 25, 2017

300 jobs to be cut at Nestle, reports suggest

Away from financial markets, reports suggest Nestle plans to cut around 300 jobs in the UK as it moves the production of the Blue Riband chocolate biscuit to Poland.

#Breaking Nestle planning to cut nearly 300 jobs, mainly in York and Newcastle, and move Blue Riband biscuit production to Poland - unions

— Press Association (@PA) April 25, 2017

'Au revoir, Marine': French bonds hold gains as markets rethink election risk

France's government bond market today held on to gains made immediately after the first round of the presidential election, indicating investors see little risk of anti-euro Marine Le Pen scoring winning the final vote.

Far-right Le Pen is lags centrist Emmanuel Macron, by around 20 points in opinion polls before their run-off on May 7.

France's benchmark government bond yield briefly touched 3-1/2-month lows on Tuesday while the gap between the French and German equivalents was its smallest since early November.

"Markets turn the page on Le Pen risks already," Commerzbank strategist Rainer Guntermann, said in a note titled "Au revoir Marine".

Le Spread plunges below 50bps on reduced political risk premia. pic.twitter.com/CjaiLN0LlN

— Holger Zschaepitz (@Schuldensuehner) April 24, 2017

French debt withstood pressure seen in other euro zone bond markets, where yields in secondary markets were rising because of a large debt sale by the euro zone bailout fund EFSF. Yields tend to rise during debt sales as investors make room in their portfolios for the new supply.

French 10-year yields briefly dipped to 0.75pc on Tuesday morning, slightly below the 0.76pc level breached Monday, but by mid-morning they were 1 bps higher at 0.77pc. Yields fell by 10 basis points on Monday.

����#France.

Betting markets have #LePen beating #Macron in roughly 1 out of 6 votes.

(note: probabilities do not sum to 100%=>house edge) pic.twitter.com/3hZKv7JQEu— Danske Bank Research (@Danske_Research) April 25, 2017

The gap between French and German equivalents dropped to around 40 basis points, its lowest since early November. German yields were 4 bps higher on the day at 0.38pc.

Strategists at ING said some political risk was baked into the spread before the final vote, which they calculate at around 10 basis points.

"If you look at the various market indicators, we see a roughly 85pcprobability of Macron being elected. The market is quite confident about the outcome and the polls were right," said Geoffroy Lenoir, head of euro sovereign rates at Aviva Investors in Paris.

Report from Reuters

US stocks poised to jump at opening bell

Staying with stock markets, US stocks are poised to build on gains made yesterday as investors digest first quarter earnings and await a major tax plan from President Donald Trump.

Trump promised last week to make "a big tax reform and tax reduction" announcement on Wednesday. Yesterday, a Trump administration said, he has directed his aides to move quickly on a plan to cut the corporate income tax rate to 15pc from 35pc.

Dow futures rallying aggressively after Caterpillar blow out street estimates. Large proportion of the index reporting today all up pre-mkt

— Anthony Cheung (@AWMCheung) April 25, 2017

Macron relief rally continues, but are these gains sustainable?

David Cheetham, of XTB, questions whether the gains in the aftermath of the French first round vote are sustainable:

"It’s seems hard to believe that there was a discount of this size priced into the market for the possibility that Macron, who is widely seen as the most market-friendly of all candidates, would advance to the second round, and with Le Pen also progressing it was still not the ideal outcome. The moves appear more based on the avoidance of a worst-case scenario (Melenchon vs Le Pen) rather than the achievement of the best case (Macron vs Fillon). The symbolic gesture of Le Pen standing down from her role as the leader of the Front National is clearly a desperate attempt to attract more moderate voters as she is well aware that her chances of victory are slim.

"The moves in stocks have held so far and in the absence of any reversal signals the path of least resistance remains higher and whilst there are many reasons to doubt its sustainability of the rally, at present the bulls are firmly in control of the tape."

How the French presidential election works 12:16PM

Half-time update: European bourses extend Macron rally

European bourses continued to rally following Macron's victory in the first round of the French vote. Robust earnings and M&A activity also boosted stocks.

Here's a look at the state of play in Europe:

FTSE 100: +0.28pc

DAX: -0.01pc

CAC 40: +0.38pc

IBEX: -0.13pc

David Cheetham, of XTB, said: "After some sharp moves on the European open yesterday, this morning has seen a sense of calm restored as markets continue to digest the recent political events in France. The FTSE 100 has added to Monday’s gains and has now recovered most of the losses seen last week following the announcement of a snap general election in the UK. In an interesting divergence which reveals a shift in driving forces on the markets, the pound remains well supported and not far from 2017 highs seen last week against the US dollar with the inverse correlation between these two subsiding somewhat in recent trade."

Resurgent euro keeps pound under pressure

The pound remains under pressure today at the hands of a resurgent euro, which rallied yesterday as markets began to price in a Macron presidency.

Although it regained some momentum in early trade, the pound remains down 0.04pc on the day at 1.1783 against the euro.

Yesterday, the pound suffered its worst day against the euro since early January, falling around 1.4pc.

Institute of Chartered Accountants: Significant amount of work to do to repair public finances

Commenting on UK public finances, Ross Campbell from the Institute of Chartered Accountants in England and Wales said: “Whatever the outcome on June 8, it's important to recognise there is still a significant amount of work to be done to repair the public finances - which are projected to stay in deficit for years to come.

"Whoever is Chancellor after the election will need to employ robust fiscal measures to tackle the massive level of public indebtedness we currently see today.

"While Brexit may dominate the pre-election narrative, it is equally important that all party manifestos tackle structural problems that plague the UK’s economy – including the longstanding problems of Government spending more that it earns and a lack of incentives to drive economic growth.”

Most of the larger UK March Public Finances deficit was higher debt interest presumably on RPI Index Linked Bonds.

— Shaun Richards (@notayesmansecon) April 25, 2017

He suggested that extra investment in infrastructure projects was needed “to spearhead the UK's economic reboot in a post-Brexit landscape”.

Read the full report by Tim Wallace here

IHS Markit: UK public finances figures 'pleasing and welcome news' for Chancellor Hammond

Weighing in on the UK public finances data, economist Howard Archer, of IHS Markit, said the figures were both "pleasing and welcome news" for Chancellor Philip Hammond as he essentially met the markedly lowered 2016/17 fiscal target contained in the March budget.

He added: "This is helpful for the Chancellor’s and government’s credibility, which is all the more welcome given the looming snap general election.

"Essentially meeting the revised 2016/17 fiscal target is a boost for the Chancellor’s credibility after it took a knock after he swiftly and embarrassingly scrapped his March budget plans to raise national insurance contributions for the self-employed. Following the fiasco over the U-turn over raising self-employed’s national insurance contributions, immediately missing his first fiscal target would fuel doubts about his ability to meet the longer-term fiscal targets."

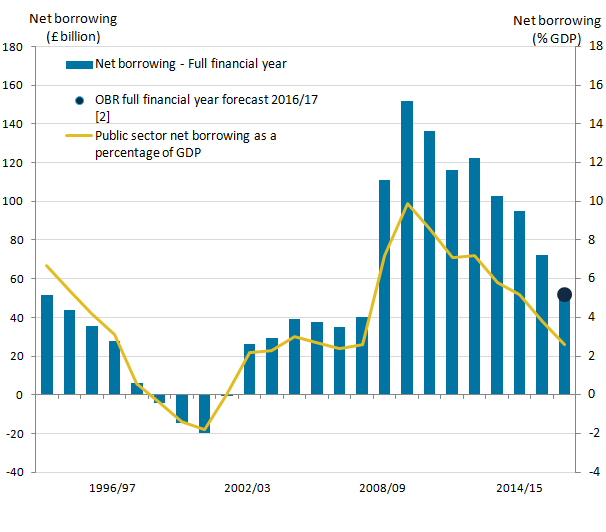

#UK budget deficit (PSNBex) of £52.0 bn in 2016/17 down from £72.0bn in 2015/16 & peak of £151.7bn in 2009/10. Lowest since 2007/8

— Howard Archer (@HowardArcherUK) April 25, 2017

2016/17 #UK#public#finances marginally above revised March budget target as PSNBex comes in at £52.0 bn (seen at £51.7bn in budget)

— Howard Archer (@HowardArcherUK) April 25, 2017

Higher-than-expected deficit and weak income tax receipts: Another sign economy have slowed in Q1

Sky's Ed Conway points out that the higher-than-expected deficit in March (it rose 20pc to £5.1bn) and weak income tax receipts are "another sign that the economy may have slowed" in the first quarter.

Higher deficit than expected in March. Weak income tax receipts. Another sign the economy may have slowed in Q1 https://t.co/uKqkY5QFun

— Ed Conway (@EdConwaySky) April 25, 2017

Full-year public sector net debt in line with OBR projections

Matt Whittaker, of Resolution Foundation, points out that full-year public sector net debt figures are in line with OBR projections.

Full year public sector net debt figures also in line w/OBR projections: equivalent to 86.6% of GDP. 3 percentage points higher than 2015-16 pic.twitter.com/0pSFLf5uoT

— Matt Whittaker (@MattWhittakerRF) April 25, 2017

Public sector net borrowing was £52bn in 2016-17, in line with OBR forecast & 28% down on 2015-16. But it's projected to rise next year pic.twitter.com/EWpWRHQj3M

— Matt Whittaker (@MattWhittakerRF) April 25, 2017

UK public finances: Falling income tax receipts are a worrying sign, warns Pantheon Macroeconomics

Returning to the UK public finances data, which showed the deficit fell to its lowest level since before the financial crisis, Pantheon Macroeconomics has warned that falling income tax receipts are "a worrying sign".

Economist Samuel Tombs said: "The public finances add to evidence that the economy has slowed significantly this year. Granted, borrowing was higher in March than a year ago because the Government’s interest payments bill rose by £0.7bn; the rebound in inflation has pushed up interest payments on the stock of index-linked debt.

"Growth in tax receipts, however, slowed to just 3.5pc in March, below the 6.2pc average of the first eleven months of the fiscal year. Tax receipts were boosted in January and February by a surge in self-assessment tax and capital gains tax receipts, which related to income generated in the 2015/16 fiscal year. PAYE income tax and taxes on production—which reflect the near-term strength of the economy—have been slowing for some time, and they fell by 3.5pc and 1.6pc year-over-year in March, respectively. "

Euro steadies below $1.09 against US dollar

The euro steadied on Tuesday, pausing after a rally sparked by the first-round results of the French presidential election.

The single currency traded up 0.5pc on the day at $1.0895 against the US dollar.

Anthony Cheung, of Amplify Trading, weighs in on the market reaction to the first round of the French vote in his latest morning briefing:

FTSE 100 edges up and mid-cap index touches new record high

The FTSE 100 continues to extend its gains following yesterday's relief rally, triggered by the outcome of the French first round vote.

It is currently trading up 12.87 points, or 0.18pc, to 7,277.27. Meanwhile, the mid-cap index hit a record high for a second consecutive trading session, rising 0.2pc in early trade.

Chris Beauchamp, of IG, said: "Markets have continued their push higher from yesterday, although at a much more relaxed pace. The immediate impact of Macron’s first-round success is wearing off, but the relief is still palpable among investors."

UK's deficit slashed to level last seen before the financial crisis

Here's our full report on the UK public sector net borrowing figures by Tim Wallace:

The Government borrowed £52bn in the last financial year, a fall of £20bn compared to the year before, as the long struggle to eliminate the deficit moved closer towards its goal.

That amounts to 2.6pc of GDP, the lowest level of borrowing since 2007-08, on the eve of the financial crisis.

But as the UK economy is bigger now, the number is still substantially larger in cash terms - the deficit nine years ago stood at £40.4bn.

That ballooned as the recession struck, spiralling up to £151.7bn in 2009-10 - equivalent to 9.9pc of GDP - before slowly falling as the Government has battled to control borrowing.

The fall in the deficit is bigger than analysts forecast a year ago, before the Brexit vote. The Office for Budget Responsibility had predicted extra borrowing of £55.5bn when it crunched the numbers in March 2016.

UK public finances: Key charts

Here are the key charts from the UK public finances data released this morning from the ONS:

Figure 1 presents cumulative public sector net borrowing (excluding public sector banks) by month in the latest full financial year and compares the cumulative borrowing with that in the previous financial year.

Figure 2illustrates that annual borrowing has generally been falling since the peak in the financial year ending March 2010 (April 2009 to March 2010).

Figure 3 breaks down outstanding public sector net debt at the end of March 2017 into the sub-sectors of the public sector. In addition to public sector net debt excluding public sector banks (PSND ex), this presentation includes the impact of public sector banks on debt.

Figure 6 illustrates PSND ex from the financial year ending March 1994 to the end of March 2017.

UK deficit falls to lowest level since 2008

British finance minister Philip Hammond met his budget deficit target in the 2016/17 financial year, data from the ONS showed this morning.

Here are the key points:

The shortfall in the public accounts in the 12 months to the end of March stood at £52bn, down nearly 28pc from the previous year thanks in large part to the strength of the economy since the Brexit vote, marking its lowest net borrowing since 2008.

The deficit was marginally above a forecast of a deficit of £51.7bn made the country's budget watchdog, the Office for Budget Responsibility, in March.

In the month of March, the deficit was higher than expected at £5.1bn, up 20pc on the same month last year and the highest March borrowing since 2015.

At 2.6 percent of gross domestic product in the 2016/17 financial year, the deficit was in line with the OBR's latest forecast.

The ONS said tax revenues and government spending - which are not adjusted for inflation - hit record highs.

Corporation tax revenues rose above their pre-crisis levels for the first time in a full financial year.

Public sector finances for March 2017 published by ONS: https://t.co/8yC0qpaHgp

— ONS (@ONS) April 25, 2017

Danske Bank: Volatility to return going into second round of French vote

Although the outcome of the first round French vote was in line with prior opinion polls, Danske Bank reckons yesterday's strong risk rally indicates that some investors were caught on the wrong foot and now see Macron winning the presidency as a done deal.

New polls released yesterday confirmed a solid 60pc to 40pc lead for Macron versus Le Pen in the second run-off on 7 May.

However, analyst Morten Helt cautioned: "While the risk rally could continue in the coming days, we still see a risk of volatility rising again driven by profit taking and risk reduction going into the second round on 7 May.

"Moreover, our equity strategy team still holds the view that equity markets will soon be back focusing on growth."

How the polls compared to the actual vote share 9:28AM

Markets rally like it is November 2016, but will it last?

Kathleen Brooks, of City Index, expects to see further upside after Macron-mania swept global markets yesterday.

However, she added that if Macron'slead over Le Pen starts to narrow then we could see nervousness and volatility return with a vengeance.

"Markets are vulnerable to polling risk now that investors’ have restored their faith in the French pollsters, and the polls leading up to round two of the French vote will be key market drivers," Brooks added.

French industry morale jumps in April to highest since June 2011

Morale among French manufacturers jumped to its highest level in almost six years, beating economists' expectations, data from state statistics body INSEE show this morning.

INSEE's industrial morale index rose three points to 108 points, higher than an average forecast of 104 in a Reuters poll and beating even the most optimistic prediction of 106.

Morale stabilised in the broader economy, with the composite index remaining at 104, higher than its average of 100.

French business morale in April jumps to highest in almost 6 years. pic.twitter.com/I7B4At4STU

— Jamie McGeever (@ReutersJamie) April 25, 2017

Report from Reuters

European bourses continue relief rally

Euroepan bourses continued to enjoy an uplift buoyed as risk appetite returned following Macron's victory in the first round at the weekend. Earnings and M&A activity also boosted stocks in the region.

Here's a snapshot of the current state of play in Europe:

Mike van Dulken, of Accendo Markets, said: "Calls for a positive open come after US bourses put on over 1% amid a French election inspired relief rally and Asian counterparts (Ex-Australia + NZ for holidays) followed suit, extending their positive start to the week, risk appetite fuelled by rising optimism about a tax reform announcement from Trump tomorrow that could revive the US reflation trade and global rally."

World stocks set fresh record high for second straight session

MSCI All-Country World Index, a gauge of global stocks, has set a fresh all-time high for a second consecutive trading session.

Meanwhile, the MSCI emerging markets index rose by 0.9pc to its highest level since June 2015.

Risk appetite returned to financial markets with a bang yesterday, with markets quickly pricing in a Macron presidency.

Michael Hewson, of CMC Markets, said: "Markets are surmising that Emmanuel Macron is a dead certainty to be French President in two weeks’ time, and while this is probably the most benign outcome at a time of rising populism it completely overlooks the challenges facing the new French President when he or she takes office on May 8."

Agenda: Investors eye UK public sector net borrowing

Good morning and welcome to our live markets coverage.

Overnight, Asian equities hit a two-year high as the Macron-inspired rally continued . Risk appetite returned to the market after the centrist came out on top in the first round of the French vote.

Chinese sharesrose 0.1pc, while Hong Kong's Hang Seng gained 0.9pc. The Chinese index posted its worst day in 2017 on Monday amid signs Beijing will tolerate further market volatility as regulators clamp down on shadow banking and speculative trading. Japan's Nikkei rose more than 1pc to a three-week high.

Good morning from Berlin! Asia stocks rise, Euro steady as relief from French vote buoys global risk sentiment. China rebounds after selloff pic.twitter.com/yk48JRPGlZ

— Holger Zschaepitz (@Schuldensuehner) April 25, 2017

Later this morning, UK public sector net borrowing will be released.

Previewing the data release, Michael Hewson, of CMC Markets, said: "Today’s UK public finance data for March is expected to show an increase from the £1.1bn in February to about £2bn keeping the government on course to reducing its overall borrowing on an annualised basis, with the OBR forecasting that the deficit this year would come in around £51.7bn."

Also on the agenda:

Full-year results: RedstoneConnect, Havelock Europa, Circassia Pharmaceuticals, Whitbread, Minds & Machines Group, Optibiotix Health, Amec Foster Wheeler

Interim results: Apax Global Alpha

Trading update: BHP Billiton, St. James’s Place, Elementis, Breedon Gorup, Carpetright, Equiniti, Virgin Money

AGM: Hammerson, Elementis, Entu, Metro Bank, Romgaz, Aggreko, Axis Bank

Economics: Public sector net borrowing (UK), Richmond manufacturing index (US), new home sales (US), CB consumer confidence (US)

European opening update - FTSE +21, DAX +54, CAC +28 at 6.57am

— David Buik (@truemagic68) April 25, 2017

Register Log in commenting policy

Yahoo Finance

Yahoo Finance