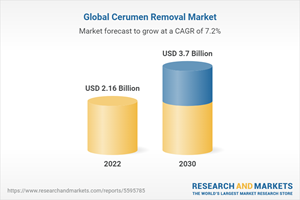

The Worldwide Cerumen Removal Industry is Expected to Reach $3.7 Billion in 2030

Global Cerumen Removal Market

Dublin, Sept. 16, 2022 (GLOBE NEWSWIRE) -- The "Cerumen Removal Market Size, Share & Trends Analysis Report by Product Type, by Consumer Group, by Distribution Channel, by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

The global cerumen removal market size is expected to reach USD 3.7 billion by 2030 and is expected to expand at a CAGR of 7.2% in the forecast period.

Significant rise in the prevalence of cerumen impaction as well as rising awareness are the major factors contributing to the expansion of cerumen removal market. As per the report published by WHO in 2021, the average prevalence of cerumen impaction is between 7% and 35% across various age groups. Also, with rising geriatric population across the globe is anticipated to raise the market for cerumen removal as cerumen impaction is very common in the geriatric population. Moreover, it is more prevalent in people using hearing aids & earplugs.

The increasing infection rates and people facing problems such as ear itching and irritation have raised the awareness of cerumen removal. The adoption of correct methods for cerumen removal and the availability of various tools and cerumen removal drops is positively impacting the market growth. Also, the market players are introducing innovative products for effective and inexpensive cerumen removal. For instance, Safkan Health introduced Otoset, a cerumen removal device. This device resembles a headphone and breaks down cerumen by using an irrigation method by providing irrigation solution through disposable ear tips.

The micro-suction segment is estimated to dominate the market throughout the forecast period. Micro-suction is the most common procedure adopted for cerumen removal and can provide immediate wax clearance when an urgent clinical need arises. the adoption of micro-suction devices in ENT clinics has raised owing to its benefit's over-ear syringing. The major benefit is that it does not damage the lining which can be a risk factor during the ear syringing and is gentle on the ears. Also, the device usually has a camera attached that gives the audiologist a clear view of the inner parts of the ear and the amount of wax.

Based on consumers, the geriatric segment is witnessing lucrative growth owing to the increasing number of geriatric populations. As per the data published by United Nations in 2020, the global geriatric population is estimated to exceed 1.5 billion by 2050. Hearing loss is prevalent in older adults and hence they are the major consumers of hearing aids, thereby raising the risk of cerumen impaction. This is anticipated to positively impact the market growth.

Based on distribution channels, retail pharmacies dominated the market owing to the increasing number and expansion of retail pharmacies. Moreover, the increasing adoption of automation and digitalization is positively impacting segment growth. For instance, in May 2018, McKesson Co. entered into an agreement with Discount Drug Mart, to provide dispensing automation platforms which will help to optimize prescription processing.

Cerumen Removal Market Report Highlights

Global cerumen removal market size is anticipated to be valued at USD 3.7 billion by 2030, owing to the increasing prevalence of cerumen impaction.

Micro-suction devices segment dominated the global cerumen removal market in 2021, owing to the increasing adoption and benefits offered by the device.

The geriatric segment dominated the market in 2021 owing to the increasing geriatric population and rising use of hearing aids by them.

Retail pharmacies held the largest market in 2021 owing to the expansion and adoption of digitalization.

The Asia Pacific dominated the market in 2021 owing to the rising awareness of cerumen impaction and the presence of local players in the region. Also, the initiative taken by the government is positively impacting the market growth.

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Global Cerumen Removal Market Variables, Trends, & Scope

3.1. Penetration & Growth Prospect Mapping

3.2. Global Cerumen Removal Market Dynamics

3.2.1. Market Driver Analysis

3.2.2. Market Restraint Analysis

3.2.3. Industry challenges

3.3.Global Cerumen Removal Industry Analysis - Porter's Five Forces

3.3.1. Supplier Power

3.3.2. Buyer Power

3.3.3. Substitution Threat

3.3.4. Threat of New Entrants

3.3.5.Competitive Rivalry

3.4.Global Cerumen Removal Industry Analysis - PEST

3.4.1. Political & Legal Landscape

3.4.2. Economic Landscape

3.4.3. Social Landscape

3.4.4. Technology Landscape

3.5. Major Deals & Strategic Alliances Analysis

3.6. Impact of COVID-19 Pandemic on Cerumen Removal Market

Chapter 4. Global Cerumen Removal Market: Product Estimates & Trend Analysis 2016-2030, (Revenue)

4.1. Product Movement Analysis & Market Share, 2021 & 2030

4.1.1.Micro-suction Device

4.1.1.1 Microsuction device market estimates and forecast, 2017-2030)

4.1.2. Irrigation Kits

4.1.2.1 Irrigation kits market estimates and forecast, 2017-2030)

4.1.3. Cerumen Removal Drops

4.1.3.1 Cerumen removal drops market estimates and forecast, 2017-2030)

4.1.4. Cerumen Removal Loops

4.1.4.1 Cerumen removal loops market estimates and forecast, 2017-2030)

4.1.5. Cerumen Removal Syringes

4.1.5.1 Cerumen removal syringes market estimates and forecast, 2017-2030)

4.1.6. PorTable Ear Cleaning Devices

4.1.6.1 PorTable ear cleaning devices market estimates and forecast, 2017-2030)

Chapter 5. Cerumen Removal Market: Consumer Group Estimates & Trend Analysis 2016-2030, (Revenue)

5.1. Consumer Group Movement Analysis & Market Share, 2021 & 2030

5.2.1. Pediatric (Aged 0 - 10)

5.2.1.1 Pediatric market estimates and forecast, 2017-2030)

5.2.2. Children (Aged 11 - 17)

5.2.2.1 Pediatric market estimates and forecast, 2017-2030)

5.2.3. Adults (Aged 18 - 64)

5.2.3.1 Pediatric market estimates and forecast, 2017-2030)

5.2.4. Geriatric (Aged 65 and Above)

5.2.3.1 Pediatric market estimates and forecast, 2017-2030)

Chapter 6. Global Cerumen Removal Market: Distribution Channel Estimates & Trend Analysis 2016-2030, (Revenue)

6.1. Distribution Channel Movement Analysis & Market Share, 2021 & 2030

6.1.1. Drug Stores

6.1.1.1 Drug stores market estimates and forecast, 2017-2030)

6.1.2. Retail Pharmacies

6.1.2.1 Retail pharmacies market estimates and forecast, 2017-2030)

6.1.3. Hypermarkets/Supermarkets

6.1.3.1 Hypermarkets/Supermarkets market estimates and forecast, 2017-2030)

6.1.4. E-commerce

6.1.4.1 E-commerce market estimates and forecast, 2017-2030)

Chapter 7. Regional Estimates & Trend Analysis, by Segments, 2016-2030, (Revenue, USD Million)

Chapter 8. Competitive Analysis

8.1. Recent Developments & Impact Analysis, by Key Market Participants, 2016 - 2022

8.2. Company/Competition Categorization (Key innovators, market leaders, emerging players)

8.3. Vendor Landscape

8.3.1. Company Market Share Analysis, 2021

8.3.2. Company Market Position Analysis

Chapter 9. Competitive Landscape

9.1.Company Profiles

9.1.1 Medline

9.1.1.1 Company Overview

9.1.1.2 Financial Performance

9.1.1.3 Product Benchmarking

9.1.1.4 Strategic initiatives

9.1.2. Henry Schein, Inc.

9.1.2.1 Company Overview

9.1.2.2 Financial Performance

9.1.2.3 Product Benchmarking

9.1.2.4 Strategic Initiatives

9.1.3. McKesson Medical-Surgical Inc.

9.1.3.1 Company Overview

9.1.3.2 Financial Performance

9.1.3.3 Product Benchmarking

9.1.3.4 Strategic Initiatives

9.1.4. Cardinal Health

9.1.4.1 Company Overview

9.1.4.2 Financial Performance

9.1.4.3 Product Benchmarking

9.1.4.4 Strategic Initiatives

9.1.5. Otex (Diomed Developments Ltd.)

9.1.5.1 Company Overview

9.1.5.2 Financial Performance

9.1.5.3 Product Benchmarking

9.1.5.4 Strategic Initiatives

9.1.6. Owens & Minor

9.1.6.1 Company Overview

9.1.6.2 Financial Performance

9.1.6.3 Product Benchmarking

9.1.6.4 Strategic Initiatives

9.1.7. Eosera Inc.

9.1.7.1 Company Overview

9.1.7.2 Financial Performance

9.1.7.3 Product Benchmarking

9.1.7.4 Strategic Initiatives

9.1.8. Innovative Designworks

9.1.8.1 Company Overview

9.1.8.2 Financial Performance

9.1.8.3 Product Benchmarking

9.1.8.4 Strategic Initiatives

9.1.9. Target Brands, Inc.

9.1.9.1 Company Overview

9.1.9.2 Financial Performance

9.1.9.3 Product Benchmarking

9.1.9.4 Strategic Initiatives

9.1.10. Debrox

9.1.10.1 Company Overview

9.1.10.2 Financial Performance

9.1.10.3 Product Benchmarking

9.1.10.4 Strategic Initiatives

9.1.11. Cipla Ltd.

9.1.11.1 Company Overview

9.1.11.2 Financial Performance

9.1.11.3 Product Benchmarking

9.1.11.4 Strategic Initiatives

9.1.12. NuLife Pharmaceuticals

9.1.12.1 Company Overview

9.1.12.2 Financial Performance

9.1.12.3 Product Benchmarking

9.1.12.4 Strategic Initiatives

9.1.13. Prestige Consumer Healthcare Inc.

9.1.13.1 Company Overview

9.1.13.2 Financial Performance

9.1.13.3 Product Benchmarking

9.1.13.4 Strategic Initiatives

9.1.14. Acu-Life Health Enterprises

9.1.14.1 Company Overview

9.1.14.2 Financial Performance

9.1.14.3 Product Benchmarking

9.1.14.4 Strategic Initiatives

9.1.15. Earest Inc.

9.1.15.1 Company Overview

9.1.15.2 Financial Performance

9.1.15.3 Product Benchmarking

9.1.15.4 Strategic Initiatives

9.1.16. GlaxoSmithKline Plc.

9.1.16.1 Company Overview

9.1.16.2 Financial Performance

9.1.16.3 Product Benchmarking

9.1.16.4 Strategic Initiatives

For more information about this report visit https://www.researchandmarkets.com/r/gtxsvd

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance