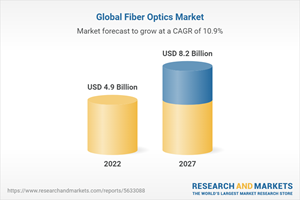

The Worldwide Fiber Optics Industry is Expected to Reach $8.2 Billion by 2027

Global Fiber Optics Market

Dublin, Sept. 06, 2022 (GLOBE NEWSWIRE) -- The "Fiber Optics Market by Fiber Type (Glass, Plastic), Cable Type (Single-mode, Multi-mode), Deployment (Underground, Underwater, Aerial), Application, and Region (North America, Europe, APAC, Rest of the World) - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

The fiber optics market is projected to grow from USD 4.9 billion in 2022 and is projected to reach USD 8.2 billion by 2027; it is expected to grow at a CAGR of 10.9% from 2022 to 2027.

The growth of this market is driven by factors such as growing internet penetration and data traffic, rising number of data center facilities worldwide, and mounting demand for high bandwidth.

Market for single-mode segment to grow at the high CAGR during the forecast period.

The single-mode segment is expected to witness high growth during the forecast period. The market growth is attributed increasing demand for single-mode fiber optic cables from telecom service providers across the globe. The single-mode fiber optic cables are majorly used by telecom companies for long-distance and high-bandwidth requirements. The rising demand has led market players to focus on new product development and launches.

For instance, in February 2021, Yangtze Optical Fibre and Cable Joint Stock Limited Company (China) launched 'X-band', a new optical fiber brand that will focus on manufacturing ultra-reduced diameter bending insensitive, single-mode fibers. Such active brand and product launches will propel the market growth over the forecast period.

Aerial deployment segment will grow at a high CAGR during the forecast period.

The aerial deployment segment will witness a high growth during the forecast period. Aerial deployment offers several advantages such as cost efficiency, easy repairs and maintenance, and faster deployment compared to other mediums. Aerial deployment is well suited for areas with flat terrain and small undulations. The rising penetration of over-the-top (OTT) media services is expected to increase the aerial deployment of fiber optics.

According to the India Brand Equity Foundation (IBEF), the number of paid subscribers for OTT services in India stood at 22.2 million in March 2020, which increased by 30% to 29.0 million in July 2020. The growing multimedia consumption increases the demand for fixed broadband connections, further fueling the aerial fiber optics deployment.

Asia Pacific will be the fastest growing region in the fiber optics market during the forecast period

Asia Pacific is expected to be the fastest growing region in the fiber optics market during the forecast period. Market growth is driven by extensive penetration of Fiber to the Home (FTTH) networks across Asia Pacific economies such as China, India, and Japan.

According to the China Internet Network Information Center (CNNIC) August 2021 report, as of June 2021, the number of FTTH connections reached 918 million, a net increase of 37.9 million over December 2020. The total length of fiber optic cable lines has steadily increased. As of June 2021, the length of fiber optic cable lines in China totaled 53.52 million kilometers, a net increase of 1.83 million kilometers from December 2020. The growing FTTH installation will fuel the adoption of fiber optics in the Asia Pacific region over the forecast timeline.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Fiber Optics Market Overview

4.2 Fiber Optics Market, by Fiber Type

4.3 Fiber Optics Market, by Cable Type

4.4 Fiber Optics Market, by Deployment

4.5 Fiber Optics Market, by Application and Region

4.6 Fiber Optics Market for Communication Applications

4.7 Fiber Optics Market, by Country

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Internet Penetration and Data Traffic

5.2.1.2 Rising Number of Data Center Facilities Worldwide

5.2.1.3 Mounting Demand for High Bandwidth

5.2.2 Restraints

5.2.2.1 Rising Preference for Wireless Communication Systems Over Wired Systems

5.2.3 Opportunities

5.2.3.1 Surging Deployment of 5G Communication Networks

5.2.3.2 Rising Demand for Fiber Optics Due to Their High Performance and Reliability

5.2.3.3 Increasing Penetration of Fiber to the X (Fttx)

5.2.4 Challenges

5.2.4.1 Challenges in Installing Fiber Optic Networks in Hard-To-Reach Terrains and High Cost of Installation

5.3 Technology Analysis

5.3.1 Plastic Optical Fibers (Pofs)

5.3.2 Glass Optical Fibers

5.3.3 Nanf Hollow-Core Fibber

5.4 Value Chain Analysis

5.5 Ecosystem

5.6 Trends and Disruptions Impacting Customers

5.7 Porter's Five Forces Analysis

5.8 Asp Analysis

5.8.1 Asp Analysis of Fiber Optic Products Offered by Market Players for Top 3 Applications

5.9 Case Study Analysis

5.9.1 Use Case 1: Alma Telecom Upgraded Its Network Using Fttp Solution Offered by Corning Incorporated

5.9.2 Use Case 2: Cnt Built Ftth Network with Cable Solutions Offered by Fiberhome Telecommunication Technologies

5.9.3 Use Case 3: Baldwin City Achieved High-Speed Broadband Connectivity Using Corning's Flexnap System

5.9.4 Use Case 4: Commscope Helped E-Fiber Commercialize Fttx Networks in the Netherlands

5.9.5 Use Case 5: Sterlite Technologies Designed Smart City Ecosystem in Kakinada, India Using Fiber Optic Solutions

5.10 Trade Analysis

5.11 Patent Analysis

5.12 Key Conferences & Events to be Held During 2022-2023

5.13 Tariff Analysis

5.14 Standards & Regulatory Landscape

5.15 Key Stakeholders and Buying Criteria

5.15.1 Key Stakeholders in Buying Process

5.15.2 Buying Criteria

6 Fiber Optics Market, by Fiber Type

6.1 Introduction

6.2 Glass

6.2.1 Glass Fiber Optics Deliver High Performance in Extreme Conditions

6.3 Plastic

6.3.1 Plastic Fiber Optics Suitable for Industrial and Automotive Lighting Applications

7 Fiber Optics Market, by Cable Type

7.1 Introduction

7.2 Single-Mode

7.2.1 Telcos Use Single-Mode Fiber Optic Cables to Meet Long-Distance and High-Bandwidth Requirements

7.3 Multi-Mode

7.3.1 Growing Demand for Unlimited Bandwidth Capacity Boosts Multi-Mode Fiber Requirement

8 Fiber Optics Market, by Deployment

8.1 Introduction

8.2 Underground

8.2.1 Rapid Development of Telecom Infrastructure to Fuel Underground Optic Fiber Deployment

8.3 Underwater

8.3.1 Increasing Installation of Submarine Optical Fiber Cables to Propel Market Growth

8.4 Aerial

8.4.1 Rising Penetration of Over-The-Top (Ott) Media Services to Increase Aerial Deployment of Fiber Optics

9 Fiber Optics Market, by Application

9.1 Introduction

9.2 Communication

9.2.1 Telecom

9.2.1.1 Cost Efficiency, Higher Bandwidth, and Higher Speed Than Copper to Drive Demand for Fiber Optics

9.2.2 Premises

9.2.2.1 Expansion of Lan and Datacenters to Drive Fiber Optics Market

9.2.3 Utility

9.2.3.1 Growth of Power Industry to Drive Fiber Optics Market for Utility Applications

9.2.4 Cable Antenna Television (Catv)

9.2.4.1 Shifting Consumer Preference Toward High-Definition (Hd) Content to Drive Market Growth

9.2.5 Industrial

9.2.5.1 Proliferation of Smart Factories Across Developed Economies to Fuel Demand for Fiber Optics for Industrial Applications

9.2.6 Military

9.2.6.1 Increase in Military Budget Worldwide to Create Opportunities for Market Growth

9.2.7 Others

9.3 Non-Communication

9.3.1 Sensors

9.3.1.1 Use of Fiber Optics in Distributed Sensing Applications to Support Market Growth

9.3.2 Fiber Optic Lighting

9.3.2.1 Growing Demand for Fiber Optics Lighting from Museum Displays, Pools, and Star Field Ceilings to Underpin Market Growth

10 Fiber Optics Market, by Region

11 Competitive Landscape

11.1 Overview

11.1.1 Overview of Key Growth Strategies Adopted by Market Players

11.2 Revenue Analysis

11.3 Market Share Analysis (2021)

11.4 Company Evaluation Quadrant

11.4.1 Stars

11.4.2 Emerging Leaders

11.4.3 Pervasive Players

11.4.4 Participants

11.5 Startup/SME Evaluation Matrix

11.5.1 Progressive Companies

11.5.2 Responsive Companies

11.5.3 Dynamic Companies

11.5.4 Starting Blocks

11.6 Competitive Benchmarking

11.7 Fiber Optics Market: Company Footprint

11.8 Competitive Scenario and Trends

11.8.1 Product Launches

11.8.2 Deals

11.8.3 Others

12 Company Profiles

12.1 Key Players

12.1.1 Corning Incorporated

12.1.2 Prysmian Group

12.1.3 Sumitomo Electric Industries, Ltd.

12.1.4 Yangtze Optical Fibre and Cable Joint Stock Limited Company

12.1.5 Fujikura Ltd.

12.1.6 Hengtong Group Co. Ltd.

12.1.7 Furukawa Electric Co. Ltd.

12.1.8 Leoni

12.1.9 Ls Cable & System Ltd.

12.1.10 Hitachi Cable America, Inc.

12.1.11 Coherent Inc.

12.1.12 Ii-Vi Incorporated

12.1.13 Optical Cable Corporation

12.1.14 Finolex Cables Ltd.

12.1.15 Commscope Holding Company, Inc.

12.2 Other Key Players

12.2.1 Sterlite Technologies Ltd

12.2.2 Ztt

12.2.3 Fiberhome Telecommunication Technologies Co. Ltd.

12.2.4 Aksh Optifibre

12.2.5 Art Photonics Gmbh

12.2.6 Rpg Cables (A Division of Kec International Limited)

12.2.7 Nestor Cables

12.2.8 Orbis Oy

12.2.9 Birla Cable Ltd.

12.2.10 Belden Inc.

13 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/ild5kl

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance