The Worldwide 1,4-Butanediol Industry is Projected to Reach $11 Billion by 2027 - Rising THF Industry Drives Growth

Global 1,4-Butanediol Market

Dublin, Jan. 10, 2023 (GLOBE NEWSWIRE) -- The "1,4-Butanediol Market by Type (Synthetic and Bio-based), Application (Tetrahydrofuran (THF), Polybutylene Terephthalate (PBT), Gamma Butyrolactone (GBL), Polyurethane (PU)), and Region (APAC, North America, Europe, RoW) - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

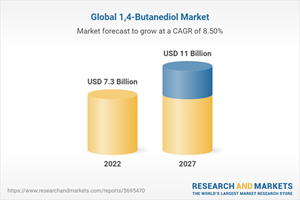

The global 1,4-Butanediol market size is estimated to be USD 7.3 billion in 2022 and is projected to reach USD 11.0 billion by 2027, at a CAGR of 8.5%.

The growing awareness regarding recyclable products, and their benefits related to the environment is one the primary factors driving the market growth. Moreover, factors like growing demand from the automotive industry, and high demand from the textile sector are also contributing toward the market growth of 1,4-Butanediol.

THF is estimated to lead the 1,4-Butanediol market, by application in terms of value during the forecast period.

By application, THF is estimated to be the largest segment in the BDO market in 2021. Tetrahydrofuran (THF) is broadly used as an intermediate raw material or as a solvent in applications, that include, PTMEG, PVC, pharmaceuticals, magnetic tapes, adhesives, paints and coatings, amongst others. It is largely used in the textile industry. With the increasing demand for special-purpose textiles from all over the world, the demand for Tetrahydrofuran (THF) is expected to rise during the forecast period. This, in turn, is propelling the market growth for BDO.

Bio-based BDO is estimated to be the fastest-growing segment in the BDO market, by type.

By type, bio-based BDO is estimated to be the fastest growing segment of the 1,4-Butanediol market during the forecast period. The usage of bio-based BDO is getting higher due to environmental regulations. The rising government regulations regarding the ban on conventional plastics and global warming initiatives are expected to drive the demand for bio-based 1,4-Butanediol across the world.

Asia Pacific is projected to be the largest market for 1,4-Butanediol during the forecast period, in terms of value.

Asia Pacific is projected to be the largest market for BDO during the forecast period. The usage of BDO is increasing extensively in the automotive industry. With the growing utilization of BDO, particularly in electric vehicle developments, most of the players are expanding their production capacities of 1,4-Butanediol. This is considered a major driving factor for the BDO market.

Report Attribute | Details |

No. of Pages | 175 |

Forecast Period | 2022 - 2027 |

Estimated Market Value (USD) in 2022 | $7.3 Billion |

Forecasted Market Value (USD) by 2027 | $11 Billion |

Compound Annual Growth Rate | 8.5% |

Regions Covered | Global |

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Significant Opportunities for Players in 1,4-Butanediol (BDO) Market

4.2 1,4-Butanediol (BDO) Market, by Region

4.3 1,4-Butanediol (BDO) Market, by Type

4.4 1,4-Butanediol (BDO) Market, by Application

4.5 1,4-Butanediol (BDO) Market, by Major Countries

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of Thf Industry

5.2.1.2 Growth of Pu Industry

5.2.2 Restraints

5.2.2.1 Health Concerns Associated with BDO

5.2.2.2 Shutdown of BDO Production Plants

5.2.3 Opportunities

5.2.3.1 Increasing Production of Bio-Based BDO

5.2.4 Challenges

5.2.4.1 Fluctuation in Raw Material Prices

5.3 Value Chain Analysis

5.4 Ecosystem

5.5 Porter's Five Forces Analysis

5.6 Pricing Analysis

5.7 Patent Analysis

5.7.1 Insights

5.7.2 Jurisdiction Analysis

5.7.3 Top Companies/Applicants

5.8 Policies and Regulations

5.9 Key Stakeholders & Buying Criteria

5.9.1 Key Stakeholders in Buying Process

5.9.2 Buying Criteria

5.10 Case Study Analysis

5.10.1 Bio-Based BDO

5.10.1.1 Problem Statement

5.10.1.2 Possible Solution by Genomatica's Geno BDO Process

5.11 Key Conferences & Events in 2022-2023

5.12 Trade Data

6 Manufacturing Process

6.1 Introduction

6.2 Reppe Process

6.3 Davy Process

6.4 Butadiene Process

6.5 Propylene Oxide Process

6.6 Others

7 1,4-Butanediol (BDO) Market, by Technology

7.1 Introduction

7.2 Reppe Process

7.3 Davy Process

7.4 Butadiene Process

7.5 Propylene Oxide Process

7.6 Others

8 1,4-Butanediol (BDO) Market, by Type

8.1 Introduction

8.2 Synthetic BDO

8.2.1 Growing Demand for Ptmeg for Producing Spandex

8.3 Bio-Based BDO

8.3.1 Increased Application in Transportation Sector

9 1,4-Butanediol (BDO) Market, by Application

9.1 Introduction

9.2 Tetrahydrofuran (Thf)

9.2.1 Growing Downstream Sector Favorable for Market Growth

9.2.2 Polytetramethylene Ether Glycol (Ptmeg)

9.2.3 Solvents

9.2.4 Others

9.3 Polybutylene Terephthalate (Pbt)

9.3.1 Second-Largest Application of BDO

9.3.2 Automotive

9.3.3 Electrical & Electronics

9.3.4 Consumer Appliances

9.3.5 Others

9.4 Gamma Butyrolactone (Gbl)

9.4.1 High Solvent Quality with Low Toxicity

9.4.2 N-Methyl-2-Pyrrolidone

9.4.3 2-Pyrrolidone/N-Vinyl-2-Pyrrolidone/ Polyvinylpyrrolidone

9.4.4 Others

9.5 Polyurethane (Pu)

9.5.1 Growing Use of Pu in Various Industries

9.6 Others

10 1,4-Butanediol (BDO) Market, by Region

11 Competitive Landscape

11.1 Overview

11.2 Revenue Analysis

11.3 Market Share Analysis, 2021

11.3.1 Basf Se

11.3.2 Sinopec Yizheng Chemical Fibre Co., Ltd.

11.3.3 Dcc

11.3.4 Xinjiang Tianye (Group) Co., Ltd.

11.3.5 Nan Ya Plastics Corporation

11.4 Company Evaluation Matrix

11.4.1 Stars

11.4.2 Emerging Leaders

11.4.3 Pervasive Players

11.4.4 Participants

11.5 Competitive Scenario

12 Company Profiles

12.1 BASF Se

12.2 Sinopec Yizheng Chemical Fibre Co., Ltd.

12.3 DCC

12.4 Xinjiang Tianye (Group) Co., Ltd.

12.5 Nan Ya Plastics Corporation

12.6 Sipchem Company

12.7 Shanxi Sanwei Group Co., Ltd

12.8 Mitsubishi Chemical Group Corporation

12.9 Mitsui & Co. Italia S.P.A.

12.10 Ashland

12.11 Genomatica, Inc.

12.12 Ineos

12.13 Evonik Industries Ag

12.14 Merck KGaA

12.15 Lanxess

12.16 Lyondellbasell Industries Holdings B.V.

12.17 LG Chem

12.18 Sk Geo Centric Co., Ltd.

12.19 Tokyo Chemical Industry Co., Ltd.

12.2 Spectrum Chemical

13 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/7w4ili

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance