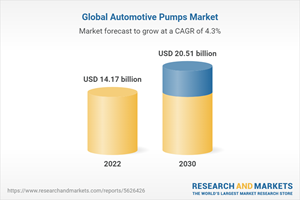

The Worldwide Automotive Pumps Industry is Expected to Reach $20.5 Billion by 2030

Global Automotive Pumps Market

Dublin, July 27, 2022 (GLOBE NEWSWIRE) -- The "Automotive Pumps Market Share, Size, Trends, Industry Analysis Report, By Vehicle Type, By Type, By Electric Vehicle Type, By Sales Channel, By Region, Segment Forecast, 2022 - 2030" report has been added to ResearchAndMarkets.com's offering.

The global automotive pumps market size is expected to reach USD 20.51 billion by 2030. The report gives a detailed insight into current market dynamics and provides analysis on future market growth.

The significant factors such as expanding vehicle manufacturing, improved compliance with environmental standards, rising integration of automation technologies such as automatic transmission, and growing acceptance of advanced digital technologies are anticipated to propel the growth of the industry over the forecast period.

Furthermore, they are frequently utilized to transport tropicalizing fluid for radiators, as well as pumping fuel and fuel additives. Therefore, the growing use of the industry in applications such as spraying release agents, pumping liquefied gases, and distributing paint and solvents on centralized systems is expected to propel industry growth.

Based on the vehicle type segment, the passenger car demand is expected to dominate the industry. The adoption of advanced technologies in the auto sector, along with the rising disposable income of consumers, is further leading to the increased demand for the industry.

Asia Pacific is expected to witness the largest share over the forecast period. The rapid growth in population, increased production of the vehicle in developing economies such as China and India, as well as the rapid advancement of hybrid vehicles are the factors contributing to the increased demand for the industry across the region.

Industry players such as Aisin Corporation, Continental AG, Denso, GMB Corporation, Hitachi, Johnson Electric, Magna International Inc., Mikuni Corporation, Mitsubishi Electric Corporation, Rheinmetall Automotive, Robert Bosch GmbH, SHW AG, Valeo, and ZF Group are some key players operating in the industry.

Key Topics Covered:

1. Introduction

2. Executive Summary

3. Research Methodology

4. Global Automotive Pumps Market Insights

4.1. Automotive Pumps - Industry Snapshot

4.2. Automotive Pumps Market Dynamics

4.2.1. Drivers and Opportunities

4.2.1.1. Rising demand for passenger cars

4.2.1.2. Increasing trend of engine downsizing

4.2.2. Restraints and Challenges

4.2.2.1. The rising cost of electrification of automotive pumps

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers (Moderate)

4.3.2. Threats of New Entrants: (Low)

4.3.3. Bargaining Power of Buyers (Moderate)

4.3.4. Threat of Substitute (Moderate)

4.3.5. Rivalry among existing firms (High)

4.4. PESTLE Analysis

4.5. Automotive Pumps Industry Trends

4.6. Value Chain Analysis

4.7. COVID-19 Impact Analysis

5. Global Automotive Pumps Market, by Electric Vehicle Type

5.1. Key Findings

5.2. Introduction

5.2.1. Global Automotive Pumps Market, by Electric Vehicle Type, 2018 - 2030 (USD Billion)

5.3. BEV

5.3.1. Global Automotive Pumps Market, by BEV, by Region, 2018 - 2030 (USD Billion)

5.4. FCEV

5.4.1. Global Automotive Pumps Market, by FCEV, by Region, 2018 - 2030 (USD Billion)

5.5. HEV

5.5.1. Global Automotive Pumps Market, by HEV, by Region, 2018 - 2030 (USD Billion)

5.6. PHEV

5.6.1. Global Automotive Pumps Market, by PHEV, by Region, 2018 - 2030 (USD Billion)

6. Global Automotive Pumps Market, by Vehicle Type

6.1. Key Findings

6.2. Introduction

6.2.1. Global Automotive Pumps Market, by Vehicle Type, 2018 - 2030 (USD Billion)

6.3. Passenger Car

6.3.1. Global Automotive Pumps Market, by Passenger Car, by Region, 2018 - 2030 (USD Billion)

6.4. Light Commercial Vehicles

6.4.1. Global Automotive Pumps Market, by Light Commercial Vehicles, by Region, 2018 - 2030 (USD Billion)

6.5. Heavy Commercial Vehicles

6.5.1. Global Automotive Pumps Market, by Heavy Commercial Vehicles, by Region, 2018 - 2030 (USD Billion)

7. Global Automotive Pumps Market, by Type

7.1. Key Findings

7.2. Introduction

7.2.1. Global Automotive Pumps Market, by Type, 2018 - 2030 (USD Billion)

7.3. Fuel Pump

7.3.1. Global Automotive Pumps Market, by Fuel Pump, by Region, 2018 - 2030 (USD Billion)

7.4. Fuel Injection Pump

7.4.1. Global Automotive Pumps Market, by Fuel Injection Pump, by Region, 2018 - 2030 (USD Billion)

7.5. Water Pump

7.5.1. Global Automotive Pumps Market, by Water Pump, by Region, 2018 - 2030 (USD Billion)

7.6. Windshield Pump

7.6.1. Global Automotive Pumps Market, by Windshield Pump, by Region, 2018 - 2030 (USD Billion)

7.7. Steering Pump

7.7.1. Global Automotive Pumps Market, by Steering Pump, by Region, 2018 - 2030 (USD Billion)

7.8. Transmission Oil Pump

7.8.1. Global Automotive Pumps Market, by Transmission Oil Pump, by Region, 2018 - 2030 (USD Billion)

7.9. Vacuum Pump

7.9.1. Global Automotive Pumps Market, by Vacuum Pump, by Region, 2018 - 2030 (USD Billion)

7.10. Headlight Washer Pump

7.10.1. Global Automotive Pumps Market, by Headlight Washer Pump, by Region, 2018 - 2030 (USD Billion)

8. Global Automotive Pumps Market, by Sales Channel

8.1. Key Findings

8.2. Introduction

8.2.1. Global Automotive Pumps Market, by Sales Channel, 2018 - 2030 (USD Billion)

8.3. OEM

8.3.1. Global Automotive Pumps Market, by OEM, by Region, 2018 - 2030 (USD Billion)

8.4. Aftermarket

8.4.1. Global Automotive Pumps Market, by Aftermarket, by Region, 2018 - 2030 (USD Billion)

9. Global Automotive Pumps Market, by Geography

10. Competitive Landscape

10.1. Expansion and Acquisition Analysis

10.1.1. Expansion

10.1.2. Acquisitions

10.2. Partnerships/Collaborations/Agreements/Exhibitions

11. Company Profiles

11.1. Aisin Corporation

11.1.1. Company Overview

11.1.2. Financial Performance

11.1.3. Product Benchmarking

11.1.4. Recent Development

11.2. Continental AG

11.2.1. Company Overview

11.2.2. Financial Performance

11.2.3. Product Benchmarking

11.2.4. Recent Development

11.3. Denso

11.3.1. Company Overview

11.3.2. Financial Performance

11.3.3. Product Benchmarking

11.3.4. Recent Development

11.4. GMB Corporation

11.4.1. Company Overview

11.4.2. Financial Performance

11.4.3. Product Benchmarking

11.4.4. Recent Development

11.5. Hitachi

11.5.1. Company Overview

11.5.2. Financial Performance

11.5.3. Product Benchmarking

11.5.4. Recent Development

11.6. Johnson Electric

11.6.1. Company Overview

11.6.2. Financial Performance

11.6.3. Product Benchmarking

11.6.4. Recent Development

11.7. Magna International Inc

11.7.1. Company Overview

11.7.2. Financial Performance

11.7.3. Product Benchmarking

11.7.4. Recent Development

11.8. Mikuni Corporation

11.8.1. Company Overview

11.8.2. Financial Performance

11.8.3. Product Benchmarking

11.8.4. Recent Development

11.9. Mitsubishi Electric Corporation

11.9.1. Company Overview

11.9.2. Financial Performance

11.9.3. Product Benchmarking

11.9.4. Recent Development

11.10. Rheinmetall Automotive

11.10.1. Company Overview

11.10.2. Financial Performance

11.10.3. Product Benchmarking

11.10.4. Recent Development

11.11. Robert Bosch GmbH

11.11.1. Company Overview

11.11.2. Financial Performance

11.11.3. Product Benchmarking

11.11.4. Recent Development

11.12. SHW AG

11.12.1. Company Overview

11.12.2. Financial Performance

11.12.3. Product Benchmarking

11.12.4. Recent Development

11.13. Valeo

11.13.1. Company Overview

11.13.2. Financial Performance

11.13.3. Product Benchmarking

11.13.4. Recent Development

11.14. ZF Group

11.14.1. Company Overview

11.14.2. Financial Performance

11.14.3. Product Benchmarking

11.14.4. Recent Development

For more information about this report visit https://www.researchandmarkets.com/r/zafdfo

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance