World's largest sovereign wealth fund to cut oil and gas investments

Norway’s $1tn (£760bn) sovereign wealth fund is continuing to distance itself from mostly investing in oil and gas investments in a bid to shake-off its heavy exposure on oil prices.

The world’s largest sovereign wealth fund, known formally as the Government Pension Fund, said in a statement that “the oil industry will be an important and major industry in Norway for many years to come,” but “a permanent reduction in the oil price will have long-term implications for public finances.”

The fund currently owns $37bn (£28.2bn) of shares in oil companies such as BP (BP.L) and Shell (RDSA.L). Norway is also one of Europe’s largest oil and gas producers and the fund is used to invest the proceeds of the nation’s oil industry and finance the country’s generous welfare state.

While the Norwegian government is still to approve the proposal, the move to diversify away from oil follows on from a report in 2017 that said cutting oil and gas investments would be a positive financial move for the fund. In March this year, it said it would divest from oil and gas investments.

In February this year, the fund reported a 485 billion kroner (£43.5bn, €50bn, $57bn) loss last year, and blamed the 6.1% drop on volatile stock markets.

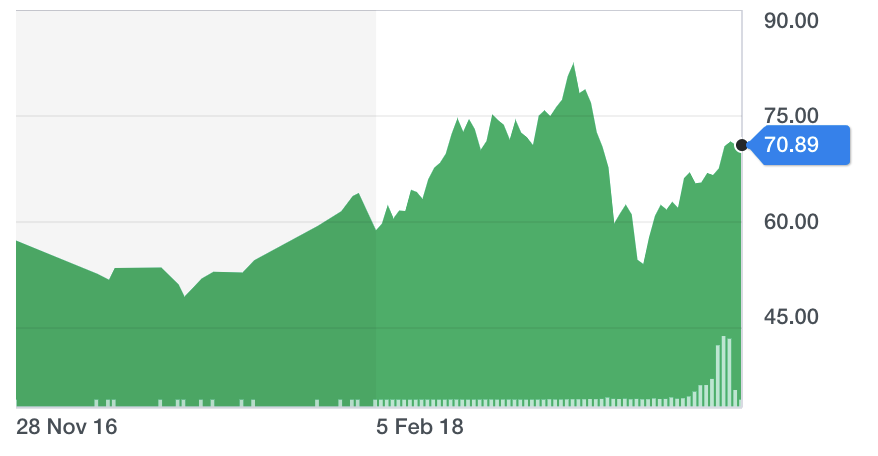

Oil (BZ=F) has had a wild ride over recent years and has failed to substantially rise above the $100 per barrel mark from over five years ago.

Equity investments make up over 50% of Norway’s sovereign wealth fund and much of these are in oil stocks. For example, it still owns 67% of Equinor, formerly known as Statoil.

Yahoo Finance

Yahoo Finance