Worldwide Glucose Biosensors Industry to 2030 - Featuring Sanofi, GlySens, Trividia Health and Bayer Among Others

Global Glucose Biosensors Market

Dublin, June 03, 2022 (GLOBE NEWSWIRE) -- The "Glucose Biosensors Market Size, Share & Trends Analysis Report by Type (Electrochemical, Optical, Others), by End Use (Hospitals, Homecare, Diagnostic centers), by Region, and Segment Forecasts, 2022-2030" report has been added to ResearchAndMarkets.com's offering.

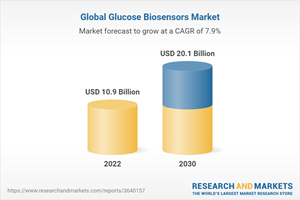

The global glucose biosensor market size is expected to reach USD 20.1 billion by 2030. The market is expected to expand at a CAGR of 7.9% from 2022 to 2030.

Glucose biosensors are an essential part of glucose monitoring systems that aid in monitoring blood glucose concentration in diabetic patients, which, in turn, helps them to manage and control diabetes and avoid any further complications. The International Diabetes Federation stated that in 2021, 537 million people were diagnosed with diabetes, and the number is anticipated to reach 783 million by 2045.

Emerging innovations in glucose monitoring are expanding the market. Glucose biosensors that use different body fluids such as sweat, blood, saliva, and tear and can be calibrated, are being increasingly researched. For instance, in October 2021, Penn State University researchers invented a novel technique that can assess glucose in sweat rather than blood, thus removing the need for a needle prick.

The market's prominent competitors are taking different initiatives such as funding and acquisitions of medium and small-sized businesses, in order to expand their product portfolio and enhance their manufacturing capacity. For instance, in August 2020, Senseonics Holdings entered into a strategic partnership with PHC Holdings Corporation and Ascensia Diabetes Care. This allowed Ascensia to be the exclusive global distribution partner for Senseonics' CGM systems.

Glucose Biosensors Market Report Highlights

by type, the electrochemical biosensor segment accounted for the largest revenue share in 2021 owing to its sensitivity, reproducibility, and ease of maintenance.

The hospital end-use segment held the largest revenue share in 2021, owing to the extensive use of glucose biosensors in hospital settings and an increase in the number of patients visiting hospitals with diabetes.

North America accounted for the largest revenue share in 2021. Asia Pacific is anticipated to expand at the fastest CAGR during the forecast period, owing to the improved healthcare facilities and reimbursement policies .

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Glucose Biosensor Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Reimbursement framework

3.4. Market Dynamics

3.4.1. Market driver analysis

3.4.1.1. Increasing incidence of diabetes

3.4.1.2. Rising demand for minimally and small-sized glucose monitoring devices

3.4.1.3. Growing patient awareness

3.4.2. Market restraint analysis

3.4.2.1. Presence of alternative method

3.5. Glucose Biosensor Market Analysis Tools

3.5.1. Industry Analysis-Porter's Five Forces Analysis

3.5.2. PESTEL Analysis

3.5.3. Major Deals & Strategic Alliances Analysis

3.5.4. Market Entry Strategies

Chapter 4 Glucose Biosensor Market: Type Estimates & Trend Analysis

4.1. Definitions and Scope

4.1.1. Electrochemical biosensors

4.1.2. Optical biosensors

4.1.3. Others

4.2. Type Market Share, 2017 & 2030

4.3. Segment Dashboard

4.4. Glucose Biosensor Market by Device Outlook

4.5. Market Size & Forecasts and Trend Analyses, 2017 to 2030 for the following

4.5.1. Electrochemical

4.5.1.1. Electrochemical biosensors market estimates and forecast, 2017 to 2030 (USD Million)

4.5.2. Optical

4.5.2.1. Optical biosensors market estimates and forecast, 2017 to 2030 (USD Million)

4.5.3. Others

4.5.3.1. Other glucose biosensors market estimates and forecast, 2017 to 2030 (USD Million)

Chapter 5 Glucose Biosensor Market: End Use Estimates & Trend Analysis

5.1. Definitions and Scope

5.1.1. Hospitals

5.1.2. Homecare

5.1.3. Diagnostic centers

5.2. End-Use Market Share, 2017 & 2030

5.3. Segment Dashboard

5.4. Glucose Biosensor Market by End-Use Outlook

5.5. Market Size & Forecasts and Trend Analyses, 2017 to 2030 for the following

5.5.1. Hospitals

5.5.1.1. Hospitals market estimates and forecast, 2017 to 2030 (USD Million)

5.5.2. Homecare

5.5.2.1. Homecare market estimates and forecast, 2017 to 2030 (USD Million)

5.5.3. Diagnostic centers

5.5.3.1. Diagnostic centers market estimates and forecast, 2017 to 2030 (USD million)

Chapter 6 Glucose Biosensor Market: Regional Estimates & Trend Analysis

Chapter 7 Competitive Landscape

7.1. Recent Developments & Impact Analysis, by Key Market Participants

7.2. Company/Competition Categorization

7.2.1. Innovators

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company market share analysis, 2020

7.3.4. Abbott Laboratories

7.3.4.1. Company overview

7.3.4.2. Financial performance

7.3.4.3. Product benchmarking

7.3.4.4. Strategic initiatives

7.3.5. Dexcom

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. Ascensia Diabetes Care

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. Nova Diabetes Care

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. F. Hoffmann-La Roche AG

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. Sanofi

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. GlySens Incorporated

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. Trividia Health

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives

7.3.12. Bayer

7.3.12.1. Company overview

7.3.12.2. Financial performance

7.3.12.3. Product benchmarking

7.3.12.4. Strategic initiatives

7.3.13. Lifescan

7.3.13.1. Company overview

7.3.13.2. Financial performance

7.3.13.3. Product benchmarking

7.3.13.4. Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/uya46h

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance