The Worldwide Aircraft Generators Industry is Projected to Reach $7.3 Billion by 2027

Global Aircraft Generators Market

Dublin, July 18, 2022 (GLOBE NEWSWIRE) -- The "Aircraft Generators Market by Current Type (AC, DC), Type (VSCF, IDG, APU, Starter Generator), Power Rating, Aircraft Technology, Platform (Fixed-wing, Rotary-wing), End Use (OEM, Aftermarket) and Region - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

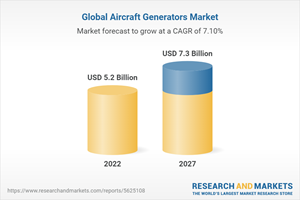

The Aircraft Generators Market is projected to grow from USD 5.2 billion in 2022 to USD 7.3 billion by 2027, at a CAGR of 7.1% during the forecast period.

The aviation industry is witnessing major transformations in terms of technological advancements in aircraft models. This has given rise to improvements in the power generation systems used in aircraft. More electric and hybrid-electric aircraft are part of the future of the aviation industry, with their adoption rate expected to significantly increase in the future.

Problems associated with conventional aircraft systems, such as cost, heating, fluid, and contamination, are eliminated in electrical solutions. Electrical systems are up to 80% more efficient than hydraulic actuators, as they come with a more efficient motor (without the issue of heating) and a lower risk of component damage.

Electrical systems are also environment-friendly and safer to use than conventional systems, which consist of hydraulic fluids that can damage the skin and cause poisoning or infection due to the high temperature. Therefore, the demand for electrical solutions has been continuously increasing, which, in turn, drives the aircraft generators market.

Fixed Wing segment to witness the highest growth in the forecast period

By Platform, the fixed-wing segment is expected to grow the highest in the forecast period. The increasing air traffic is contributing to the increasing requirements for commercial aircraft across regions. Increasing border tensions across regions are also a major factor for countries investing in tactical aircraft. These factors contribute to the growth of the fixed-wing segment in the aircraft generator market.

VSCF generator to witness the highest growth in the forecast period.

Based on type, the VSCF generators are witnessing highest growth in the forecast period. VSCF generators can accommodate flexible electrical architectures. That is the components of the VSCF generators can be spread out across the aircraft in contrast with IDG generators where it needs to be mounted closer to the engine. This factor is driving aircraft designers to increasingly adopt the VSCF generators into their systems.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Attractive Growth Opportunities in Aircraft Generators Market

4.2 Aircraft Generators Market, by End Use

4.3 Aircraft Generators Market, by Platform

4.4 Aircraft Generators Market, by Country

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Trend of More Electric Technology

5.2.1.2 Advancement in Power Generation Technology of Hybrid Electric Platforms and Light Aircraft

5.2.1.3 Increasing Demand for New Commercial Aircraft

5.2.2 Restraints

5.2.2.1 High Voltage and Thermal Issues

5.2.2.2 Existing Backlog of Aircraft Deliveries

5.2.3 Opportunities

5.2.3.1 Development of Advanced Power Electronics

5.2.4 Challenges

5.2.4.1 Stringent Regulatory Framework

5.2.4.2 Reduced Global Demand for Maintenance, Repair, and Overhaul (Mro) Services due to COVID-19

5.3 Pricing Analysis

5.4 Value Chain Analysis

5.5 Aircraft Generators Market Ecosystem

5.5.1 Prominent Companies

5.5.2 Private and Small Enterprises

5.5.3 End-Users

5.6 Trade Data Statistics

5.7 Technology Trends in Aircraft Generators Market

5.7.1 Turbogenerators for Electric Motors and Batteries

5.7.2 Variable Speed Constant Frequency Generators

5.8 Case Study Analysis

5.8.1 Honeywell Apu Introduces Two-Stage Axial Turbine System

5.9 Trends/Disruptions Impacting Customer Business

5.9.1 Revenue Shift and New Revenue Pockets for Aircraft Generator Manufacturers

5.10 Porter's Five Forces Analysis

5.11 Key Stakeholders & Buying Criteria

5.11.1 Key Stakeholders in Buying Process

5.11.2 Buying Criteria

5.12 Key Conferences & Events in 2022-2023

5.13 Tariff and Regulatory Landscape

6 Industry Trends

6.1 Introduction

6.2 Technology Trends

6.2.1 Hydrogen-Based Electricity Generator

6.2.2 Hybrid Electric Propulsion System

6.3 Impact of Megatrends

6.3.1 3D Printing

6.3.2 Sustainable Aviation Fuel

6.4 Supply Chain Analysis

6.5 Innovation & Patent Registrations

7 Aircraft Generators Market, by Current Type

7.1 Introduction

7.2 Ac

7.2.1 Can Efficiently Transmit Electricity Over a Long Range

7.3 Dc

7.3.1 Increasing Usage in Light Aircraft

8 Aircraft Generators Market, by Aircraft Technology

8.1 Introduction

8.2 Conventional Aircraft

8.2.1 Need to Replace Conventional Power Systems with Electrical Systems Boosts Segment

8.3 Hybrid Electric Aircraft

8.3.1 Need for Environmentally Friendly Aircraft Drives Growth

9 Aircraft Generators Market, by Type

9.1 Introduction

9.2 Variable Speed Constant Frequency Generator

9.2.1 Provides More Flexible Electrical System Architecture

9.3 Integrated Drive Generator

9.3.1 Increasing Usage in Commercial and Military Aircraft for Electrical Systems

9.4 Auxiliary Power Unit

9.4.1 Essential as Back-Up Electrical Supply for Aircraft

9.5 Starter Generator

9.5.1 Acts as Parallel Electrical Power Supply Unit

9.6 Alternator

9.6.1 Provides Smoother Output and Can Reach High Speed Faster Than Generators

10 Aircraft Generators Market, by Power Rating

10.1 Introduction

10.2 Less Than 100 Kw

10.2.1 Increasing Usage in Light Aircraft

10.3 100-500 Kw

10.3.1 Wide-Scale Usage in Commercial and Military Aircraft for Electrical Systems

10.4 More Than 500 Kw

10.4.1 Application in Hybrid Electric Aircraft on the Rise

11 Aircraft Generators Market, by Platform

11.1 Introduction

11.2 Fixed-Wing Aircraft

11.2.1 Commercial Aviation

11.2.1.1 Narrow-Body Aircraft

11.2.1.1.1 Growth in Air Passenger Traffic to Drive Demand

11.2.1.2 Wide-Body Aircraft

11.2.1.2.1 Demand Booster-Increase in Long-Haul Travel

11.2.1.3 Regional Transport Aircraft

11.2.1.3.1 Increasing Use in Us and Japan-Key Growth Contributor

11.2.2 Business & General Aviation

11.2.2.1 Business Jets

11.2.2.1.1 Increase in Private Aviation Companies Globally Drives Demand

11.2.2.2 Light Aircraft

11.2.2.2.1 Segment Driven by Technology Advancements and Modernization of General Aviation

11.2.3 Military Aviation

11.2.3.1 Fighter Aircraft

11.2.3.1.1 Growing Concerns Over Border Tensions Fuel Segment

11.2.3.2 Transport Aircraft

11.2.3.2.1 Increasing Demand for Transport Aircraft in Military Operations

11.2.3.3 Special Mission Aircraft

11.2.3.3.1 Growing Defense Spending and Territorial Disputes Drive Demand

11.3 Rotary-Wing Aircraft

11.3.1 Commercial Helicopters

11.3.1.1 Increasing Usage for Passenger Transport and Medical Services

11.3.2 Military Helicopters

11.3.2.1 Technologically Advanced Military Helicopters with Next-Generation Electro-Optic Systems Drive Demand

12 Aircraft Generators Market, by End Use

12.1 Introduction

12.2 Original Equipment Manufacturers (Oem)

12.2.1 Increasing Need for New Aircraft Drives Segment Growth

12.3 Aftermarket

12.3.1 Focus on Reduced Repair Time and Improved Readiness Increases Need for Aftermarket Refurbishment

13 Regional Analysis

14 Competitive Landscape

14.1 Introduction

14.2 Market Share Analysis, 2021

14.3 Revenue Analysis of Top Five Market Players, 2017-2021

14.4 Company Evaluation Quadrant

14.4.1 Stars

14.4.2 Emerging Leaders

14.4.3 Pervasive Players

14.4.4 Participants

14.5 Start-Up/SME Evaluation Quadrant

14.5.1 Progressive Companies

14.5.2 Responsive Companies

14.5.3 Dynamic Companies

14.5.4 Starting Blocks

14.5.5 Competitive Benchmarking

14.6 Competitive Scenario

14.6.1 Deals

14.6.2 Product Launches

15 Company Profiles

15.1 Key Players

15.1.1 Honeywell International Inc.

15.1.2 Safran

15.1.3 Thales Group

15.1.4 Collins Aerospace

15.1.5 General Electric

15.1.6 Ametek, Inc.

15.1.7 Meggitt plc

15.1.8 Rolls-Royce Holdings plc

15.1.9 Astronics Corporation

15.1.10 Calnetix Technologies

15.1.11 Unison Industries

15.1.12 Pbs Aerospace

15.1.13 Aerospace Electrical Systems

15.1.14 Arc Systems, Inc.

15.1.15 Skurka Aerospace, Inc.

15.1.16 Sinfonia Technology Co. Ltd.

15.1.17 Epropelled

15.1.18 Duryea Technologies

15.1.19 Denis Ferranti

15.1.20 Plane-Power

15.2 Other Players (Aftermarket)

15.2.1 Naasco

15.2.2 Precision Aviation Group

15.2.3 Tae Aerospace

15.2.4 Heico Corporation

15.2.5 Aerotech of Louisville, Inc.

16 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/ehk9eb

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance